ProShares’ Bitcoin Technique ETF experiences a big drop in buying and selling exercise as traders shift focus to identify Bitcoin ETFs.

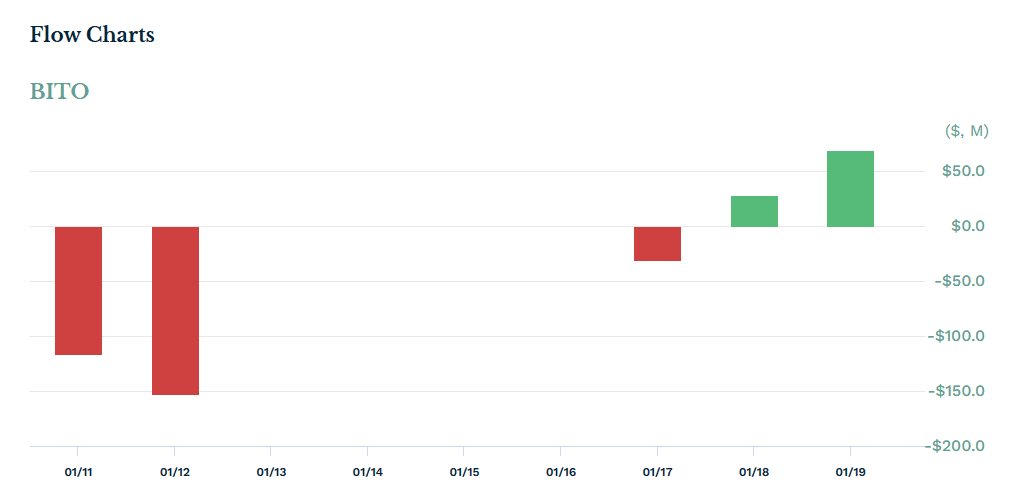

On Jan. 18, buying and selling volumes for BITO on the New York Inventory Alternate fell sharply to only above $500 million, a big lower from the $2 billion peak seen on Jan. 11, per Coinbase’s knowledge. Moreover, knowledge from ETF.com reveals a considerable outflow from BITO, exceeding $270 million, throughout the identical timeframe. Regardless of this downturn in buying and selling exercise, market analysts preserve a constructive outlook on BITO’s position within the sector, significantly as a hedging software.

The choice for spot Bitcoin ETFs over futures-based choices like BITO is more and more evident. This shift is attributed to the inherent mechanism of BITO, which requires the rolling over of futures contracts, resulting in extra prices that adversely have an effect on its long-term efficiency.

In stark distinction, the primary week following the launch of 11 spot Bitcoin ETFs noticed a exceptional $14 billion in buying and selling quantity, surpassing the full for all ETFs launched in 2023. These spot ETFs collectively attracted over $1.2 billion in investments of their inaugural week, highlighting their rising reputation amongst traders.

Presently, Bitcoin is the second largest ETF market within the U.S., based mostly on belongings underneath administration, stunning silver.