As Bitcoin retains outperforming conventional safe-haven property like gold or bonds, suppliers of spot Bitcoin exchange-traded funds (ETFs) are more likely to double down on their new merchandise.

Bitcoin’s (BTC) uneven returns and low correlation may function “stable help” for the just lately launched spot Bitcoin ETFs, on condition that institutional gamers are more likely to proceed fueling the continued enthusiasm for crypto ETFs.

In a research report, analysts at Kaiko famous that the most important cryptocurrency by market capitalization has amassed over $2 billion in web influx since spot ETFs launch on Jan. 10, signaling a rising investor urge for food for Bitcoin as a safe-haven asset amid broader market uncertainties.

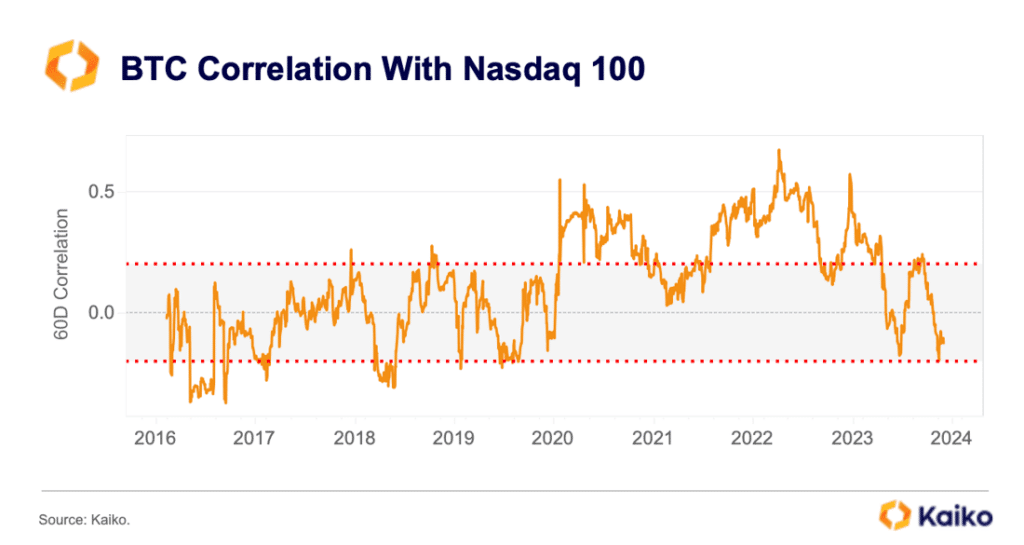

The 60-day correlation between BTC and the Nasdaq 100 index has seen a major decline over the previous 12 months, Kaiko stated, saying additional that since June 2023, this correlation has been constantly near zero.

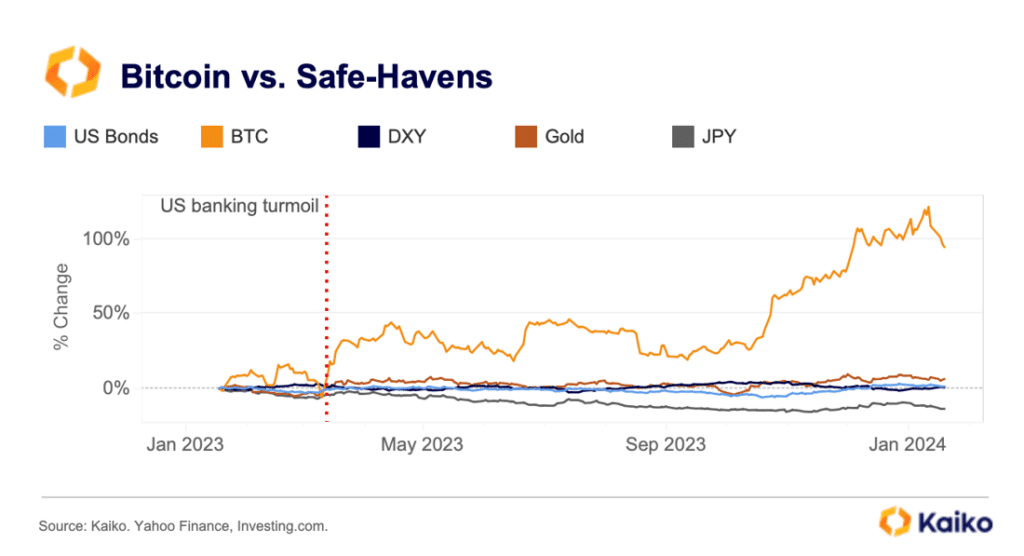

“General, nonetheless, BTC affords considerably larger returns than different conventional safe-havens akin to gold, U.S. bonds or the greenback.”

Kaiko

Whereas Bitcoin has solidified its standing as a safe-haven asset by sustaining a low correlation with conventional markets, its enchantment is additional underscored by delivering considerably larger returns in comparison with property like gold, U.S. bonds, or the greenback. Notably, Bitcoin exhibited distinctive efficiency throughout the U.S. banking crisis in 2023, attracting important “safe-haven flows,” the Paris-headquartered agency added.

Whereas gold costs rose 15% in 2023, reaching a report annual shut at $2,078 per ounce, Bitcoin gained over 154%, contributing $530 billion to its market capitalization.

Nonetheless, as of press time, BTC is grappling with surpassing the $40,000 threshold as a result of apparently constant gross sales of Grayscale’s Bitcoin Belief (GBTC). As crypto.information reported earlier, Grayscale Investments bought over $2.14 billion in BTC following the approval of spot Bitcoin ETFs by the U.S. Securities and Alternate Fee.