The Concern and Greed Index fell to its lowest ranges in 100 days as Bitcoin (BTC) fell under the $40,000 mark for the second time in every week.

Towards the backdrop of modifications to BTC and the cooling of the market within the wake of the extensively anticipated spot BTC change traded funds (ETF), the Concern and Greed Index has moved into the impartial zone indicating a lower within the curiosity of potential buyers in cryptocurrency.

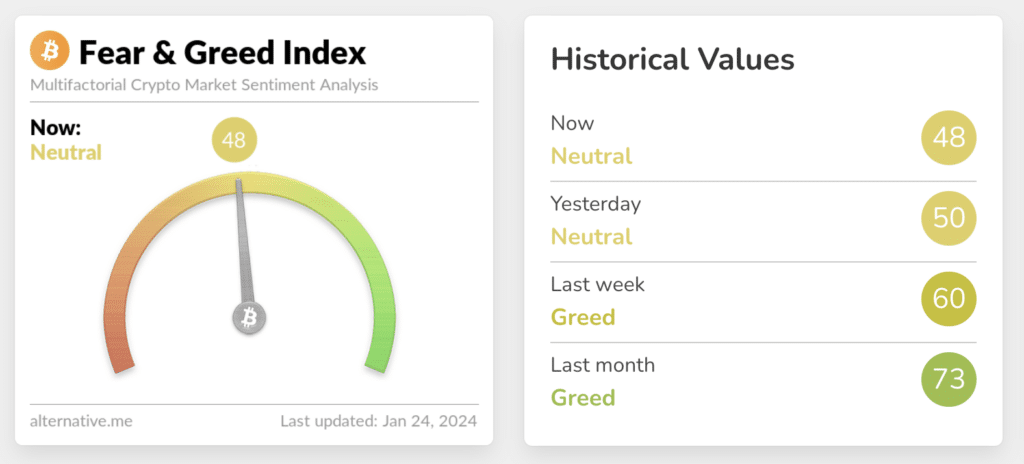

The Concern and Greed Index is a scale from 0 to 100 with 0 being essentially the most fearful and 100 being essentially the most grasping.

Presently the Index is at 48 factors similar to a impartial zone with a predominance of worry. That is the bottom worth since Oct. 16, when the Index was 47.

Because the starting of Nov. 2023, the worry and greed index has been within the “greed” zone, indicating buyers’ need to purchase cryptocurrencies. Curiosity in buying digital belongings was pushed by anticipation of the approaching launch of a Bitcoin ETF.

Now, the Index has fallen amid the launch of buying and selling in spot Bitcoin ETFs in the US and the descent of BTC under the $40,000 degree. Investor sentiment could point out that the frenzy for Bitcoin exchange-traded funds has subsided.

Grayscale CEO Michael Sonnenshein additionally believes that many of the 11 U.S. Securities and Trade Fee (SEC) authorized spot Bitcoin ETFs are more likely to fail. In his opinion, solely “two or three exchange-traded funds will in all probability obtain some vital mass.”