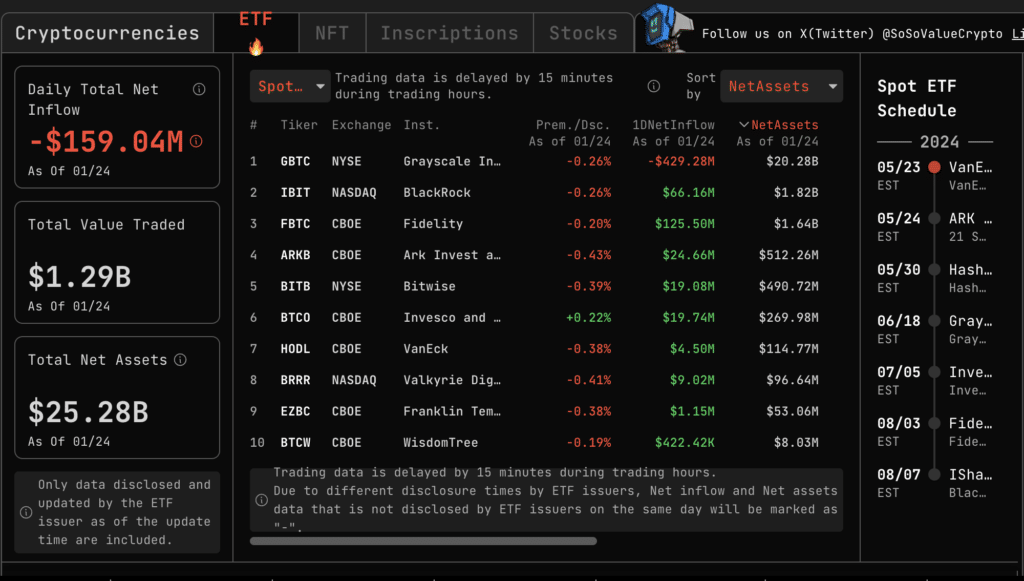

On Jan. 24, the overall internet outflow of Bitcoin spot ETFs was $159 million, the biggest single-day whole internet outflow.

In response to the analytics platform Alpha, on Jan. 24 the overall internet outflow of Bitcoin spot ETFs hit $159 million, the biggest one-day internet outflow since launch.

Grayscale ETF has been the chief in internet outflows with $429 million for the reason that fund’s launch. All ETFs besides Grayscale had internet inflows of $270 million.

On the similar time, for the second day in a row, the outflow of funds from Grayscale Bitcoin Belief (GBTC) has been reducing. The determine was the bottom for the reason that launch of spot Bitcoin ETFs in the USA.

Bloomberg analyst Eric Balchunas wrote in X that GBTC outflows are exhibiting a “downward development.” Nonetheless, he famous that liquidations are nonetheless big.

On Jan. 23, the outflow amounted to $515 million, and on the twenty second – $640 million, in line with CC15Capital. In whole, over 9 buying and selling days, the Bitcoin Belief misplaced 106,092 BTC value about $4.4 billion.

Nonetheless, Grayscale CEO Michael Sonnenshein believes that many of the 11 spot Bitcoin ETFs accepted by the U.S. Securities and Change Fee (SEC) are more likely to fail. In his opinion, solely “two or three exchange-traded funds will most likely obtain some essential mass.”