MicroStrategy shares have risen 320% in 2023, however in keeping with one researcher a decelerate could possibly be imminent.

The value of MicroStrategy shares might fall by 20% or extra in keeping with specialists at 10x Analysis. Of their opinion, the place is overvalued by 26% based mostly on conclusions they gleaned from a regression mannequin that permits one to hint the correlation between MicroStrategy and Bitcoin (BTC).

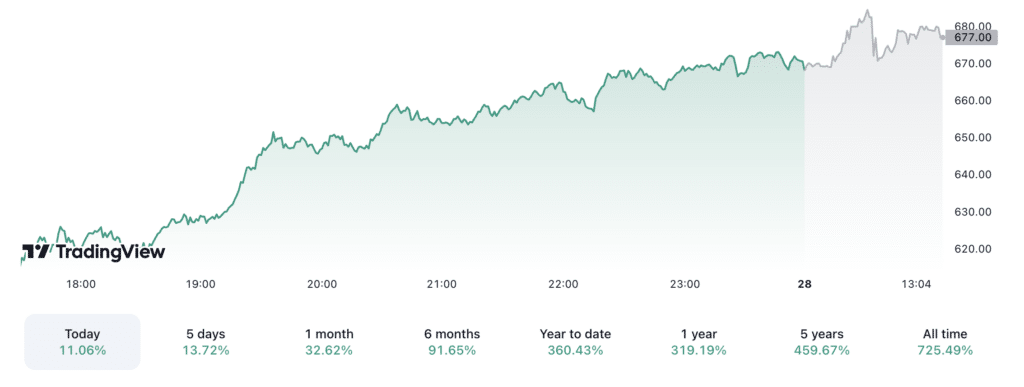

For the reason that begin of 2023, MicroStrategy’s inventory worth has risen from $141 to $670.71. Within the final month alone, MicroStrategy’s inventory worth has elevated by greater than 32%. Over the yr, the increase was 319.19%, in keeping with TradingView.

After buying an extra 14,620 BTC in 2023, the corporate’s unrealized revenue reached $2.2 billion. For the reason that starting of the yr, Bitcoin has risen in worth by 160%, reaching multi-month highs. The joy is primarily related to the anticipation of the attainable approval of spot Bitcoin ETFs and the halving, an occasion that systematically reduces the provision of Bitcoin out there to miners.