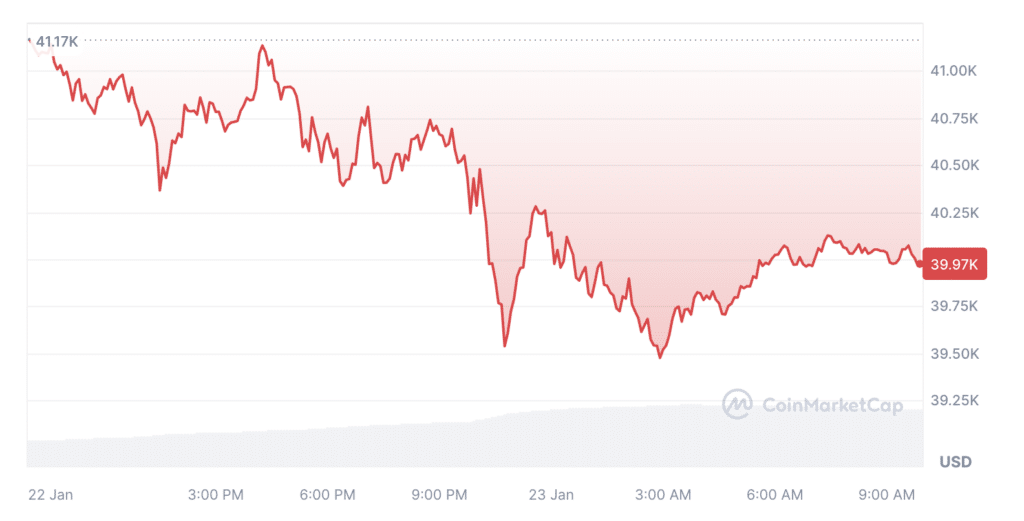

For the primary time because the starting of the yr, Bitcoin (BTC) fell under the $40,000 stage, resulting in panic available in the market.

Analysts on the Greeks.stay service famous that the fall of BTC under $40,000 on the night time of Jan. 22-23 led to a sure variety of short-term panic orders available on the market, and the bearish energy of the market has elevated. Nonetheless, total, lengthy and quick positions are comparatively balanced, and it’s nonetheless a “fierce sport.”

Bitcoin continues to be in a correction section after launching a number of Bitcoin spot exchange-traded funds within the US for the primary time. Over the previous 24 hours, the worth of the most important cryptocurrency has dropped by 3% to $39,970 on the time of writing. On the similar time, BTC buying and selling volumes have sharply elevated over the previous 24 hours by 113%, reaching $29.2 billion.

Greeks.stay beforehand highlighted that the impression of the BTC spot ETF is over; the core of the latest market play is Grayscale promoting strain and new investor shopping for; the market is prone to happen primarily in the course of the ETF buying and selling session.

In the meantime, spot Bitcoin ETFs experienced internet outflows of $76 million in in the future, in response to Bloomberg analyst James Seyffart.

The chief within the outflow of belongings was a fund from Grayscale with a complete of $3.45 billion. Nonetheless, the top of Grayscale, Michael Sonnenshein, remains optimistic in regards to the destiny of his firm’s ETF, noting that Grayscale has been round for over ten years with a various investor pool and probably the most appreciable liquidity of any spot Bitcoin ETF.