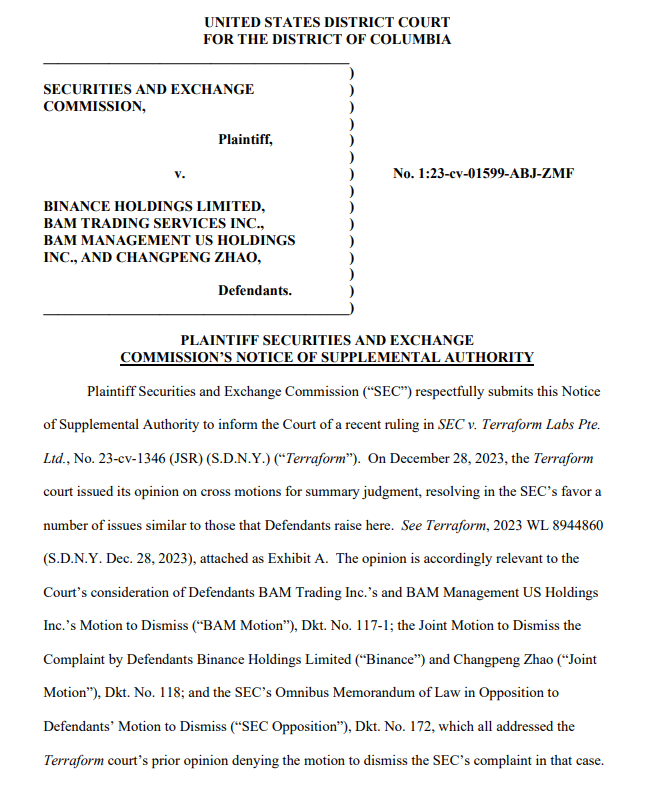

The SEC has submitted a brand new argument in its ongoing authorized battle with Binance, referencing a latest determination involving Terraform Labs.

The transfer by the SEC goals to strengthen its case in opposition to Binance, notably regarding classifying the cryptocurrency BUSD as a safety. Within the latest filing, the SEC highlighted the court docket’s determination within the Terraform case, the place cryptocurrencies similar to UST, LUNA, wLUNA, and MIR had been deemed securities primarily based on the Howey take a look at.

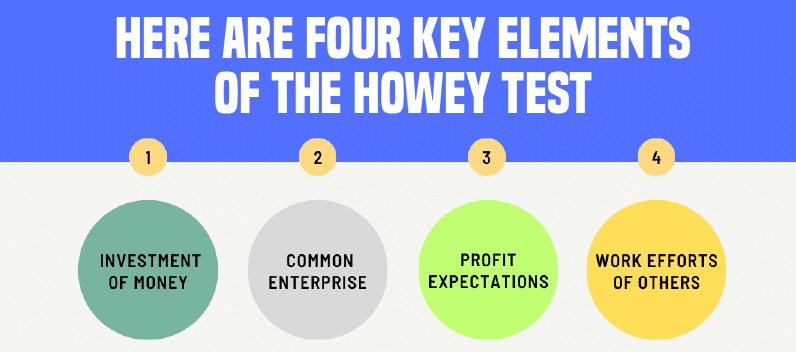

The Howey Take a look at is a authorized commonplace established by the U.S. Supreme Courtroom to find out whether or not a transaction qualifies as an “funding contract” and, thus, a safety. It assesses if cash is invested in a standard enterprise with an affordable expectation of income.

The SEC’s reference to the Terraform ruling counters an earlier movement to dismiss the case filed by BAM Administration and BAM Buying and selling in September. On this movement, BAM Administration had argued that investments in cryptocurrencies like LUNA didn’t represent an funding contract underneath the SEC’s interpretation.

The SEC maintained that promoters used cash invested in such tokens for growing blockchain functionalities or providing yield-bearing returns, with the buyers standing to realize worth primarily based on the promoters’ actions.

Nonetheless, the latest judgment within the Terraform case has offered the SEC with a foundation to argue that the Howey take a look at, a authorized commonplace used to find out what constitutes a safety, also needs to apply within the Binance case. The SEC emphasizes that the court docket’s evaluation of Terraform’s UST stablecoin is very related when contemplating Binance’s BUSD and different choices like BNB Vault and Easy Earn applications.