Whereas Individuals have seen the adoption of Bitcoin (BTC) spot and futures ETFs, the state of affairs in Europe is completely different.

Bitcoin ETFs have been a scorching matter for a lot of months, because the approval of ETFs primarily based on precise Bitcoin within the U.S. may doubtlessly result in an inflow of funds from Wall Avenue establishments, presumably pushing the worth of Bitcoin to new heights.

How do Bitcoin ETFs work?

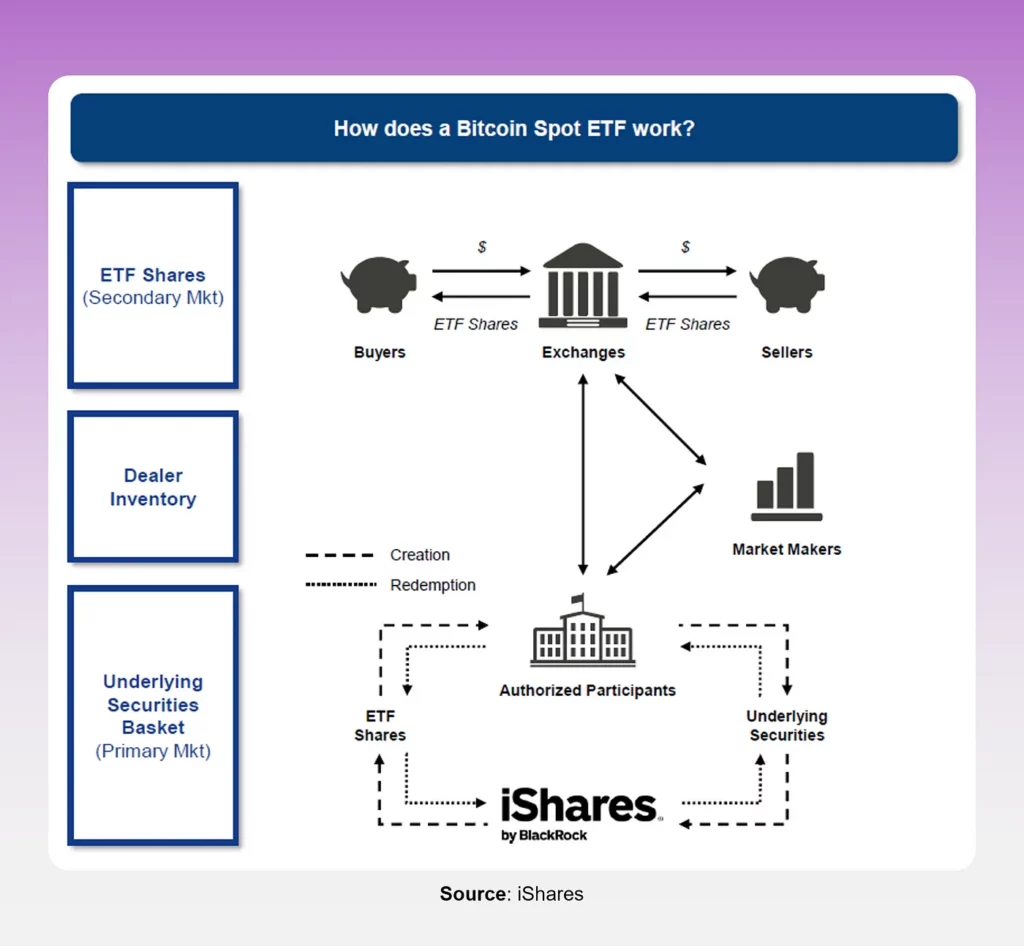

Like conventional ETFs, Bitcoin ETFs are issued by monetary establishments that spend money on Bitcoin and handle the fund on behalf of traders. A Bitcoin ETF could be structured in varied methods. For instance, it could maintain Bitcoin futures or “bodily” Bitcoin because the underlying asset, managed by the ETF issuer on behalf of the investor.

Within the case of funds with a Bitcoin base, the issuing establishment buys BTC and holds it. Subsequently, it points shares of the fund on a securities change, monitoring the asset’s value. Traders instantly personal a portion of the underlying Bitcoin, and as the price of BTC fluctuates, the worth of the ETF modifications accordingly.

One notable benefit of Bitcoin ETFs is their buying and selling on regulated securities exchanges, offering accessibility to varied traders and eliminating the necessity for technical data in securely storing crypto belongings.

Because of this, traders new to cryptocurrencies can acquire publicity to Bitcoin with out requiring a crypto pockets or partaking in buying and selling on a cryptocurrency change platform.

Bitcoin ETP: to not be confused with ETF

Along with ETFs, exchange-traded merchandise (ETPs) exist within the regulated funding markets. ETP stands for exchange-traded product, representing an funding product obtainable on a inventory change.

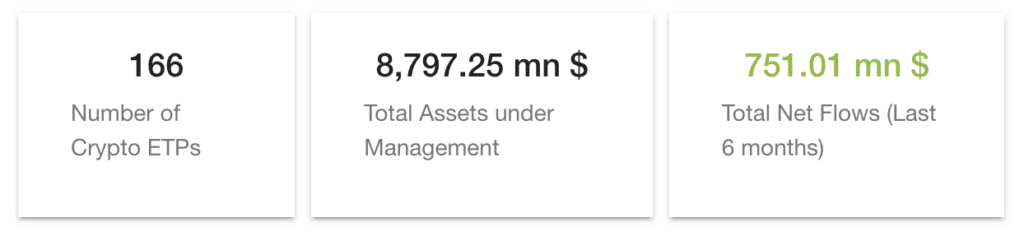

As the worth and alternative of the digital asset market grows, extra cryptocurrency ETPs are coming into circulation, together with ETPs for Bitcoin, Ethereum (ETH), and Litecoin (LTC).

What is thought about ETP in Europe

Spot Bitcoin ETPs have existed in Europe for a very long time, offering traders with entry to digital tokens. Europe is way more progressive by way of cryptocurrency merchandise.

In Could 2015, Swedish vendor XBT AB introduced the authorization of Bitcoin Tracker One (a CoinShares product). It was the very first BTC-based safety obtainable on a regulated change. In October 2015, the corporate launched the euro-denominated Bitcoin Tracker EUR safety system, obtainable by way of Nasdaq Nordic.

About $9 billion is at present allotted to ETPs in Europe, in keeping with ETFbook, with a lot of the asset assortment and earnings over the previous 12 months pushed by a flood of reports associated to anticipated ETF approvals within the U.S.

Bitcoin ETF in Europe

The primary Bitcoin ETF in Europe, the Jacobi FT Wilshire Bitcoin ETF, was launched in August 2023 on the Euronext Amsterdam change beneath the ticker BCOIN.

Jacobi FT Wilshire Bitcoin ETF, a inexperienced ETF from Jacobi Asset Administration, aligns its targets with the European Union’s aspirations for sustainable blockchain innovation. It is a important first step in direction of introducing ETFs in Europe as different asset administration corporations look to spend money on the area’s blockchain business. The instrument has a built-in resolution for renewable power certification. In accordance with the corporate, it permits “institutional traders to entry the advantages of Bitcoin whereas reaching ESG targets.”

The agency obtained the Guernsey Monetary Providers Fee’s approval to launch the product in October 2021. In accordance with Jacobi’s plans, the Bitcoin fund was supposed to seem in July 2022, however it was postponed because of the collapse of Terra.

Nonetheless, the fund’s approval didn’t trigger a lot pleasure. The main cryptocurrency entered an upward pattern solely in direction of the tip of the 12 months in anticipation of the acceptance of spot Bitcoin ETFs in america.

There are some obstacles to creating cryptocurrency ETFs, primarily the Undertakings for Collective Funding in Transferable Securities Directive 2009 or UCITS. Crypto, like gold and different commodities, is just not included within the European Fee’s Eligible Asset Directive for UCITS funds.

Will there be analogs of spot Bitcoin ETFs in Europe?

Regardless of the cryptocurrency state of affairs in Europe changing into extra progressive with the launch of the Market in Crypto Property (MiCA) regulation, it’s unlikely that the European Union will comply with the trail of america quickly.

Firstly, cultural variations between Individuals and Europeans ought to be thought of. Whereas Individuals are sometimes seen as shiny representatives of capitalism, unafraid to speculate and check out new monetary devices, Europe has a considerably completely different strategy.

Notably, because of the extra conservative funding strategy of Europeans, it’s unlikely that spot Bitcoin ETFs in Europe will replicate the success seen in america. Furthermore, exchange-traded merchandise (ETPs) are already acquainted on the continent, with asset managers like CoinShares, 21shares, WisdomTree, and VanEck providing ETPs that behave like ETFs.

Nonetheless, the emergence of spot Bitcoin ETFs in Europe can’t be fully dominated out. If the American market units a constructive instance, maybe Europeans will comply with swimsuit.