Discover the great breakdown of what occurred to FTX in 2023: from Sam Bankman-Fried going to jail to his ex-girlfriend’s confessions.

The crypto trade has all the time been stuffed with fascinating tales of large success, in a single day failures, infamous scams, and overwhelming frauds. Nevertheless, only a few tales have impacted the world of cryptocurrency and finance as a lot because the dramatic rise and fall of FTX.

The FTX saga was unveiled underneath the management of Sam Bankman-Fried, a younger entrepreneur who quickly ascended to the higher echelons of the crypto world. It’s a story of ambition, innovation, and a catastrophic downfall. On this article, we’ll discover the intriguing particulars of the FTX fraud, from its meteoric rise to its final failure, ensuing within the felony conviction of Sam Bankman-Fried.

FTX’s rise and prominence

Bankman-Fried’s journey within the crypto world started with establishing Alameda Research in 2017, a quantitative buying and selling agency. His profitable ventures in Bitcoin (BTC) arbitrage in 2018 supplied the capital and expertise to launch FTX in 2019.

FTX quickly grew to become a titan within the crypto alternate trade, poised to take over Binance because the market chief. The recognition of the alternate was sky-high, with celebrities like Tom Brady endorsing it and the historic American Airways Enviornment altering its title to the FTX Arena in 2019. Bankman-Fried, an MIT graduate and a former quantitative dealer, grew to become the face of FTX and a poster little one for the complete crypto trade.

By 2021, FTX had established itself because the third-largest crypto alternate by quantity, a outstanding feat in an trade characterised by intense competitors and speedy innovation. The platform boasted over a million buyer accounts, underscoring its widespread acceptance and belief inside the crypto group. FTX’s progress was not restricted to its core alternate operations. Bankman-Fried additionally launched a $2 billion enterprise fund to seed different crypto companies and startups, additional increasing the corporate’s affect within the sector.

The corporate moved its headquarters from Hong Kong to the Bahamas in September 2021, buying a big workplace advanced and investing closely in native properties. This transfer coincided with FTX’s aggressive advertising and sponsorship campaigns, together with high-profile sports activities sponsorships such because the Miami Warmth’s NBA enviornment and Formulation 1 race automobiles.

Bankman-Fried’s affect prolonged past the enterprise facet of crypto and into the political enviornment. He grew to become a distinguished donor to the Democratic Celebration in the USA, searching for to form the legislative panorama of the cryptocurrency trade. This involvement in political circles was a part of a broader technique to advocate for favorable regulatory environments for crypto enterprises.

How FTX collapse started

The downfall of FTX started to materialize in early 2022, marked by a collection of troubling revelations and monetary missteps. Alameda Analysis was initially a quantitative buying and selling agency however had grow to be deeply intertwined with FTX. The crux of the issue lay in Alameda’s important holdings of FTX’s native token, FTT. This interdependence raised questions on each entities’ solvency and monetary practices, notably relating to the usage of buyer funds.

When the crypto market skilled turbulence in spring 2022, pushed by the collapse of Terra LUNA and its stablecoin, UST, Bankman-Fried tried to place himself as a savior of the trade. FTX supplied monetary help to struggling companies like Voyager Digital and BlockFi. These actions, whereas initially considered as a stabilizing pressure, would later be scrutinized for his or her function within the broader monetary troubles that engulfed FTX.

The unraveling accelerated in November 2022 when experiences emerged that FTX had allegedly transferred substantial buyer deposits to Alameda Analysis. These transfers, purportedly “backed” by FTT tokens and shares in buying and selling firm Robinhood, raised severe considerations in regards to the misuse of buyer funds and the general monetary stability of FTX.

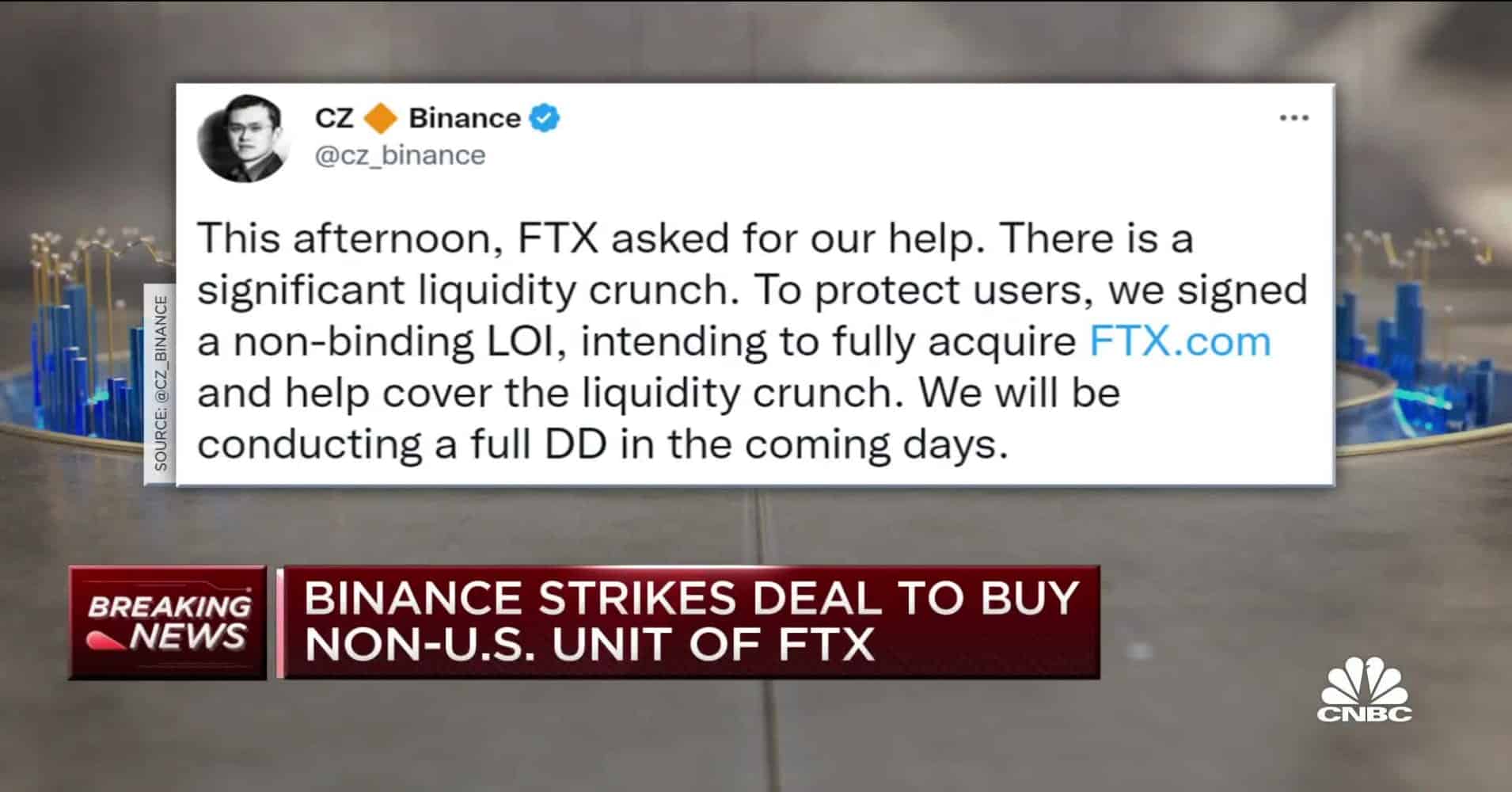

The state of affairs reached a tipping level when Binance determined to liquidate its holdings within the token. This in the end triggered a pointy sell-off in FTT. The ensuing liquidity disaster at FTX led to a flood of buyer withdrawal requests, which the alternate struggled to meet. Finally, the revelation of those monetary irregularities and the following liquidity disaster precipitated a dramatic collapse of FTX and Alameda Analysis.

FTX’s chapter filings and authorized implications

FTX and Alameda Analysis declared chapter in November 2022 because the disaster unfolded. The chapter filings revealed a chaotic and financially unsound surroundings inside FTX, with courtroom paperwork suggesting that the corporate owed over $3 billion to its high 50 collectors. Newly appointed CEO John Ray III, overseeing the chapter course of, acknowledged that he had by no means seen “such an entire failure” of company controls in his profession.

Amidst the chapter of FTX, a hacker stole round $477 million price of funds from the alternate and commenced laundering it via varied means. Moreover, Bahamian securities regulators seized a few of FTX’s property, including to the complexity of the authorized battles over the alternate’s remaining property.

The collapse additionally had a right away and profound affect on the crypto ecosystem. The occasion triggered a big decline within the costs of main cryptocurrencies, together with Bitcoin and Ethereum (ETH). The trade confronted a disaster of confidence, with questions arising in regards to the security of buyer funds and the necessity for extra sturdy regulatory oversight within the crypto market.

Sam Bankman-Fried’s authorized troubles

In December 2022, the narrative of the FTX saga took a decisive flip as Sam Bankman-Fried was arrested within the Bahamas, the place he lived and the place the alternate was based mostly. This marked the start of a collection of authorized proceedings that will see him dealing with severe fraud and conspiracy costs.

Following his arrest, Bankman-Fried agreed to be extradited to the USA and subsequently appeared in a Manhattan federal courtroom. The courtroom granted him launch to dwelling detention at his dad and mom’ dwelling in Palo Alto, California, on a $250 million bond.

Sam Bankman-Fried’s trial in 2023

The fees in opposition to the FTX founder included a number of fraud and conspiracy allegations associated to the operation of the alternate and Alameda Analysis. On Jan. 3, 2023, he pleaded not responsible to those costs, and subsequently, a trial was scheduled for October 2023.

The lead-up to the trial noticed a number of key developments. In February 2023, Nishad Singh, the previous director of engineering on the alternate, pleaded responsible to fraud costs and agreed to cooperate with prosecutors. Following this, different key figures just like the alternate’s co-founder Gary Wang and Alameda CEO Caroline Ellison additionally pleaded responsible.

This cooperation added stress on Bankman-Fried and probably supplied the prosecution with precious inside info. Moreover, in August 2023, the courtroom revoked his bail after discovering possible trigger to imagine he tampered with witnesses, leading to his remand to Brooklyn’s Metropolitan Detention Middle pending trial.

The historic trial of Bankman-Good friend started on Oct. 3 and noticed him stand earlier than the jury with seven completely different fraud and cash laundering costs. The trial featured testimonies from varied witnesses, together with those that had beforehand pleaded responsible to associated costs. The defendant himself testified in his protection. He targeted on the argument that the FTX collapse resulted from broader downturns within the crypto markets relatively than deliberate fraud or mismanagement.

A pivotal testimony got here from Caroline Ellison, the previous CEO of Alameda Analysis and Bankman-Good friend’s ex-girlfriend, who detailed the monetary intertwinings and irregular practices between FTX and Alameda Research. Ellison’s testimony revealed Alameda had a limiteless line of credit score with the alternate, which in the end got here from buyer funds.

Nishad Singh additionally revealed how Bankman-Fried may use buyer funds and money owed for political lobbying and celeb endorsements. There have been additionally a number of testimonies about how Garry Wang, Nishad Singh, and Caroline Ellison took large-scale loans from the alternate for property purchases and private bills.

The trial additionally heard from monetary regulation and cryptocurrency consultants, who supplied context on the trade requirements and the extent to which FTX’s practices deviated from these norms. These testimonies performed an important function in illustrating the broader implications of FTX fraud for the cryptocurrency market and monetary regulation.

After a relatively quick deliberation, the jury discovered Bankman-Good friend guilty of all seven costs he confronted. His sentencing is about to begin in late March subsequent 12 months, as he faces a most of 110 years in jail for the fees introduced in opposition to him.

Will FTX 2.0 occur?

Within the aftermath of the unique alternate’s collapse, the idea of FTX 2.0 is actively being explored underneath the management of the brand new CEO, John J. Ray III. This initiative continues to be in its formative levels, with Ray and his crew specializing in varied points of restructuring and relaunching the alternate. Courtroom filings from Could 2023 have revealed that Ray has been engaged in a number of conferences to debate the structuring and restarting of the alternate, together with finalizing supplies essential for this reboot. These developments recommend a proactive strategy in direction of resurrecting FTX in a brand new avatar.

Regardless of these efforts, the precise particulars and timeline for the launch of FTX 2.0 stay unsure. There have been mentions of a bidding course of as a part of the reboot technique, indicating that the relaunch may contain new stakeholders or buyers. As of now, FTX and its debtors have agreed with Bahamian liquidators to launch a settlement agreement for its prospects.

Penalties of FTX collapse

The FTX rip-off stands as a profound second in crypto historical past. Bankman-Fried was as soon as hailed for his revolutionary imaginative and prescient for crypto, and the alternate was extensively trusted not simply by normal customers, however by big companies, celebrities, skilled buyers, and politicians. Some consultants assume that the scandal erased years’ price of belief and credibility from the crypto sector that different organizations labored laborious to determine.

The story of FTX’s rise and fall serves as a cautionary story in regards to the significance of transparency, moral practices, and sturdy monetary oversight within the crypto trade. Because the market and its contributors mirror on these occasions, the teachings realized will undoubtedly form the longer term trajectory of the crypto trade.

Key occasions and dates within the FTX saga

- Nov 2022: FTX’s collapse, chapter filings, and the revelation of monetary mismanagement and misuse of buyer funds.

- Dec 12, 2022: Bankman-Fried’s arrest within the Bahamas.

- Dec 21, 2022: Bankman-Fried extradited to the USA.

- Jan 3-12, 2023: Bankman-Fried pleads not responsible; trial set for October.

- Feb 28, 2023: Nishad Singh, former FTX director of engineering, pleads responsible to fraud costs.

- Aug 11, 2023: Bankman-Fried’s bail is revoked attributable to witness tampering allegations.

- Oct 3, 2023: Trial begins.

- Oct 28, 2023: Bankman-Fried testifies in his protection.

- Nov 2, 2023: The jury finds him responsible on all seven costs.

FAQs

What occurred to FTX prospects?

FTX prospects confronted important monetary losses because the platform grew to become bancrupt and filed for chapter, resulting in frozen accounts and inaccessible funds. Prospects are nonetheless awaiting settlement, however the alternate has lately agreed over a settlement plan.

What occurred to FTX buyers?

FTX buyers skilled substantial losses because of the collapse of the alternate, as the worth of their investments plummeted following the revelation of monetary mismanagement and subsequent chapter proceedings.

What occurred to Sam Bankman-Fried?

Sam Bankman-Fried was arrested in December 2022 on fraud and conspiracy costs associated to the collapse of FTX and was discovered responsible of all costs in November 2023. His sentencing is about for mid-March 2024.