Bitcoin (BTC) has barely declined after the annual league championship sport of the Nationwide Soccer League, often known as the Super Bowl options no crypto advertisements.

BTC is down by 0.7% up to now 24 hours and is buying and selling on the $48,200 mark on the time of writing. The asset’s market cap continues to be above $945 billion with a every day buying and selling quantity of $19.2 billion.

The decline comes because the Tremendous Bowl goes without any crypto ads for the second 12 months in a row. Even the trillion-dollar firms with Bitcoin ETFs weren’t able to pay the $7 million charge for ads.

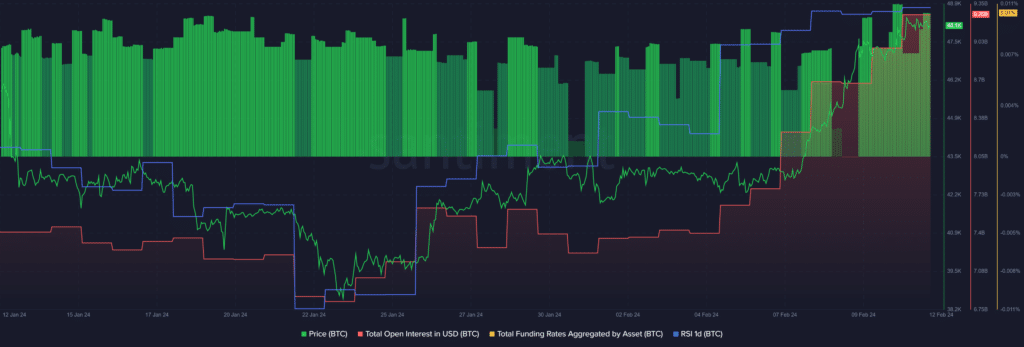

In line with information offered by Santiment, Bitcoin’s whole open curiosity (OI) surged from $7.6 billion to $9.2 billion over the previous week. The continual incline comes as extra buyers are betting on an extra value hike, concentrating on the $50,000 mark.

Knowledge from the market intelligence platform exhibits that the whole Bitcoin funding fee on all exchanges elevated from 0.007% to 0.009% over the previous 24 hours. This exhibits that long-position holders are barely dominating BTC’s whole OI till additional value actions.

Alternatively, Bitcoin’s Relative Energy Index (RSI) has been hovering above the 80 mark since Feb. 7, per Santiment. The BTC RSI is presently sitting at 84, suggesting the potential for a value cooldown.

At this level, Bitcoin is consolidating with excessive volatility after reaching a neighborhood excessive of $48,700 earlier as we speak.

For Bitcoin to stay bullish, its RSI would wish to remain under the 60 mark.