Funding crypto merchandise’ outflows amounted to $21 million final week.

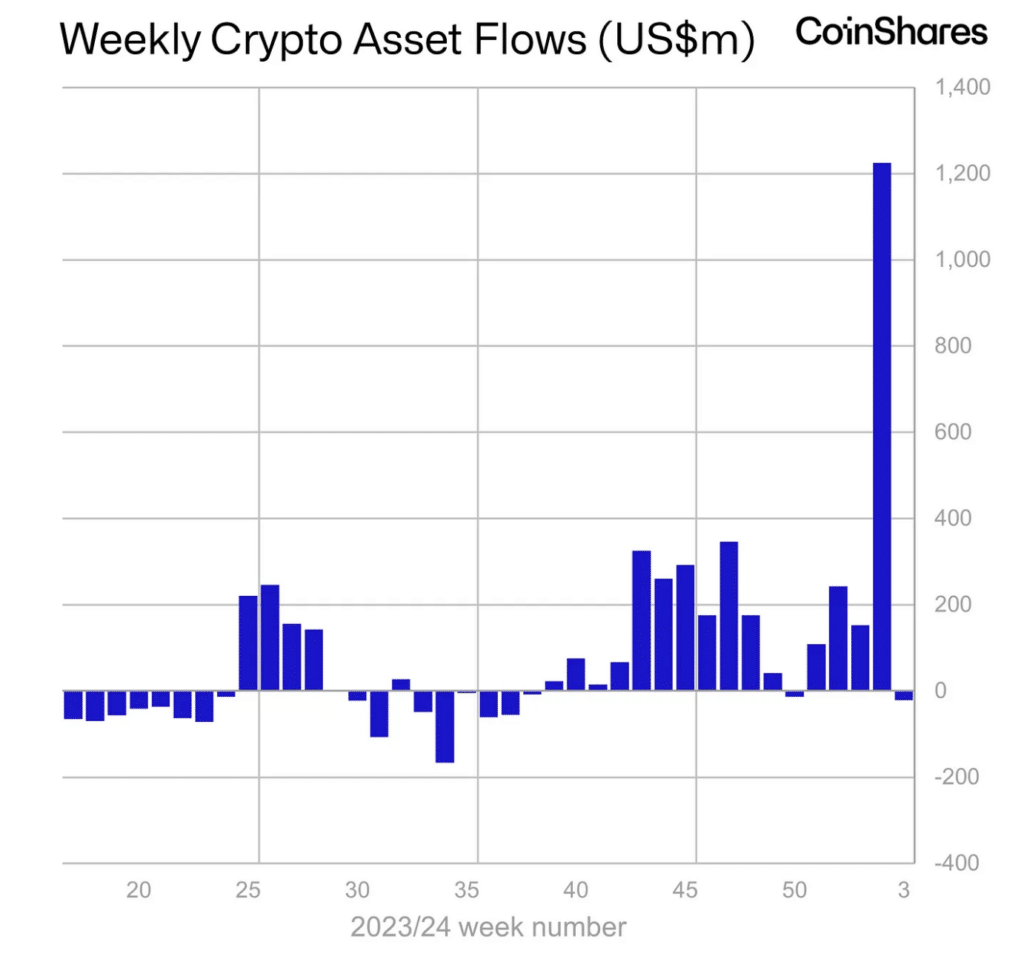

In accordance with a CoinShares report, outflows from funding merchandise into digital belongings had been modest at $21 million final week. Nevertheless, this determine masks very excessive Bitcoin (BTC) buying and selling volumes final week, totaling $11.8 billion, seven instances the typical weekly buying and selling quantity in 2023.

Geographically, capital inflows into the USA totaled $263 million, whereas Canada and Europe noticed outflows of $297 million. Analysts recommend that such developments are defined by the migration of belongings to the USA.

Bitcoin product outflows had been minor, totaling $25 million, though buying and selling volumes of $11.8 billion represented 63% of all BTC volumes on trusted exchanges. Ethereum (ETH) and Solana (SOL)-based merchandise noticed outflows of $14 million and $8.5 million, respectively.

Analysts observe that ETP exercise is at the moment dominating total buying and selling exercise. Incumbent issuers with increased prices have been hit within the U.S., with capital outflows totaling $2.9 billion because the launch of spot Bitcoin ETFs.

Since launch, these newly issued ETFs have gained $4.13 billion, outpacing losses from costlier current ETPs. Buyers noticed the current worth decline as a possibility so as to add to brief Bitcoin funding merchandise, receiving an inflow of $13 million. Internet inflows into U.S. ETFs have been $1.2 billion since launch.

Senior IT architect at BTCData Chris Jay Terry predicted an outflow of one other $25 billion from the most important spot Bitcoin ETF GBTC.

After six days of buying and selling, the online outflow from GBTC amounted to $2.8 billion. JPMorgan Chase financial institution consultants anticipate that the fund will lose about $13 billion, of which $10 billion will probably be transferred by traders to different merchandise from the identical sector.