Disclosure: The views and opinions expressed right here belong solely to the writer and don’t characterize the views and opinions of crypto.information’ editorial.

2023 has been characterised by bearish situations flattening markets and a heavy give attention to regulation and compliance via the lens of the large-scale collapses and fraud incidents in 2022.

Nonetheless, issues are not often quiet for lengthy on this trade, and alter is already within the air. Whereas the query of jail time for Sam Bankman-Fried and Changpeng Zhao should still be excellent, the drama of the authorized battles seems to be largely settled, and the sector is buzzing with anticipation of a brand new bull market because it seems to be forward to the yr forward. An anticipated spot ETF approval and the upcoming Bitcoin halving are each including to rising hypothesis.

Whereas a change in market situations is sweet information, it inevitably brings contemporary challenges for web3 safety professionals. Listed below are three macro developments that can form the web3 safety panorama within the upcoming yr.

Hacks and scams on the rise

Cybercrime exercise in web3 has an unlucky tendency to comply with the ebb and move of the markets. According to the US Federal Commerce Fee, losses to crypto scams in 2021, when Bitcoin (BTC) reached its all-time excessive, have been sixty instances the degrees seen in 2018. Nonetheless, the newest knowledge from Chainalysis suggests that rip-off exercise dropped by as a lot as 77% in 2023 in comparison with the earlier yr.

Nonetheless, Chainalysis notes that sure forms of rip-off exercise, notably impersonation scams, are literally exhibiting a rise. Moreover, if the market does decide up in 2024—as many analysts imagine it would—scammers will as soon as once more be drawn to the monetary alternatives in crypto.

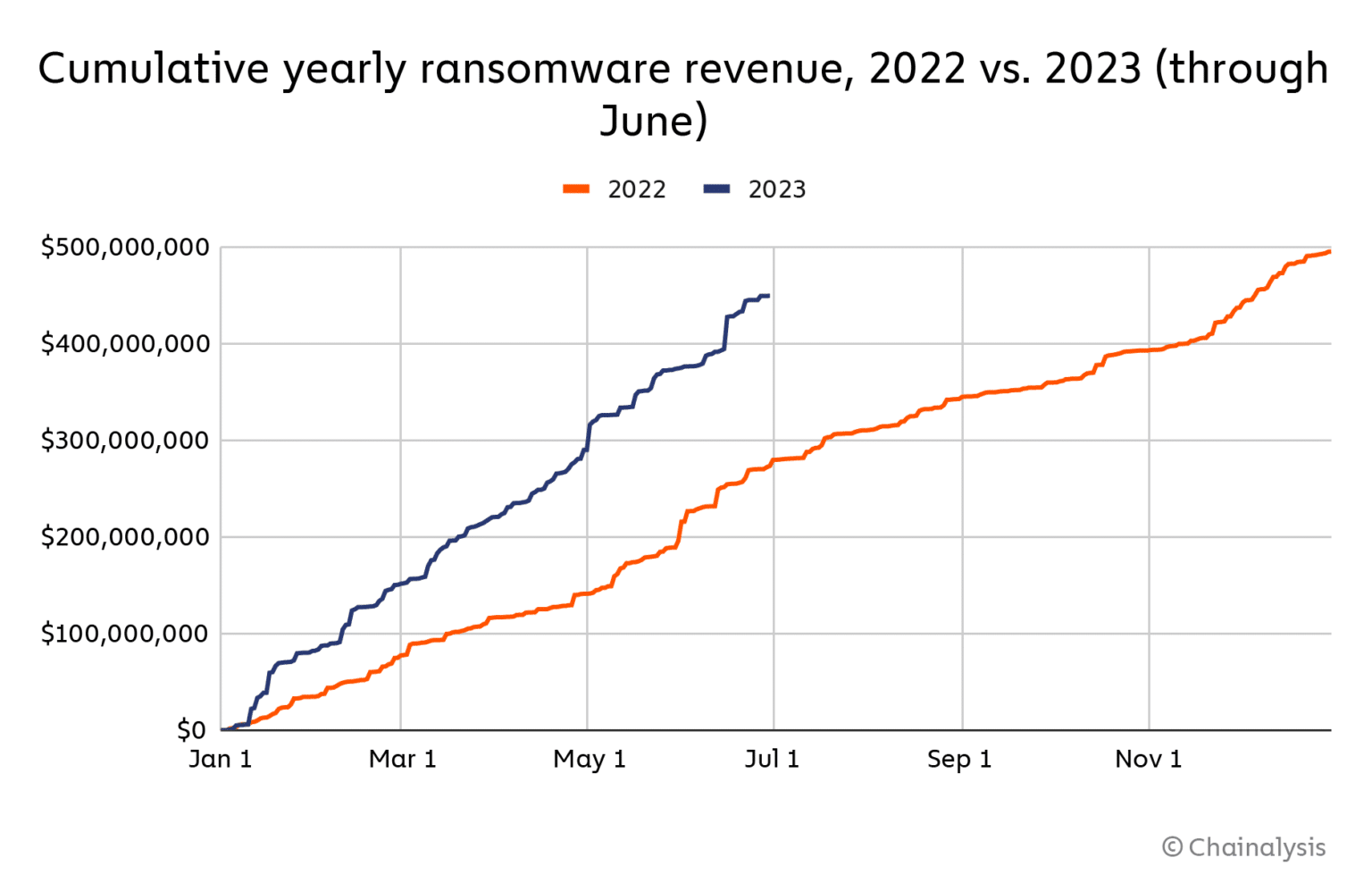

Ransomware is rising in 2023 | Supply: Chainalysis

Due to this fact, we’re more likely to see not simply a rise within the variety of scams but in addition growing ranges of sophistication and consolidation in scammer exercise. One instance is superior evasion methods designed to cloak fraudulent actions. These embrace spoofing, which entails masquerading malicious entities as benign by mimicking respectable options; morphing, the place scammers change a sensible contract’s habits primarily based on context; and obfuscation, which makes dangerous code troublesome to detect and perceive.

Off-chain signatures, which permit transaction signing with out broadcast to the blockchain community, are one other space of vulnerability to be preyed on by scammers. In signature phishing scams, the attacker will arrange a situation comparable to a faux dapp requiring the consumer to generate an off-chain signature for a transaction that appears respectable. One instance could possibly be offering a signature to checklist an NFT, the place the consumer is inadvertently signing a transaction that can enable the scammer to empty all NFTs from their pockets.

The recent shutdown of ‘draining as a service’ Inferno Drainer, a toolkit that equips fraudsters with the technical technique of stealing from wallets, is undoubtedly excellent news for the trade. Nonetheless, it’s unlikely to be the final of its sort, given it’s reportedly answerable for stealing $80 million price of crypto this yr alone. We will anticipate to see extra of this type of consolidation exercise amongst scammers in 2024.

Enlargement of web3 cybersecurity capabilities

Simply as fraud exercise is ready to develop into extra refined, the web3 cybersecurity ecosystem can be gaining new options and instruments to assist battle again in opposition to scams and illicit exercise. Assault detection protocols have already recognized hacks that had taken place, including the $33 million theft from SushiSwap in April 2023, earlier than the funds have been withdrawn.

On-chain extensions, much like pockets extensions, can additional assist risk prevention by finishing up threat monitoring utilizing on-chain knowledge in actual time, offering a further layer of safety for customers and protocols.

Moreover, on-chain knowledge and analytics will tackle new dimensions because of the growing involvement of TradFi and institutional liquidity, which can bifurcate the sector. The open, pseudonymous, and permissionless protocols that dominate the trade immediately will more and more function alongside permissioned, compliant, and safe counterparts. The extra layers of information and knowledge will improve the power and accuracy of threat profiling—advantages that may be additional compounded by additional advances in AI and machine studying.

A extra strategic web3 cybersecurity strategy

With every market cycle, the maturity of the crypto and web3 house grows. Initiatives and corporations are more and more conscious that they need to go above and past a code audit to show a dedication to cybersecurity and keep one step forward of fraudsters. A complete technique that begins with safe design and strikes all the way in which to monitoring and risk prevention options is required.

Menace dealing with ought to take a holistic strategy to threat, utilizing preventive measures comparable to asset segregation and transaction screening, mixed with mitigation measures like automated circuit breakers, together with reactive aid comparable to insurance coverage.

To satisfy this demand, suppliers comparable to Forta have developed cybersecurity instruments comparable to blockchain rip-off detectors and assault detectors which can be designed particularly for the wants and threats going through Web3 operators.

Shifting ahead into 2024, the palpable sense of optimism is long-awaited and far deserved. Nonetheless, conscious of the dangers that growing wealth and liquidity will convey, Web3 companies have to be prepared for a brand new wave of threats going through the trade and have all their cybersecurity guardrails in place to maintain belongings and customers secure.