Spot Bitcoin ETFs witnessed a internet influx of $247 million for the primary time per week.

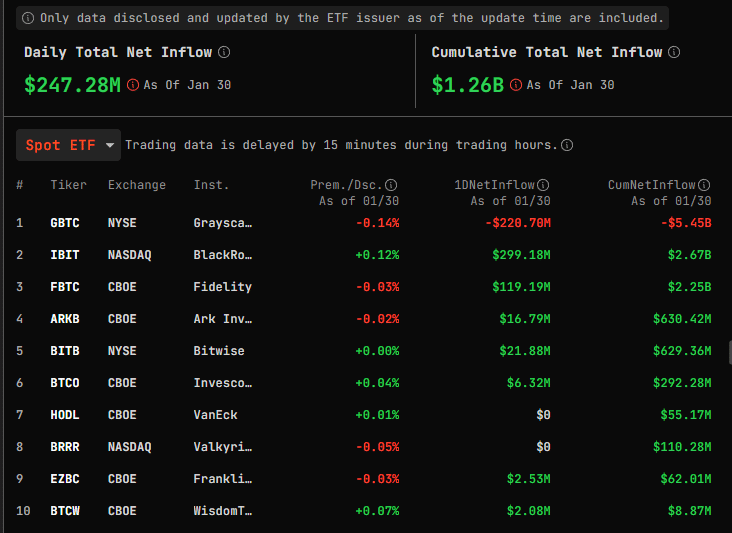

This divergence in fund flows was significantly evident among the many different 9 ETFs, excluding Grayscale, which collectively noticed a internet influx of $467 million. Knowledge from SoSo Value exhibits that BlackRock’s ETF IBIT recorded a single-day internet influx of $299 million, constituting 64% of the overall internet inflows this week.

Nevertheless, Grayscale’s Bitcoin Belief (GBTC) reported a considerable internet outflow of $220 million in a contrasting growth. Grayscale transferred 2,682 BTC, valued at roughly $114 million, to the handle of Coinbase Prime Deposit. Moreover, the agency moved 5,281 BTC to a brand new handle, alleged to be Grayscale’s up to date custody handle. The transactions may point out a big restructuring in Grayscale’s asset administration technique.

This resurgence contributed to a spike in Bitcoin’s value, reaching its highest level prior to now three weeks. Regardless of the online outflows from GBTC, the ETF issuers augmented their holdings by greater than 4,200 Bitcoin, value roughly $183 million. This shift in dynamics comes after per week of destructive every day flows, which noticed almost 20,000 Bitcoins exiting the funds between Jan. 23 and Jan. 26.