Bitwise Chief Funding Officer Matt Hougan provided a long-term view on the Bitcoin halving primarily based on historic knowledge and spot ETF demand.

Talking with CNBC on April 19, Hougan regarded this yr’s Bitcoin (BTC) halving as a “purchase the information” alternative for traders on this planet’s largest cryptocurrency asset class.

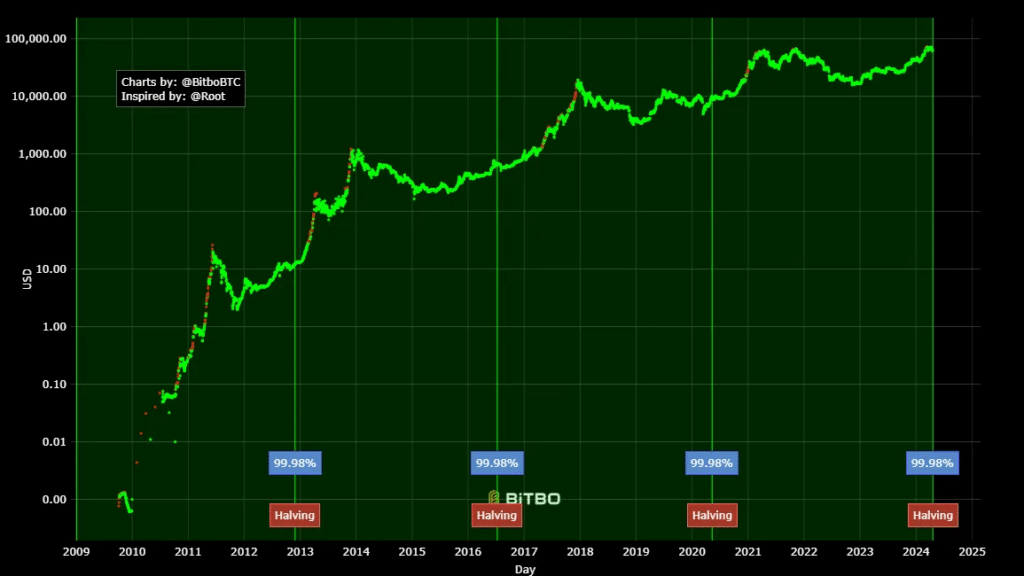

“When you look traditionally at halvings, the value motion inside per week or two after the Bitcoin halving is comparatively muted. However when you look out at a yr, BTC costs have rallied considerably after every of the previous three halvings and I feel it would achieve this once more.”

Matt Hougan, Bitwise CIO

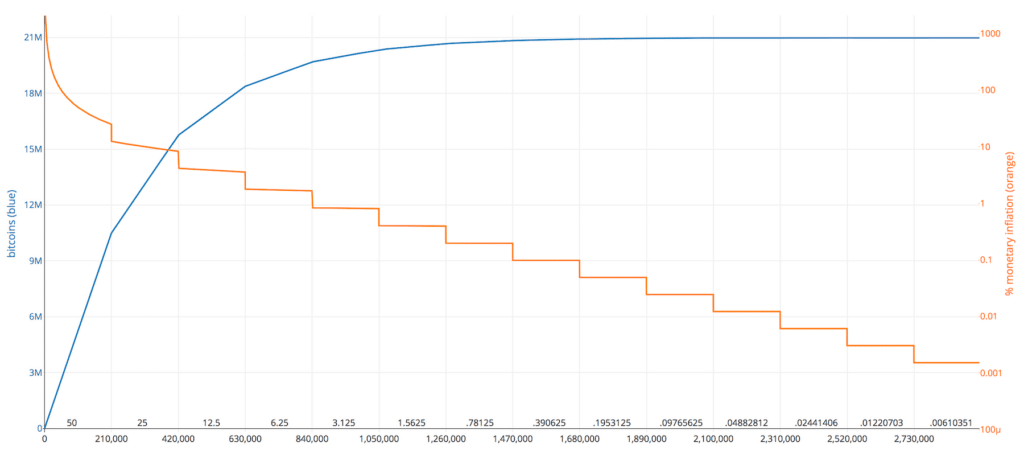

The halving is a pre-installed code change designed by nameless Bitcoin creator Satoshi Nakamoto to throttle BTC inflation and preserve provide shortage. Nakamoto constructed the system to slash mining rewards by 50% each 210,000 blocks or 4 years.

As block mining rewards are halved, so is the quantity of latest BTC getting into circulation. Many consider this lowered provide, mixed with rising demand by means of spot Bitcoin ETFs, will lead to greater costs by subsequent yr. Hougan, whose firm is a BTC ETF issuer, sides with this sentiment.

“The quantity of latest provide of Bitcoin coming into the market is being lower in half. We’re eradicating $11 billion of annual provide. I feel large image, that needs to be good for worth and that’s what I’d count on over the subsequent yr.”

Matt Hougan, Bitwise CIO

Bitcoin halving to solidify spot BTC ETF demand

Coinpass CEO Jeff Hancock informed crypto.information that Bitcoin has matured from a pastime and speculative market into an actual asset with institutional curiosity. It’s certain to make this cycle totally different, particularly in a excessive inflation, high-interest price financial system, Hancock stated.

“A historic market alternative may current itself this Bitcoin cycle, after the 4th halving occasion. Bitcoin ETFs have already efficiently launched within the US, we now have pending ETFs in Hong Kong, ETNs on the London Inventory Change, and Bitcoin costs are already pushing all-time highs earlier than the halving, one thing that has by no means occurred earlier than. Bitcoin’s market future has an infinite potential for my part.”

Jeff Hancock, Coinpass CEO

In Hancock’s view, Bitcoin’s world demand is right here to remain nicely past 2024, and tradfi will proceed to proliferate crypto’s ecosystem. Spot Bitcoin ETFs have already amassed over $60 billion in property in lower than six months.

The U.Okay.-registered crypto agency boss added that success with spot BTC ETFs might lengthen to an Ethereum (ETH) counterpart regardless of seemingly staunch opposition from the U.S. SEC.

“Institutional demand for Bitcoin is right here to remain. Ethereum ETFs may observe in 2024, which means institutional traders will now have entry to staking rewards and decentralized finance by means of an institutional instrument.”

Jeff Hancock, Coinpass CEO