Analysts opined that the U.S. SEC would possible approve spot BTC ETFs in early January 2024, with eyes on the deadline for a call on ARK Make investments’s software.

ETF skilled Nate Geraci surmised that the ultimate response date for ARK Make investments’s joint submitting with 21Shares for a spot Bitcoin (BTC) ETF additional strengthens predictions of approval throughout the first two weeks of January 2024.

The Securities and Change Fee (SEC) has till Jan. 10 to resolve whether or not to simply accept or deny ARK Make investments’s bid. Geraci speculated that this hints at a possible inexperienced gentle from the SEC for the reason that first spot BTC ETF was filed 125 months in the past.

As reported by crypto.information, discussions between issuers like BlackRock and the SEC moved into their remaining phases, with each events reportedly negotiating over a redemption mannequin for the funds.

The choices accessible are referred to as money creates, which requires suppliers to carry the fiat equal of belongings supplied within the ETF, and in-kind, which doesn’t mandate holding parallel money reserves. Each translate to totally different penalties relating to working prices and taxation.

Michael Sonnenshein, CEO of Grayscale, voiced bullish remarks about filings receiving the nod from Gary Gensler’s SEC, and ARK Make investments boss Cathie Wooden stated approval would sign the ultimate endorsement for institutional buyers to deploy capital towards Bitcoin and probably the broader digital asset ecosystem.

Wooden’s feedback echoed statements from Galaxy Digital CEO Mike Novogratz, who expects spot BTC ETFs to usher in billions of {dollars} in its first yr and propel Bitcoin’s value far above its $69,000 all-time excessive.

Lars Seier Christensen, co-founder and chairman of Concordium, advised crypto.information {that a} bull run premeditated by the SEC’s approval of BTC ETFs adopted by Bitcoin’s halving appeared like “textbook stuff”.

Usually, in conventional monetary markets, some of these situations aren’t essentially predictable as a result of skilled individuals can anticipate potential developments past the apparent. However possibly, as a result of immaturity of crypto markets, it would play out as everybody predicts.”

Lars Seier Christensen, co-founder and chairman, Concordium

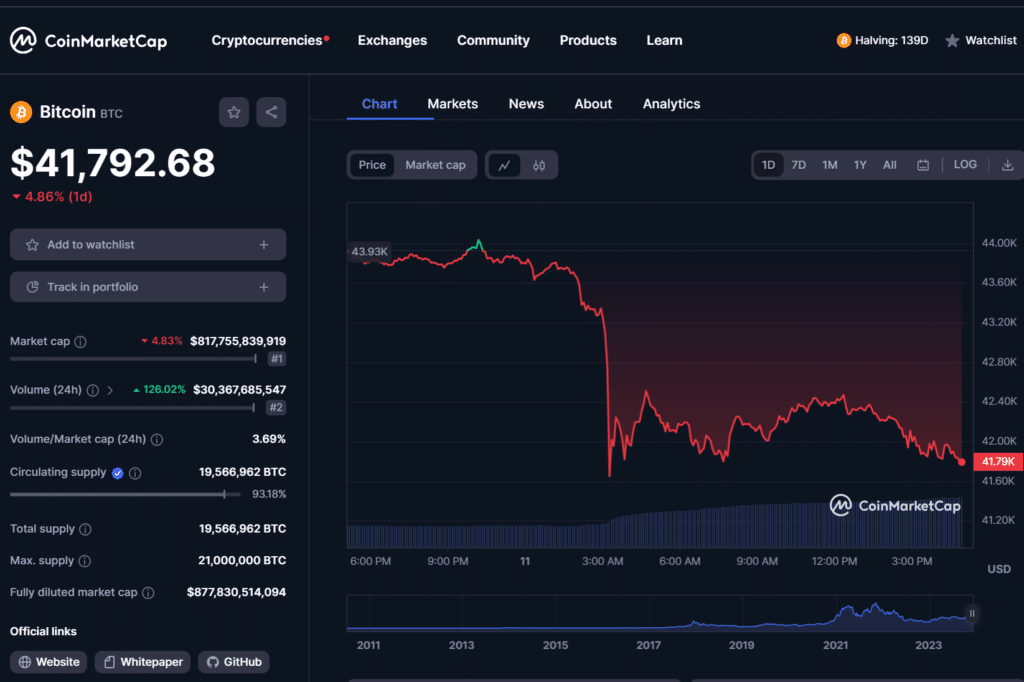

Christensen suggested warning, including that different outcomes wouldn’t come as a shock as Bitcoin slid below $41,000 amid a market correction.

I might be very cautious, although. I feel we shall be in for some shocking deviations from the widely predicted path.

Lars Seier Christensen, co-founder and chairman, Concordium