Trias Token (TRIAS) lately clinched a two-year-high, rallying by almost 27% over the past 24 hours amid an observable uptick in investor curiosity and demand.

Since hitting a excessive of $8.5 on Dec. 22, Trias has traced a bearish trajectory, recording intermittent drops amid the bearish atmosphere surrounding the broader crypto market. Trias collapsed 19.8% from $8.5 on Dec. 22 to $6.81 on Dec. 26.

The drop from Trias was not an remoted occasion, triggered by an identical value decline from different main gamers comparable to Bitcoin (BTC). BTC slumped to a weekly low of $41,637 on Dec. 26 after an intraday drop of two.45%, the best in over two weeks.

As BTC dropped different crypto property adopted. Trias was not spared any onslaught. Nevertheless, the token witnessed a direct value restoration hovering above the pivotal resistance at $7.215 and flipping it into assist on the identical day.

Trias has continued to surge since then, hoping to get well the losses of the previous few days and reclaim the Dec. 22 excessive of $8.50. The resurgence triggered elevated social quantity for the crypto token, which spiralled into elevated quantity as extra merchants grew to become conscious of the token.

This phenomenon has launched larger demand as evidenced by an enormous 120% surge in commerce quantity for the asset over the past 24 hours. Trias now boasts a 24-hour quantity of $5.36 million, the best intraday quantity the token has recorded for the reason that $7.16 determine on Sept. 19.

Based on a put up on X, the group confirmed that final week the venture entered right into a partnership with main web3 browser Carbon, Triathon Lab launched an financial idea involving a dual-token mannequin, and Tusima community built-in with native zkEVM protocol Scroll.

As of press time, Trias presently trades for $9.52 up 28% within the final 24 hours and 32% over the previous week. The asset presently seems to be to interrupt above the pivotal resistance at $9.9 to reclaim a two-digit worth above $10 for the primary time since late 2021.

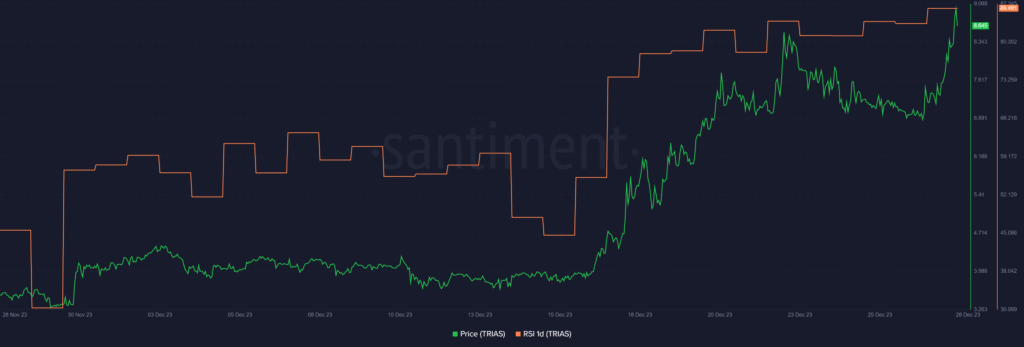

As the value surge continues, the Relative Energy Index (RSI) of the Trias Token rallied from 44 to 86 over the previous two weeks, in response to Santiment. The indicator suggests a attainable value cooldown because the asset would possibly face promoting strain.

Then again, Santiment knowledge exhibits {that a} “purchase sign” for Trias has emerged because the variety of new addresses for the asset is rising. Based on the info supplied by the market intelligence platform, Trias Token’s price-daily energetic addresses (DAA) divergence is presently hovering round 541%.