Ondo Finance, a platform specializing in tokenized real-world property, has expanded its operations into the Asia Pacific area.

In keeping with its enlargement efforts Ondo has appointed Ashwin Khosa — a former worker of Tether and Bitfinex — as its new Vice President of Enterprise Improvement for the Asia/Pacific area.

Nevertheless, the agency didn’t disclose the nation or the town the place the workplace has been opened.

The corporate, with a considerable 40% share of the worldwide market, provides three key tokenized merchandise: OUSG, offering entry to US Treasuries; OMMF, linked to US cash market funds; and USDY, a yield-bearing various to conventional stablecoins.

These choices grant world buyers the chance to interact with distinguished US asset lessons by means of tokenization.

Nathan Allman, the founder and CEO of Ondo, highlighted the colourful and increasing crypto neighborhood in Asia Pacific, in addition to the area’s curiosity in US asset publicity by means of tokenized means.

The newest enlargement follows a sequence of notable developments from Ondo, together with the discharge of a strategic roadmap for the upcoming 24 months and up to date partnerships with Mantle Network and Solana. These alliances goal to combine USDY into their respective blockchain networks.

Moreover, the Ondo Basis has launched a factors program and proposed unlocking the ONDO token, reflecting the corporate’s dedication to evolving the on-chain finance panorama.

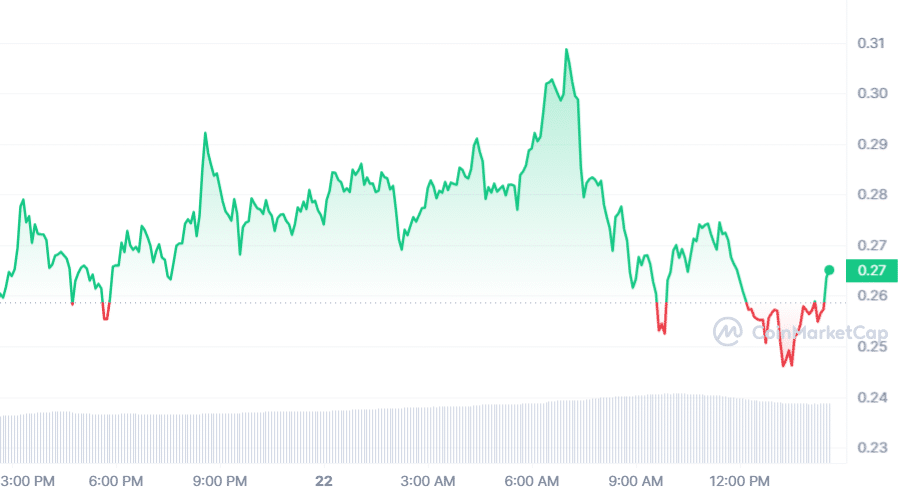

On the time of writing, Ondo worth witnessed a 2.4% rise and traded at $0.265, with its buying and selling quantity hovering 28.8% to $196.7 million. Nevertheless, over the past seven days, it has added greater than 60% to its worth.