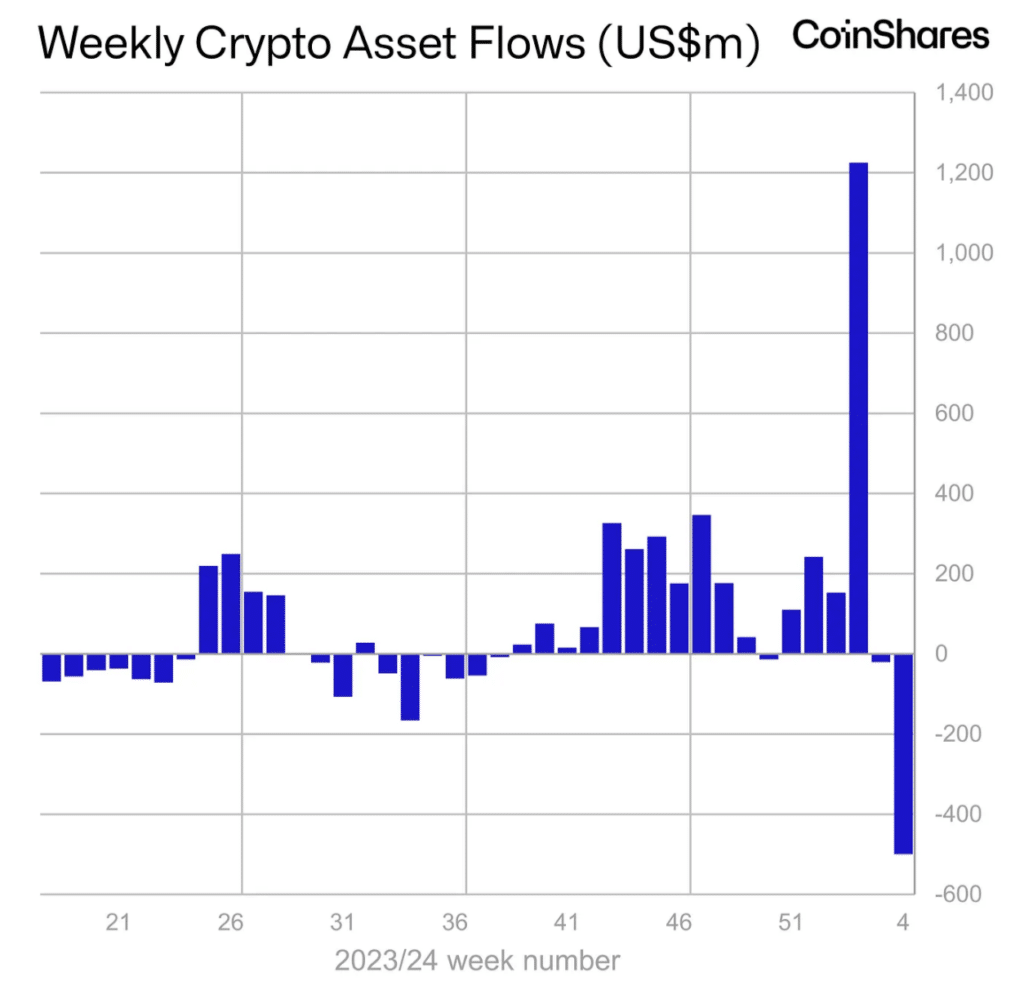

Digital asset funding merchandise noticed vital outflows final week, totalling $500 million.

Analytics firm CoinShares offered a report on the stream of funds in funding merchandise primarily based on cryptocurrencies from Jan. 20 to Jan. 26, 2024. In line with obtainable data, Grayscale Investments’ spot Bitcoin (BTC) ETF performed a central function within the report. Over the week, the outflow of funds from the crypto fund exceeded $2.2 billion. On the similar time, the whole quantity of withdrawn property crossed the $5 billion mark.

On the similar time, the funding product of monetary large BlackRock continues to obtain vital infusions, analysts say. Over the previous week, the inflow of funds amounted to $744 million. In second place on this indicator is the crypto fund of Constancy Investments, which acquired monetary injections of $643 million.

In whole, spot Bitcoin ETFs recorded an influx of $1.84 billion. Furthermore, since their launch on January 11, 2024, crypto funds have acquired infusions of $5.94 billion.

On the regional degree, the primary outflow occurred within the USA ($409 million), Switzerland ($60 million) and Germany ($32 million). A web influx of property was noticed solely in Brazil – $10.3 million and in France – $100,000.

Analysts notice that because of spot Bitcoin ETFs, the primary motion of funds throughout this era was related to the primary cryptocurrency. This asset accounts for an outflow of $479 million. On the similar time, the influx from brief Bitcoin positions amounted to $10.6 million.

On the similar time, Ethereum (ETH)-based trade merchandise noticed an outflow of $39 million. Most crypto funds primarily based on different altcoins additionally misplaced funds in various quantities.

Final week, CoinShares analysts stated that capital inflows into cryptoy funding merchandise totaled $21 million, with issuers with increased charges struggling since the launch of spot Bitcoin ETFs in the US on Jan. 10, 2024. Thus, the outflow of funds from such funds amounted to $2.9 billion. $4 billion had been invested within the new instrument.