Choices buying and selling analysts pointed to Jan. 10 and past because the timeline for an SEC choice on spot Bitcoin ETFs amid bearish hypothesis that each one purposes could also be rejected.

Greekslive famous {that a} U.S. Securities and Trade Fee (SEC) stand on spot Bitcoin (BTC) ETFs was unlikely to reach earlier than Jan. 7, citing inventory worth actions from crypto mining operations and digital asset-related corporations in America.

Present month places at the moment are cheaper, and block trades are beginning to see energetic put shopping for, with choices market knowledge suggesting that institutional buyers aren’t very bullish on the ETF market.

Greekslive on X

The report was launched to a market gripped by hypothesis surrounding 14 spot Bitcoin ETF purposes filed by TradFi giants like BlackRock and crypto-native entities like Hashdex. Such merchandise have been traditionally rejected by the SEC, though latest developments indicated by a number of conferences and up to date filings fueled optimism for a special end result in 2024.

Nevertheless, some opinion leaders surmised that the SEC may delay spot Bitcoin ETFs past January. Certainly, Matrixport mentioned the SEC could reject all bids for a fund that invests in Bitcoin at spot costs as crypto.information reported.

Authorized consultants mentioned this end result may lead to litigation in opposition to the SEC attributable to a court ruling through the Grayscale case.

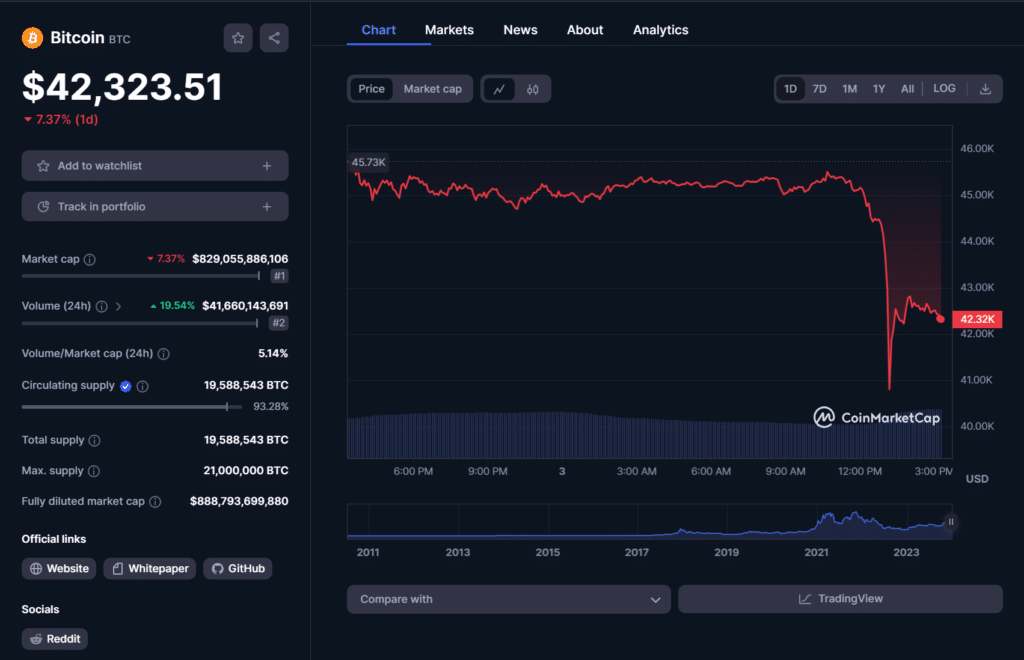

A large 7% drop adopted the report from Matrixport in BTC’s worth because the token dipped under $43,000 and triggered over half a billion in liquidations throughout crypto markets. These liquidations had occurred inside solely 4 hours at press time.

Whereas Matrixport expects Bitcoin to return towards $36,000, the corporate foresees a surge in BTC costs this month. Analysts on the crypto startup predicted a surge to a minimum of $50,000 earlier than February and a brand new all-time excessive above $125,000 by the yr’s shut.