Discover defi’s preliminary promise in revolutionizing finance and its journey by means of market fluctuations and challenges.

Rising as a byproduct of the blockchain revolution, decentralized finance (defi) initially promised a radical shift within the monetary sector. Nonetheless, its journey has been marked by vital fluctuations and challenges.

In 2021, DeFi skilled a surge, aligning with the broader bullish sentiment within the crypto market. Its market cap soared to almost $180 billion in Nov. 2021, underlining the immense investor curiosity and confidence on this nascent sector.

This era was characterised by revolutionary monetary fashions, a surge in decentralized lending, and the emergence of yield farming, which attracted each retail and institutional traders.

Nonetheless, this speedy development was not with out its drawbacks. The defi sector confronted hurdles, together with scalability points, excessive transaction charges, particularly on networks like Ethereum (ETH), and a plethora of scams that exploited the decentralized nature of those platforms.

Consequently, the market witnessed a pointy decline, with the market cap plummeting to about $30 billion by Jan. 2023.

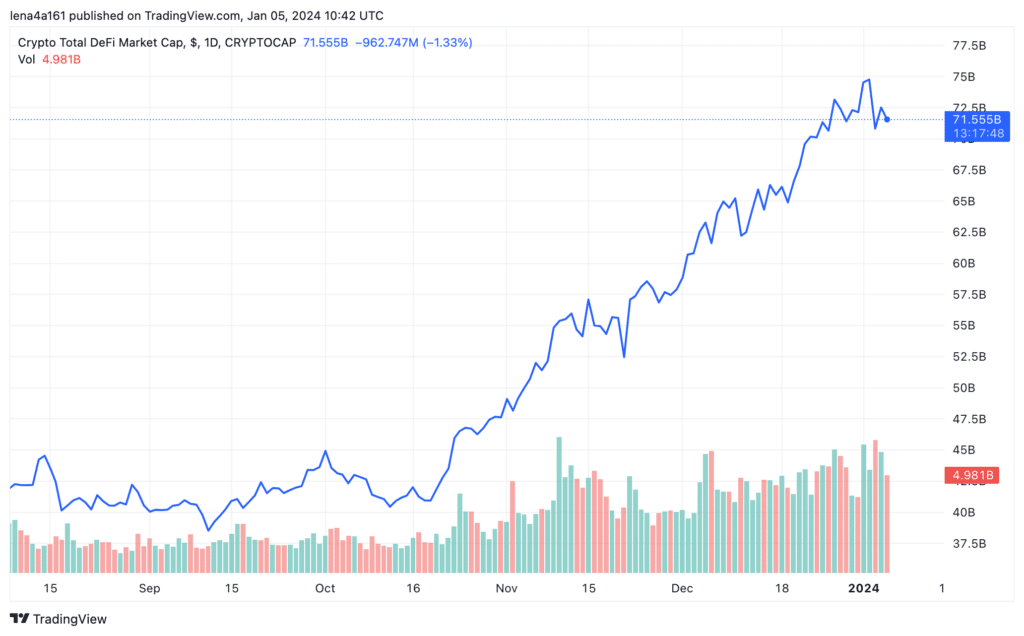

On the finish of 2023, defi has proven indicators of restoration at a extra measured tempo. The present market cap is roughly $70 billion, indicating a cautious however regular resurgence.

Let’s dissect the components behind these shifts and perceive what to anticipate from the defi market in 2024.

2021: the 12 months of unprecedented development

In 2021, the defi market skilled a interval of explosive development and mainstream adoption, setting the stage for widespread curiosity and funding within the sector.

Explosive development

2021 was a landmark 12 months for defi, characterised by a pointy rise in complete worth locked (TVL), which soared to $175 billion by November, as per DeFi LIama.

This era additionally noticed widespread adoption of defi purposes and was marked by substantial improvements in yield farming, liquidity swimming pools, and decentralized exchanges (DEXs).

Key platforms like Uniswap (UNI), Aave (AAVE), and Compound (COMP) grew manifold and gained substantial traction throughout this era.

Regulatory consideration

With this speedy development, defi additionally began to draw regulatory consideration, notably from the Securities and Change Fee (SEC), with discussions across the want for client safety and anti-money laundering measures.

2022: market challenges and correction

In 2022, the defi market skilled a big correction, partly as a result of Terra-Luna crash. This crash had profound results on the broader defi ecosystem.

Market correction from Terra-Luna crash

The collapse of TerraUSD (UST), an algorithmic stablecoin, and its related cryptocurrency, Luna, considerably impacted the defi market. UST misplaced its peg to the greenback, resulting in a steep decline in Luna’s worth.

This occasion raised critical issues concerning the stability and reliability of algorithmic stablecoins and resulted in a lack of investor confidence in speculative defi initiatives.

The crash additionally induced a domino impact throughout numerous defi platforms and cryptocurrencies, resulting in a decline of their values.

Scalability and effectivity challenges

Following the market correction, main defi platforms turned their focus to scaling options to handle elevated site visitors and decrease transaction prices.

Defi 2.0 emerged as a response to those points, aiming to enhance upon the primary era of defi initiatives.

Defi 2.0 initiatives centered on enhancing safety, scalability, and user-friendliness. This new wave of initiatives sought to be taught from the errors of their predecessors and supply extra sustainable and environment friendly options for the defi sector.

As an example, some defi 2.0 initiatives explored offering insurance coverage towards impermanent loss in liquidity swimming pools, thereby incentivizing extra liquidity suppliers by lowering danger.

Persistent safety issues

Regardless of the expansion and improvements within the DeFi house, safety remained a significant problem. The sector continued to grapple with safety points, with a number of high-profile hacks, including the foremost Acala hack wherein hackers stole a USD value $1.3 billion by exploiting the vulnerabilities inside Acala’s algorithm.

2023: consolidation and institutional adoption

By 2023, the defi market started to indicate indicators of stabilization and a extra cautious strategy from traders, specializing in sustainable improvement and long-term worth creation:

Market stabilization

The TVL in defi was reported at practically $40 billion as of Jan. 2023, which has elevated considerably to over $70 billion as of Jan. 2024. Nonetheless, the TVL ranges nonetheless stay at virtually 40% of their peak 2021 ranges.

Throughout 2023, main defi protocols like Uniswap, Curve, Aave, and Synthetix continued to steer the market.

Uniswap, for instance, remained the dominant DEX on account of its concentrated liquidity and dealing capital necessities.

Curve retained a secure 10-15% share of the DEX quantity, and Aave developed a number of revolutionary initiatives, together with the GHO decentralized stablecoin and Lens Protocol.

Institutional curiosity

2023 witnessed elevated institutional adoption of defi, with conventional monetary establishments exploring defi purposes.

Main companies like Disney, Starbucks, and Adidas confirmed curiosity in embracing crypto expertise, indicating defi’s rising acceptance in mainstream monetary sectors.

Regulatory readability

Regulatory readability round defi started to take form in 2023, with world and nationwide regulators engaged on creating pointers for digital belongings.

Key areas of regulatory focus included the classification of cryptocurrencies, taxation, anti-money laundering (AML), know-your-customer (KYC) necessities, the regulation of safety tokens, and pointers on stablecoins.

What specialists assume led to defi’s decline?

Slava Demchuk, the CEO of AMLBot, in a dialog with crypto.information provided an in depth evaluation of the defi market’s contraction. He identified the correlation between the shrinking TVL in defi and the broader crypto market’s depreciation towards the U.S. greenback. Demchuk said:

“TVL shrank largely on account of crypto closing its worth towards the U.S. Greenback. This was underscored by the altering dynamics within the world market, which rubbed off on the crypto ecosystem.”

Moreover, Demchuk addressed the widespread false impression that the decline in defi’s TVL was primarily on account of safety breaches and frauds. He clarified that these points, whereas prevalent throughout excessive market exercise durations, aren’t the elemental causes of the market downturn. He defined:

“Durations of excessive market exercise, corresponding to bull runs, are usually marked by a rise in hacks and frauds, so we can not see these as potential triggers.”

In discussing the long run prospects of the defi market, Demchuk brings an optimistic outlook, hinting at pivotal developments such because the potential approval of a Bitcoin spot ETF.

He believes such developments may considerably improve defi’s credibility and entice extra investments into the sector.

Then again, Oleg Bevz, an advisor at Playnance, shared a essential view of the defi market’s peak and subsequent fall. Bevz noticed the dramatic lower in TVL from its peak in 2021 and identified the trigger because the market’s overreliance on speculative habits fairly than sustainable development. He said:

“The present outlook of the defi world per its TVL pegged at $53 billion, down from over $180 billion at its peak in 2021, is proof that the market is bleeding. The increase of the defi market in 2021 was related to the truth that individuals began throwing cash into the market anticipating unrealistic income, not as a result of they might get actual advantages tailor-made as services or products for that cash. Capitalizing on this greed, most initiatives printed yields out of skinny air. The cycle collapsed as a result of it was constructed extra on expectations and FOMO fairly than actual utility.”

What to anticipate from the defi market in 2024?

In 2024, the DeFi market is anticipated to bear vital developments influenced by a number of key traits:

Regulation and transparency

The deal with regulatory frameworks will turn out to be extra outstanding in 2024. True defi initiatives, that are decentralized in nature, are more likely to stay outdoors the present regulatory perimeters.

Nonetheless, hybrid finance (HyFi) initiatives, which comprise parts of centralized management, could face elevated regulatory scrutiny.

The trade is anticipated to pivot in the direction of a stability between privateness and transparency, adopting proactive compliance measures to handle institutional issues and regulatory frameworks.

Tokenization of belongings

A serious development for 2024 would be the tokenization of varied belongings, together with yield-bearing stablecoins and real-world belongings (RWAs).

This transfer is anticipated to reinforce liquidity, scale back transaction prices, and open up new alternatives for defi protocol designs.

The development in the direction of tokenization is predicted to energy vital development within the defi sector, doubtlessly driving market maturation and increasing the scope of collateral use.

Development in yield-bearing stablecoins

Yield-bearing stablecoins are forecasted to be one of many fastest-growing sectors in defi, increasing from round $1 billion to over $10 billion.

These stablecoins may provide yields stemming from each staked Ether-based and RWA-based stablecoins, thus enhancing their presence out there.

These traits point out that 2024 could possibly be a pivotal 12 months for defi, marked by developments in expertise, regulatory readability, and market maturity, positioning it for renewed development.