Bankrupt cryptocurrency change FTX is liquidating property to repay prospects, abandoning plans for a restart because of monetary and authorized difficulties.

This determination was introduced by FTX’s lawyer, Andy Dietderich, throughout a bankruptcy court hearing in Delaware.

FTX filed for chapter in November 2022 and has been embroiled in a number of controversies and authorized challenges. Its founder, Sam Bankman-Fried, has confronted fraud charges linked to his firm administration. In accordance with Dietderich, efforts to search out traders or patrons for FTX had been unsuccessful, highlighting the corporate’s lack of sustainable know-how and administration. Dietderich labeled FTX as an “irresponsible sham” created by Bankman-Fried.

Regardless of these setbacks, FTX has reportedly recovered over $7 billion in property to repay prospects. The reimbursement plan has been agreed upon with varied authorities regulators, who will wait till prospects are absolutely compensated earlier than searching for roughly $9 billion in claims towards the corporate.

A notable level of rivalry has been the valuation of those repayments. FTX plans to make use of cryptocurrency costs from November 2022 for calculating repayments when the change failed and the market was notably low. The choice has precipitated dissatisfaction amongst some prospects, as the worth of cryptocurrencies like Bitcoin (BTC) has considerably elevated.

Nonetheless, U.S. Chapter Decide John Dorsey upheld this strategy, citing the stipulations of U.S. chapter legislation, which requires money owed to be valued on the time of the corporate’s bankruptcy filing. Decide Dorsey emphasised the shortage of flexibility on this authorized matter, underscoring the necessity to adhere to the precise language of the Chapter Code.

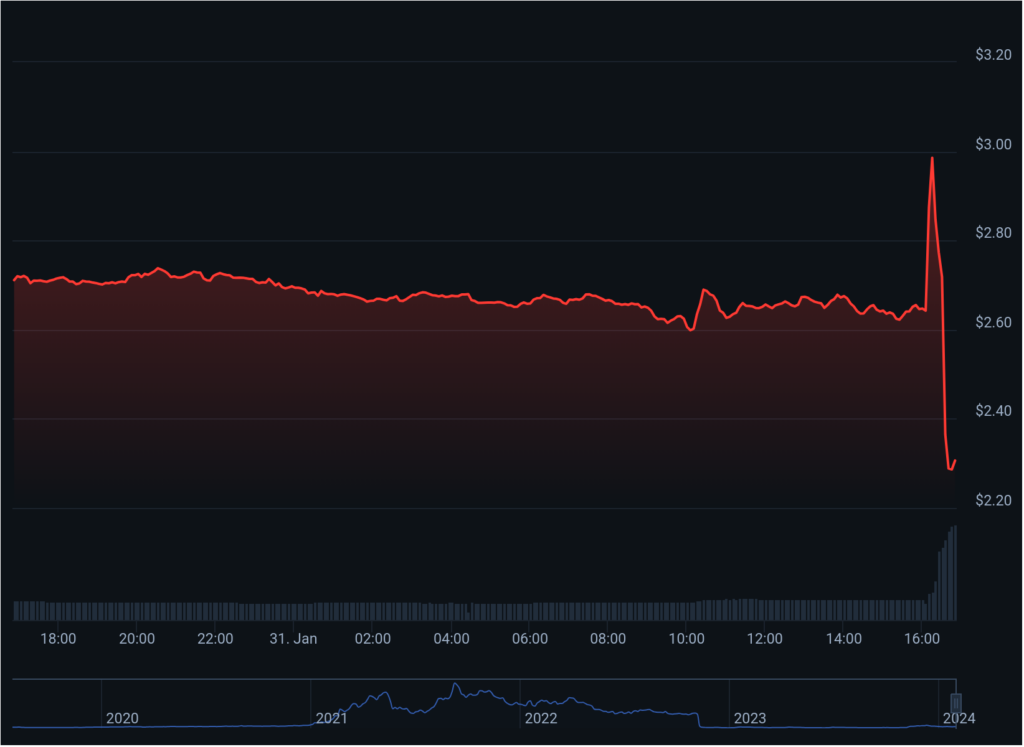

Following this announcement, FTX’s native token, FTT, skilled an over 11% improve in worth earlier than dropping 28% all the way down to $2.30, in accordance with CoinGecko.