Because the 12 months attracts to a detailed, we do an NFT market evaluation, mapping its trajectory and evaluating it with the predictions specialists have laid out for 2024.

2023 was not the most effective 12 months to be a non-fungible token (NFT) holder or dealer. Following practically two years of unprecedented development, a liquidity plunge hit the NFT market in This fall 2022, persisting into mid-2023.

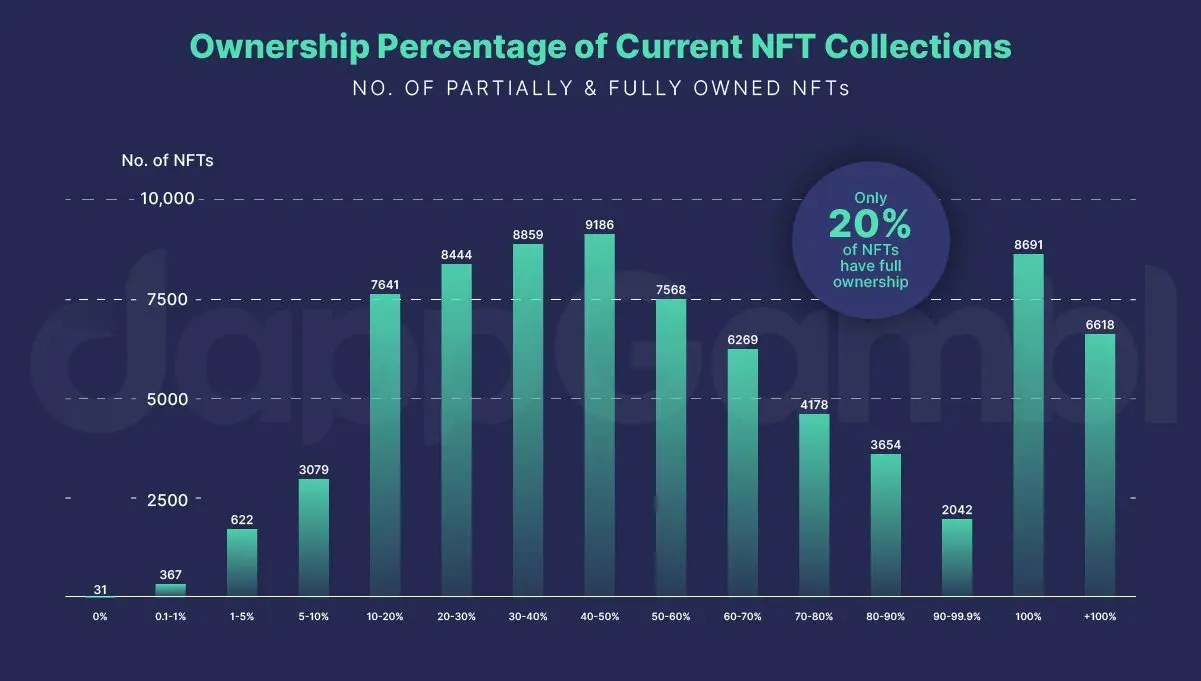

It brought about the ground costs of a minimum of 95% of NFT initiatives to crash close to zero ranges, as revealed by a dappGambl report from September.

To emphasize the gravity of the scenario, the report indicated that almost 80% of all NFT tokens remained unsold as there was nearly no demand to maintain up with the provision.

Moreover, per dappGambl, lower than 1% of practically 9,000 high NFT collections it surveyed had a worth north of $6,000. About 41% have been priced between $5 and $100, whereas 18% have been nugatory, with a flooring value of 0 Ether (ETH).

NFT market evaluation for 2023

Regardless of the decline within the broader crypto market, NFT buying and selling volumes elevated sharply in Q1 2023. The improved numbers got here from zero-fee incentives, airdrops from the Blur NFT market, and its royalty wars with OpenSea.

Throughout that early a part of the 12 months, NFT token transactions reached $4.7 billion, with Ethereum dominating the market, registering $514 million in trades in a single month alone.

The community additionally accounted for a minimum of 50% of complete NFT transactions in 2023, with common month-to-month transaction volumes of between 1 and a pair of million per knowledge from CryptoSlam.

In the meantime, Solana (SOL) skilled a dip in its NFT market dimension because it struggled with the fallout from the FTX chapter and a collection of downtimes and glitches that affected it in 2022.

Nonetheless, after attaining a excessive of 74,550 ETH in mid-February, buying and selling volumes throughout NFT blockchains decreased step by step, with NFT coin holders reaching year-low ranges by April, per knowledge from NFTGo.

Q1 2023 additionally noticed the resurgence of the NFT lending market. Gamers within the house disbursed greater than $25 million within the first three months of the 12 months, with platforms like ParaSpace turning into essentially the most outstanding, whereas NFTFi accrued the very best variety of NFT lending customers.

One of many important speaking factors of the 2023 NFT panorama was Bitcoin’s (BTC) distinctive tackle non-fungible tokens. The so-called Bitcoin Ordinals supplied a unique spin from the extra in style variants on networks like Ethereum and Solana. Nonetheless, they got here with limitations, together with slower transaction speeds and a restricted utility vary.

However regardless of these challenges, Bitcoin’s NFT ecosystem made important strides, exemplified by Yuga Labs’ profitable public sale of its TwelveFold assortment.

Launched in February 2023, Bitcoin Ordinals generated about $400 million in buying and selling volumes by Might, with complete gross sales simply north of 832,000.

Elsewhere, Gem.xyz’s rebrand to OpenSea Pro additionally made headlines. It was accompanied by introducing the Gemesis NFT line, which registered fast buying and selling development and a gentle holding time and worth amongst customers.

November stood out as a month of recovery following a interval of lean profitability. In line with CoinDCX, greater than 40% of merchants turned a revenue that month, a development harking back to the market stability noticed within the second quarter of 2022.

Market watchers additionally famous a rise in distinctive lively wallets and buying and selling volumes. Some sources pegged the buying and selling quantity escalation at 125%, which observers thought of a manifestation of collective investor confidence and echoed the constructive outlook prevalent within the broader crypto market in November.

Concurrently, the holding interval for NFTs noticed a steep decline, from a median of 100 days in October to simply 18 days in November. Analysts noticed this as indicating a shift in technique in the direction of short-term holding, which can have mirrored readiness amongst NFT merchants to use shorter market cycles.

Nonetheless, the constructive outlook didn’t cease common NFT costs from dipping by about 42% in This fall 2023 to settle across the $150 mark.

NFT market analysis

NFT market analysis by TechNavio revealed that the collectible token sector is poised to develop off the again of rising world demand and the digital transformation of varied industries.

In line with the agency, rising web and cellular utilization has prompted firms to increase their digital asset choices and investments.

On a regional scale, the survey projected the Asia-Pacific area to contribute as a lot as 39% of the worldwide NFT market cap. That is underpinned by elevated demand for non-fungible tokens in nations like Singapore, South Korea, the Philippines, Japan, and China.

Moreover, the analysis revealed that the NFT market dimension is bolstered by enlargement into artwork and style gross sales in shops, exemplified by partnerships like CJ OliveNetworks and Galaxia Metaverse.

One other market survey carried out by NFT knowledge supplier NFTGo determined that the imply property per investor for particular person NFT initiatives have been $3,893, whereas the median worth stood at $1,459.

The marked discrepancy between the 2 figures, with the common exceeding the median by 63%, urged that property held by wealthier buyers considerably inflated the imply per capita property, additional widening the wealth hole amongst individuals in several initiatives.

A more in-depth have a look at NFTGo’s knowledge revealed that though the 12 months was marked by promoting, important purchases have been additionally noticed, particularly for top-tier NFTs like CryptoPunks, which traded at a median value of 67.05 ETH.

NFT market worth in 2023

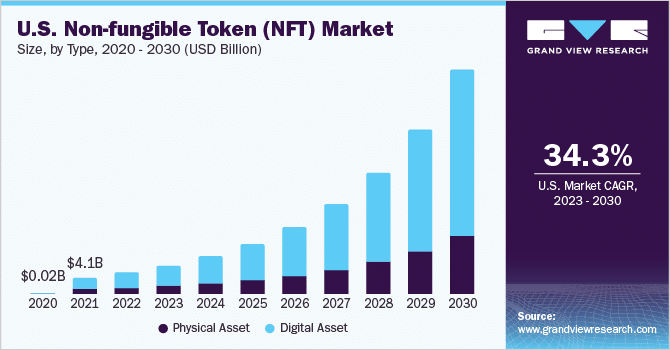

Skilled predictions had the U.S. NFT market, valued at about $22 billion directly, rising at a compound annual development fee (CAGR) of greater than 34% between 2023 and 2030.

Nonetheless, as beforehand said, the NFT market development in 2023 noticed a major decline, with transaction volumes slumping to $4.7 billion, starkly contrasting the $12.6 billion quantity recorded in the identical interval in 2022.

With the general public dropping curiosity in NFTs, main marketplaces reminiscent of OpenSea witnessed important drops in deal values between December 2021 and December 2022, and this development was mirrored throughout a number of different platforms as properly.

OpenSea’s month-to-month lively consumer base stood at round 250,000, with the platform observing a outstanding 450% surge in distinctive NFT patrons between 2020 and 2021. This spike noticed the month-to-month purchaser quantity soar from 10,000 to 40,000.

Nonetheless, Q1 2023 marked a low variety of NFT holders, presumably traced again to the royalty wrangling between Blur and OpenSea.

Apparently, up till 2022, there have been extra patrons than sellers within the NFT market, with a ratio of 1.3 to 1. By 2023, nonetheless, there was a shift out there graph, with sellers outnumbering patrons, signaling a possible change in market habits and presumably marking the start of the NFT market’s second main cycle.

NFT development evaluation

The emergence of a number of tendencies marked the 2023 NFT market. Prime amongst them was the reshuffling of main blue-chip NFT initiatives. Regardless of initially being worthwhile, many of those initiatives began steadily declining as a result of bear market that gripped the broader crypto sector in late 2022 and early 2023.

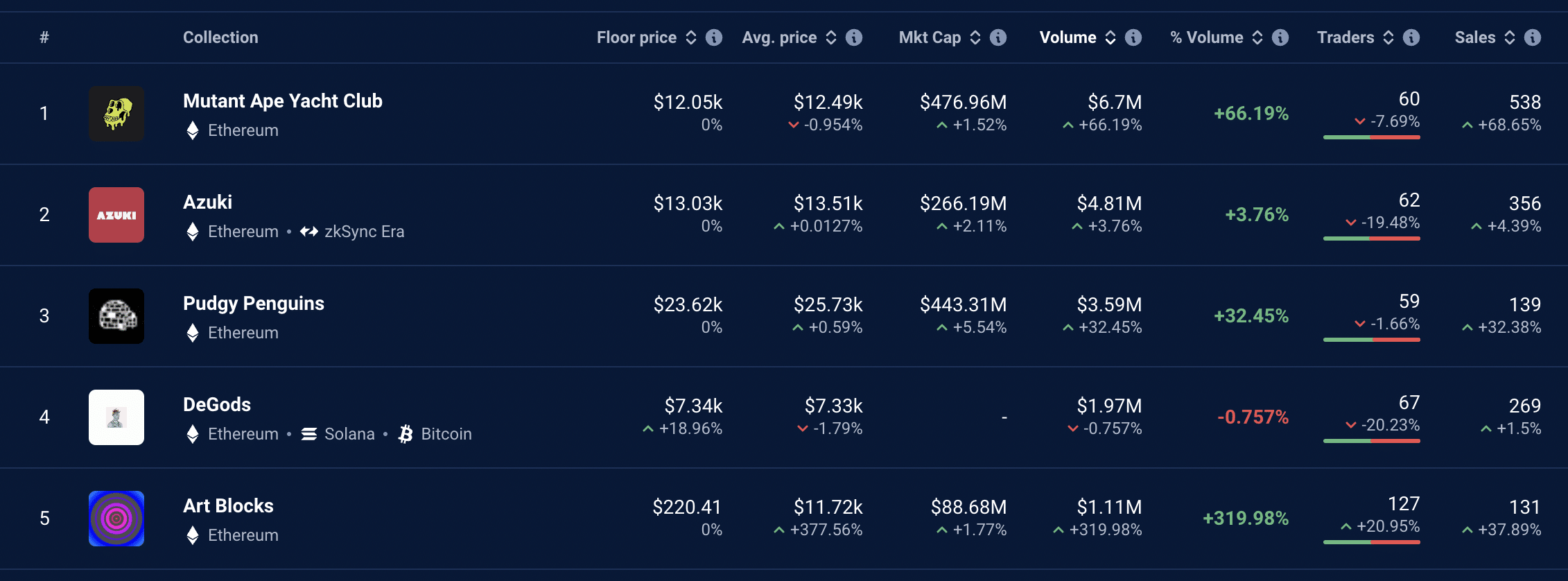

Main initiatives reminiscent of Bored Ape Yacht Membership (BAYC) stood agency towards the prevailing bear wave, whereas others like Azuki struggled initially however later bounced again. In distinction, smaller initiatives reminiscent of Moonbirds took successful on their profitability instantly after launch and have but to get well.

2023 additionally noticed what analysts thought of a major evolution within the habits and profitability of NFT merchants. They noticed a shift in NFT possession, with outstanding buyers more and more dominating the market. For example, based on NFTGo, initiatives like Azuki noticed the variety of whale homeowners double.

The following highest whale proprietor enhance was noticed in Moonbirds, whose basic possession dropped by 1%, however the variety of whales elevated by 41%.

Doodles and CLONE X every registered 24% will increase within the variety of massive buyers, whereas CryptoPunks stood at 22%. Among the many high NFT initiatives, BAYC reported the bottom enhance in whales at 18%.

Attributable to their substantial holdings and affect, many felt whales have been pivotal in steering NFT market tendencies in 2023.

One other development famous in 2023 was the necessity for extra sustainable demand for brand new NFTs. Whereas initiatives reminiscent of HV-MTL, Otherdeed Expanded, and Otherside Vessel carried out steadily, others, like Nakamigos and Checks-VV, wanted to maintain early sturdy momentums.

One other attention-grabbing tidbit gleaned from statistics collected by DappRadar was how blockchain video games remained the highest NFT class, with buying and selling volumes led by Axie Infinity. The sport’s NFT assortment was essentially the most traded, hitting a market cap of $224 million at one level. Different in style web3 video games included NBA Prime Shot, Legendary Beings, Gods Unchained, and NFL All Day.

Nonetheless, on the similar time, the market noticed flooring costs for high NFTs and metaverse land falling considerably. At one level, BAYC flooring costs have been as little as 24.8 ETH, a stark drop from their 152 ETH peak in Q2 2022.

In December, the NFT market recovered barely, with Mutant Ape Yacht Membership main the checklist.

Lastly, specialists have attributed the NFT market’s rising visibility to the rising curiosity of mainstream manufacturers, together with Visa and Budweiser. Such companies have strategically acquired current NFTs as an alternative of producing their very own.

The attraction of NFTs to those huge manufacturers stems from the potential for extra income streams. Furthermore, the adoption of NFTs as buyer rewards is turning into more and more prevalent, with such dynamics anticipated to generate a constructive impact throughout the NFT market and propel its development trajectory within the new 12 months.

NFT market forecast for 2024

Regardless of the troubles encountered by NFTs in 2023, many analysts stay bullish in regards to the expertise’s prospects heading into 2024.

Listed here are some key developments they anticipate to occur which will change the trajectory of NFTs:

NFTs evolving past collectibles

Going into 2024, many anticipate a shift within the NFT panorama because it strikes from collectibles to utility-driven digital property. Tokens with real-world purposes might mark an important change within the NFT paradigm, with such tokens serving as conduits between the digital and bodily worlds, providing worth past inventive appreciation.

GameFi

Analysts additionally anticipate the mixing of NFTs will change gamification, enabling precise possession of in-game property and incentivizing gamers with rewards for engagement.

Regulatory readability

The enhancement of crypto regulatory frameworks within the coming 12 months is predicted to coincide with the maturation of the NFT crypto market.

Regulators worldwide are creating pointers to make sure a safer and clear atmosphere to construct belief and market stability. This might supply a protected atmosphere for NFT creators, merchants, and buyers to pursue their respective actions.

Integration with defi

There have additionally been strategies that NFTs might merge with decentralized finance protocols in 2024, a step many think about revolutionary as it could enable for tokenizing real-world property as NFTs and connecting conventional finance with crypto.

It might give NFT crypto holders the choice to leverage their tokens as collateral for loans or to generate curiosity through defi platforms, thus representing a substantial leap in the direction of monetary inclusivity and asset monetization.

Cross-platform interoperability

Proponents are additionally banking on improved interoperability between networks reminiscent of Cosmos and Polkadot (DOT) to rework the NFT market.

Enabling customers to maneuver non-fungible tokens throughout totally different blockchains easily might increase alternatives for creators and collectors and additional reinforce the mixing of the digital asset ecosystem.

AI-powered NFTs

Hope is rife within the NFT house that synthetic intelligence will personalize the NFT crypto expertise, providing tailor-made engagement, distinctive creations, and new use instances for the tokens in 2024.

Progress projections

TechNavio’s evaluation anticipated the NFT market dimension to increase at a CAGR of 30.28 between 2024 and 2028 and finally hit a minimum of $68 billion. The agency’s researchers pegged their optimism on a number of key drivers, reminiscent of escalating curiosity in digital artwork and rising use instances for NFTs, together with these listed above.

In 2024, TechNavio’s prediction outlined a year-over-year development within the NFT market cap of a minimum of 23.27%.

Relating to geographical areas, North America and Europe have been on the forefront of NFT adoption. Nonetheless, statistics collated by Metav.rs NFT shopper habits confirmed that Singaporeans, Chinese language, and Venezuelans have been essentially the most lively NFT merchants in 2023. Nigeria confirmed promising potential for future development, presumably starting from 13.7% to 35.3%.

Moreover, the Metav.rs figures revealed ladies in Thailand confirmed the next curiosity in NFTs, with 30% accumulating them in comparison with 23% of males. Notably, 70% of People have been unaware of what NFTs are, whereas in France, 3.5% of the inhabitants have bought NFTs, and nearly half of the French youth aged 18-24 are open to purchasing NFTs.

These potential areas of development include caveats, regulation being considered one of them. As governments worldwide take a keener curiosity within the crypto house, business watchers anticipate to see extra guidelines and laws that might affect NFT markets as properly.

FAQs

How huge is the NFT market?

The worldwide non-fungible token market dimension was valued at $20.44 billion in 2022.

How a lot is the NFT market price?

The NFT market is predicted to develop at a compound annual development fee (CAGR) of 34.2% from 2023 to 2030.

Is the NFT market rising?

Sure, the NFT market is rising, pushed by the distinctiveness, transparency, and safety of NFTs, in addition to the rising curiosity in digital possession.

What are the important thing components driving the expansion of the NFTs market?

The expansion of the NFT market could be attributed to the rise of social media and digital platforms, the adoption of blockchain expertise, and the convergence of conventional industries with the NFT market.