Discover the largest crypto hacks of 2023 in our complete assessment, together with the roles of infamous hacking teams and their affect on the crypto {industry}.

Cryptocurrency hacks in 2023 have seen the {industry} lose over $1 billion, with the biggest hacks occurring within the ultimate quarters of the 12 months. The current bull market has marked the top of a protracted crypto winter that began in 2022, pushed by the Terra LUNA crash and the FTX collapse. Nevertheless, this has additionally renewed hackers’ curiosity out there, with extra malicious threats focusing on main defi protocols and crypto exchanges.

From the multi-million greenback heist at Mixin to the delicate phishing scams affecting particular person traders, every hack supplied a stark reminder of the continuing battle between cybersecurity and cybercriminals within the digital age. So, what had been the biggest crypto hacks of 2023? Let’s discover out.

Mixin breach ($200m): largest crypto hack of 2023

September 2023 noticed arguably the biggest current crypto hack, because the Mixin platform suffered a staggering lack of $200 million. This incident unfolded via an information breach of Mixin’s cloud service supplier. The platform couldn’t monitor down the attacker or recuperate the stolen funds. Nevertheless, Mixin dedicated to compensating customers for half of their misplaced holdings.

Euler Finance hack ($197m)

In March 2023, Euler Finance skilled a major hack, shedding almost $200 million. The breach was initially recognized by PeckShield, a blockchain safety agency, which observed uncommon transaction exercise on the platform. These transactions had been later confirmed as the tactic via which $197 million in cryptocurrency was stolen.

Nevertheless, in a uncommon prevalence, the stolen funds had been unexpectedly returned to Euler Finance a couple of weeks after the hack. An apology word was included in one of many return transactions, as noticed on Etherscan.

Poloniex hack (over $120m)

Well-liked crypto alternate Poloniex confronted a safety breach in November, resulting in a loss exceeding $33 million, later revised to over $120 million. The unauthorized outflow of funds from its scorching pockets affected a number of networks, together with Ethereum (ETH) and Bitcoin (BTC). Justin Solar, the bulk shareholder of Poloniex, reassured the neighborhood of the alternate’s monetary stability and pledged full reimbursement for the misplaced property.

To resolve the state of affairs, Solar initially provided a $10 million bounty to the cryptocurrency hackers for returning a good portion of the funds inside per week and supplied pockets addresses for potential reimbursement. Nevertheless, as per the most recent studies, the hackers didn’t reply. Poloniex continues its inside investigation and stays dedicated to compensating affected customers.

HTX hack ($110 m)

Yet one more alternate linked to Justin Solar skilled a serious breach this 12 months. HTX, previously often known as Huobi, skilled a major safety breach, resulting in a internet outflow of $250 million after resuming operations.

This outflow adopted the November assault wherein HTX lost around $110 million, in response to Solar. The incident prompted a brief suspension of withdrawals and deposits. Regardless of the substantial outflow, an HTX emphasised that person funds had been secure.

MultiChain rug pull ($130m)

In July, MultiChain, a cross-chain protocol, reported suspicious withdrawals totaling $130 million, sparking issues of a hack or rug pull. The collection of transactions led to the Chinese language authorities’ arrest of MultiChain’s CEO, Zhaojun, fueling hypothesis of insider involvement.

Zhaojun’s units, together with telephones and {hardware} wallets, had been confiscated. The incident led to MultiChain ceasing operations, as detailed in a put up on social media. The closure of MultiChain adopted these occasions, leaving many questions on the true nature of the incident.

Atomic Pockets hack ($100m)

In June, Atomic Wallet, a widely-used software program crypto pockets, was hacked, resulting in the lack of $100 million. The breach impacted over 5,000 person accounts, with some customers experiencing partial thefts and others having their wallets fully emptied.

The preliminary suspicion pointed towards the Lazarus hacking group. The incident led to a class-action lawsuit from Russian traders in opposition to Atomic Pockets in August 2023. The latter claimed that the hint led to the Ukrainian group of hackers. Nevertheless, there was no proof of this assertion since then.

The corporate’s response to the crypto hack and the authorized repercussions are but to be absolutely resolved.

CoinEx hack ($70m)

Crypto alternate CoinEx suffered a serious safety breach in September, ensuing within the theft of $70 million. Crypto hackers accessed quite a few non-public keys for person scorching wallets, transferring substantial quantities of assorted cryptocurrencies, together with almost 5,000 ETH and 231 BTC.

Regardless of the numerous loss, CoinEx’s chilly wallets remained unaffected. The North Korean Lazarus group is suspected to be behind this assault.

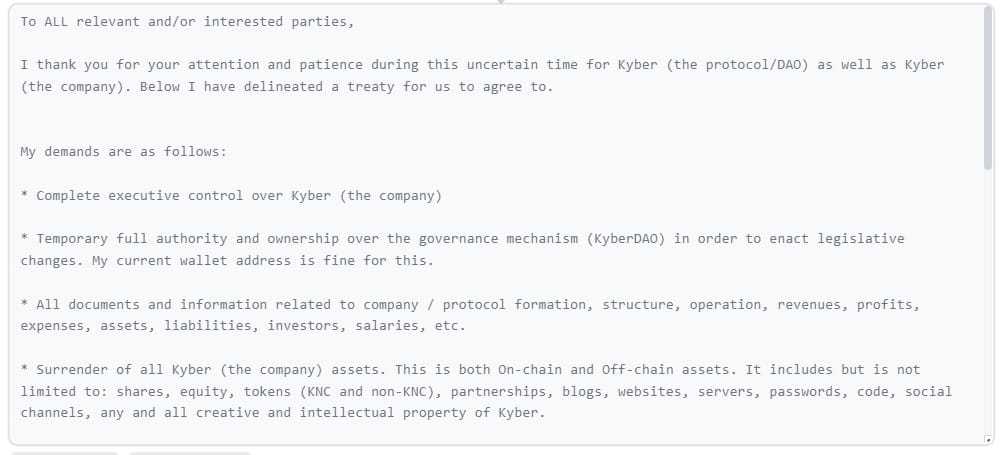

KyberSwap hack ($47m)

The KyberSwap hack in November 2023 stands out for its complexity and the numerous loss incurred. The multi-chain decentralized alternate aggregator fell sufferer to a wise contract reentrancy assault, resulting in the theft of $47 million throughout varied networks, together with Ethereum, Polygon (MATIC), Arbitrum (ARB), and Optimism (OP).

This breach resulted in a drastic 90% drop in KyberSwap’s whole worth locked, falling from $84.9 million to only $8.28 million, showcasing the extreme affect of good contract vulnerabilities.

The hacker behind this assault made uncommon demands, searching for whole management over KyberSwap’s protocol, which included its governance mechanism and firm property. These calls for, hooked up to a transaction on Etherscan, had been unprecedented and highlighted a brand new stage of boldness in crypto hacking.

The hacker sought to overtake KyberSwap’s operational construction, together with worker salaries and govt buyouts. This incident displays the technical vulnerabilities of defi platforms and underscores the evolving challenges in securing defi ecosystems in opposition to more and more refined assaults.

Stake hack ($41m)

September was undoubtedly one of many costliest months this 12 months, with the variety of hacks exceeding all different months in 2023. Well-liked crypto playing platform Stake additionally suffered a breach that month, resulting in a theft of $41 million.

This hack particularly focused customers’ crypto scorching wallets, and the property stolen included Ethereum and Dai, amongst others. All funds had been initially transferred to a single pockets, believed to belong to the hacker, after which dispersed to varied different wallets. This dispersion tactic made monitoring the stolen property tougher. The FBI’s investigation later confirmed the involvement of the North Korean Lazarus hacking group on this theft, though the stolen funds stay unrecovered.

North Korea’s Lazarus group: state-affiliated risk in crypto hacks

In 2023, the Lazarus Group, a North Korea-linked hacker group, has been a distinguished actor within the crypto hacking panorama. They’ve been accountable for over $300 million in crypto hacking incidents, accounting for about 17.6% of the full losses incurred within the crypto {industry} through the 12 months. This contribution to the full losses highlights the group’s important affect on the crypto house.

Traditionally, the Lazarus Group has been concerned in a few of the largest cyberattacks, courting again to their actions in opposition to Sony Footage in 2014. Over time, they’ve shifted their focus to crypto protocols, buying billions of {dollars} from these assaults. From 2021 to 2023, roughly $1.9 billion has been stolen from varied crypto initiatives, showcasing the group’s persistence and evolving ways.

In 2023, the Lazarus Group executed at the least 5 assaults, together with a notable $70 million theft from the Hong Kong-based crypto alternate CoinEx. Their technique moved in the direction of focusing on centralized finance platforms and noncustodial crypto wallets, demonstrating eager adaptability to the altering panorama of the crypto {industry}.

Regardless of a world decline within the total amount of cash stolen in digital asset hacks, the risk posed by teams like Lazarus stays important. Regulation enforcement businesses have been actively combating these actions by tracing stolen funds and disrupting crypto mixers, which obscure illicit funds’ origins. The U.S. Treasury Division has addressed these challenges by sanctioning fashionable mixing providers like Twister Money and proposing stricter rules for decentralized platforms.

Crypto hacks in 2024: prospects

The surge of crypto hacks within the latter half of 2023 displays a regarding narrative for the {industry} heading into 2024. The upcoming 12 months is poised to be a vital time for crypto, with the expectations across the Bitcoin spot ETF launch in January and the Bitcoin halving occasion in April.

So, the {industry} is getting ready for a busy 2024, and so will the hackers. Constructing industry-wide resilience can be the important thing to curbing these large-scale threats; in any other case, we could be in for a costlier new 12 months.

FAQs

Can blockchain be hacked?

Whereas blockchain know-how is mostly safe as a consequence of its decentralized and encrypted nature, it’s not fully resistant to hacking, particularly via vulnerabilities in good contracts or centralized factors like exchanges.

Is Bitcoin hackable?

Bitcoin’s core blockchain protocol is extremely safe, however Bitcoin exchanges and wallets will be susceptible to hacking.

What’s the world’s largest crypto alternate hack?

The world’s largest crypto alternate hack occurred at Coincheck in 2018. The corporate misplaced $534 million price of NEM tokens.

What’s the largest hack in Bitcoin historical past?

Essentially the most important Bitcoin hack was the Mt. Gox incident in 2014, the place roughly 850,000 bitcoins had been stolen, enormously impacting the Bitcoin neighborhood and market.

What are the most recent crypto hacks?

Latest notable crypto hacks embody the assaults on Ledger, HTX, KyberSwap, and Poloniex, with losses mounting over lots of of hundreds of thousands.