The U.S. Securities and Alternate Fee (SEC) has delayed a call on Constancy’s software to launch spot Ethereum (ETH) ETFs.

In accordance with data on the regulator’s website dated Jan. 18, a call on the applying is now anticipated on March 5, 2024.

“The Fee finds it applicable to designate an extended interval inside which to take motion on the proposed rule change in order that it has ample time to think about the proposed rule change and the problems raised therein.”

SEC submitting

Bloomberg analyst James Seyffart referred to as the transfer “anticipated.” On the similar time, he admitted that in March, the SEC would once more postpone the choice on the applying till Might.

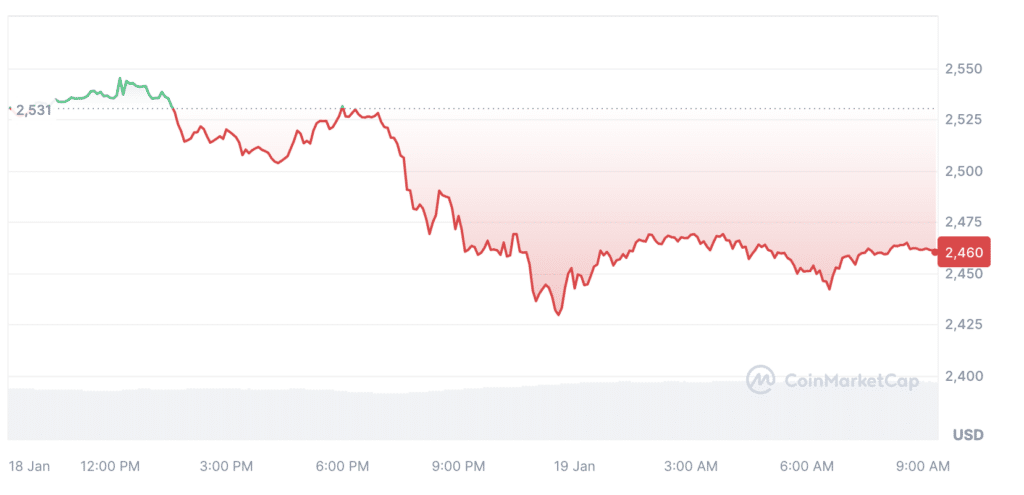

The worth of Ethereum reacted with a slight drop falling 2.8% to $2,459 on the time of writing. Nonetheless, cryptocurrency buying and selling volumes elevated considerably – greater than 14% in 24 hours, to $11.9 billion.

Final week, the SEC approved 11 spot Bitcoin (BTC) ETFs to start buying and selling, prompting some within the trade to marvel whether or not an Ethereum spot ETF might be following.

In late 2023, Constancy joined fellow large BlackRock within the race for an Ethereum spot ETF. A month earlier than these companies filed bids for spot merchandise, ETH futures ETFs went dwell. The pinnacle of monetary large BlackRock, Larry Fink, said he “sees worth” in a spot ETF based mostly on the second-largest cryptocurrency. In his opinion, these are “simply steps in the direction of tokenization.”