Based on a report by Hacken, nearly half of the crypto hacks in 2023 occurred on account of entry management points.

The crypto market confronted losses totaling $1.9 billion on account of hacks in 2023, reflecting a major 93.6% decline in comparison with 2022, primarily influenced by the Terra collapse, as per a analysis report from Hacken, a blockchain safety auditor.

Regardless of this lower, analysts categorical concern in regards to the dynamics of 2023, emphasizing the amount and nature of incidents. Whereas the dimensions of assaults might seem smaller than in 2022, Hacken highlighted a 14% improve in assaults over the previous 12 months, figuring out entry management points as probably the most damaging vulnerability in 2023.

“Unauthorized entry to scorching wallets by hackers or insiders accounted for half of all stolen funds, averaging $31 million per incident.”

Hacken

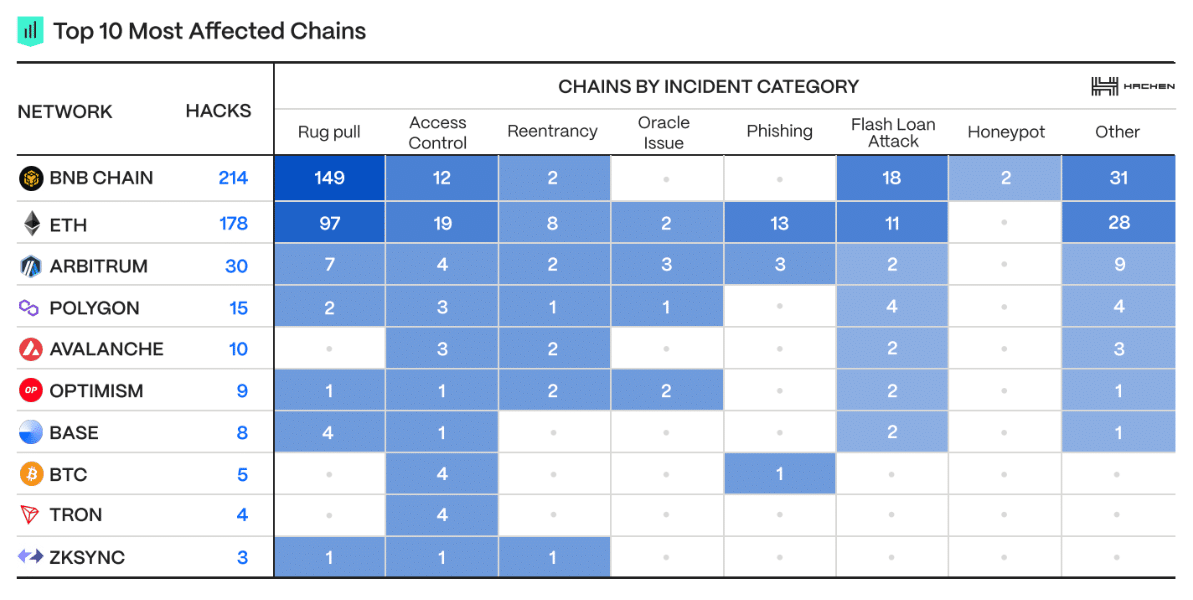

Different kinds of assaults, together with rug pulls and flash mortgage assaults, nonetheless enriched hackers with a whole lot of hundreds of thousands of {dollars} value of crypto, as indicated by information compiled by Hacken.

BNB Chain (previously Binance Good Chain) emerged as probably the most focused community by hackers in 2023, with 214 incidents recorded, adopted by Ethereum (178 incidents) and Arbitrum (30 incidents). Analysts at Hacken counsel that these statistics could also be attributed to blockchain builders who stay hesitant to audit their protocols.

Based on the agency’s information, solely 10% of exploited good contracts underwent any type of audit in 2023, including that “merely half of those had been related.” Regardless of this, Hacken famous circumstances the place protocol builders launched a unique code in manufacturing than the one ready for audits.

Nonetheless, 2023 seems to be the primary 12 months when exploited good contracts efficiently recovered round 20% of stolen funds (value ~$400 million) due to fast staff responses and, surprisingly, the goodwill of hackers, Hacken concluded.