The native token of the Elastos ecosystem, ELA, has emerged as the highest gainer among the many high 500 cryptocurrencies whereas a key indicator suggests downward momentum.

ELA is up 35% previously 24 hours and is buying and selling at $4.24 on the time of writing. The asset’s market cap rose to $91 million, making it the 384th-largest crypto asset. Whereas each day buying and selling quantity of Elastos additionally recorded a 50% rally, reaching $2.57 million.

Information reveals that over 64% of the spot ELA trading volume comes from Coinbase with the US greenback buying and selling pair.

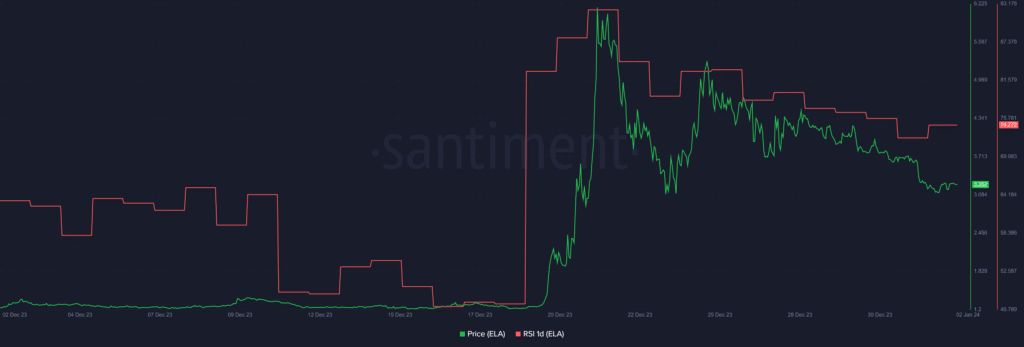

In line with information supplied by the market intelligence platform Santiment, Elastos might face notable promoting stress because the asset has been recording consecutive declines since reaching an area high of $4.6 on Jan. 2.

Per Santiment, the Relative Energy Index (RSI) of the ELA token at present stands at 74.7. The RSI indicator suggests the potential of an additional value drop because the asset’s bullish momentum might need been triggered by massive gamers.

With the current spike, Elastos registered a 425% value rally over the previous yr after falling to an all-time low of $0.79 on Jan. 3, 2023. The worth hike began in mid-December 2023 after the blockchain developer announced a layer-2 network for Bitcoin (BTC) — calling it “Bitcoin Elastos Layer2” or “BeL2” for brief.

Regardless of the current value rally, ELA continues to be down by 95% from its all-time excessive of $93.9, which it hit on Feb. 24, 2018.