Amid the information that Binance would delist Monero, ought to the crypto group brace for the decline of the period of nameless tokens, or will various options emerge?

On this planet of cryptocurrency, transactions are logged in a public ledger, that means that one can hint an individual’s identification with some effort. Nonetheless, privacy-focused cash intention to alter that.

Nameless cash are digital currencies designed to uphold secrecy by obfuscating the motion of funds inside their networks. The most well-liked nameless tokens are:

- Monero (XMR): Monero makes use of ring signatures to mix personal and public keys.

- Zcash (ZEC): The coin employs the zk-SNARK protocol, enabling customers to show info accuracy with out revealing particulars.

- Komodo (KMD): A Zcash fork that facilitates public and nameless transactions utilizing zero-knowledge proof and a delayed proof-of-work (dPoW) protocol.

- Sprint (DASH): Divides cash from a number of senders into parts, completely mixing them.

- Verge (XVG): Makes use of Tor software program to hide switch places and person IP addresses

A number of years in the past, many buyers, merchants, and customers of crypto belongings held a detrimental view of nameless cash. Regardless of this sentiment, a devoted group of admirers nonetheless see the potential of such expertise. Nonetheless, the sheer quantity of fans could not attain the degrees seen prior to now.

What’s incorrect with nameless tokens?

The first intention of nameless cryptocurrencies is to safeguard the privateness of economic transactions. Nonetheless, their proliferation has coincided with a notable rise in fraudulent assaults and monetary crimes involving cryptocurrencies, with attackers leveraging these tokens to obscure the motion of illicit funds.

In response, governments worldwide have pivoted in direction of stricter cryptocurrency rules, focusing on what are often called confidential cash. Sure crypto platforms are opting to discontinue help for these privacy-focused tokens.

By refraining from an outright ban on digital currencies, governments intention to deal with two major considerations: safeguarding buyers and merchants and curbing legal actions facilitated by cryptocurrencies.

Sanctions in opposition to Twister Money

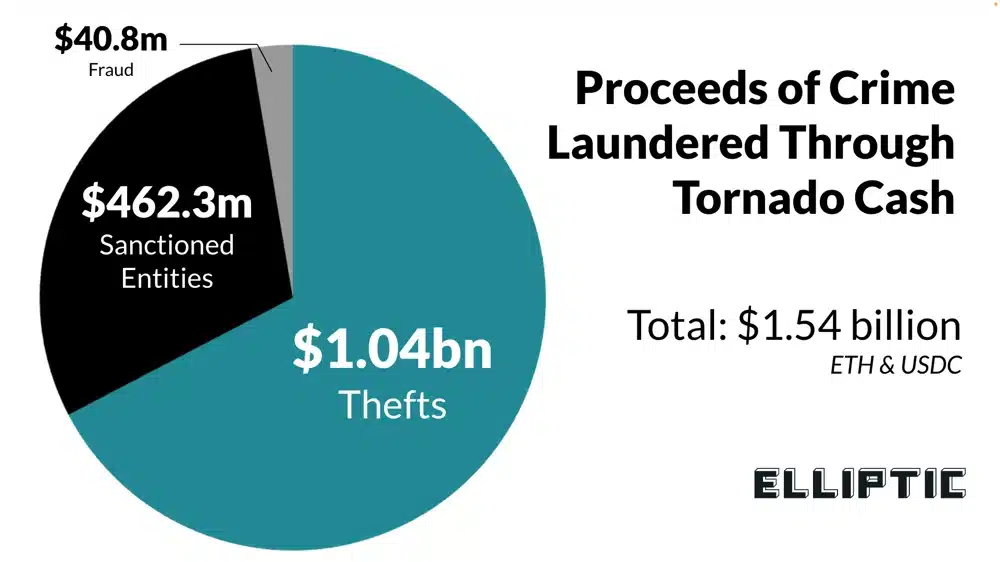

On Aug. 8, 2022, the U.S. Division of the Treasury published an replace to the Sanctions Record (SDN), including the Twister Money cryptocurrency protocol and its related digital pockets addresses. The choice was prompted by findings indicating the platform’s use in laundering illicitly obtained funds, the place crypto-assets have been acquired utilizing proceeds from unlawful actions.

OFAC additionally claims that Tornado Cash has change into a key device utilized by criminals to launder cryptocurrency funds stolen from decentralized exchanges and video games reminiscent of Axie Infinity.

Sanctions in opposition to Tornado Cash signify a big regulatory motion not solely focusing on crypto mixers but additionally highlighting considerations about privacy-enhanced cash usually. The growth of sanctions past particular person addresses to embody undertaking codes units a doubtlessly precedent-setting motion with broad implications, notably for U.S. residents.

These developments have sparked considerations inside the cryptocurrency group in regards to the potential banning of different nameless cryptocurrencies. For example, the Monero group acknowledges a potential detrimental consequence, particularly following the arrest of Alexey Pertsev from the Twister Money crew, as many considered Monero as a direct competitor.

Developments in delisting nameless cash

There’s a noticeable development in direction of elevated regulation within the cryptocurrency sphere, with main exchanges searching for licenses throughout varied jurisdictions to make sure regulatory compliance.

In December 2023, the OKX crypto change announced the delisting of a number of nameless cryptocurrencies, together with Monero and ZCash. The platform cited the rationale for deleting buying and selling pairs as “not assembly its strict standards.”

Equally, Binance announced the delisting of nameless cryptocurrencies like Monero in February, prompting a big drop in XMR’s worth by practically 20%.

In June 2023, following person suggestions, Binance reversed its choice to delist some privateness cash in sure European international locations. Seven cryptocurrencies, together with Decred, Sprint, Zcash, PIVX, Navcoin, Secret, and Verge, have been exempted from delisting in France, Italy, Poland, and Spain. The agency clarified that restrictions will nonetheless apply to Beam, Monero, Mobilecoin, Firo, and Horizen. The crypto change introduced the potential of creating an up to date classification of cash that may meet the necessities of regulators.

Some crypto group members speculate that Binance’s choice to delist Monero stems from its reluctance to have interaction with nameless cryptocurrencies, which can conflict with authorities pursuits.

Regulatory authorities within the U.S. and elsewhere have raised considerations in regards to the change. Binance’s transfer away from nameless cash may very well be interpreted as a response to regulatory strain.

What is going to occur to nameless cryptocurrencies?

Authorities are hesitant to endorse fully nameless fee instruments. Will they deal with privateness cash like they did Bitcoin? Unlikely. Regulators are pushing for strict guidelines requiring full transaction identification and reporting.

In consequence, personal cash could not match into the overall development of worldwide adoption of cryptocurrencies. Exchanges could proceed to refuse them, and they need to not count on an inflow of institutional cash. Nonetheless, if groups abandon the anonymity operate, their tasks will lose their distinctive properties and a big a part of their customers.

Alexander Ray, CEO of Albus Protocol, a KYC verification platform, expressed considerations about the way forward for nameless cryptocurrencies in regulated monetary settings. In an interview with crypto.information, he stated:

“Regulators will more and more view nameless cryptocurrencies not simply with skepticism however as lively instruments to evade transparency and AML/ATF rules. This attitude is not only a prediction however a mirrored image of the evolving calls for for oversight within the digital foreign money area, suggesting a doubtlessly troublesome highway forward for the acceptance and sustainability of nameless cryptocurrencies in regulated monetary circles.”

Alexander Ray, CEO of Albus Protocol

Maybe the crypto group will quickly see a change in positioning amongst many personal cash. Some could abandon their nameless standing, specializing in creating community scalability and velocity. And a few will stay a distinct segment product for individuals who worth privateness.