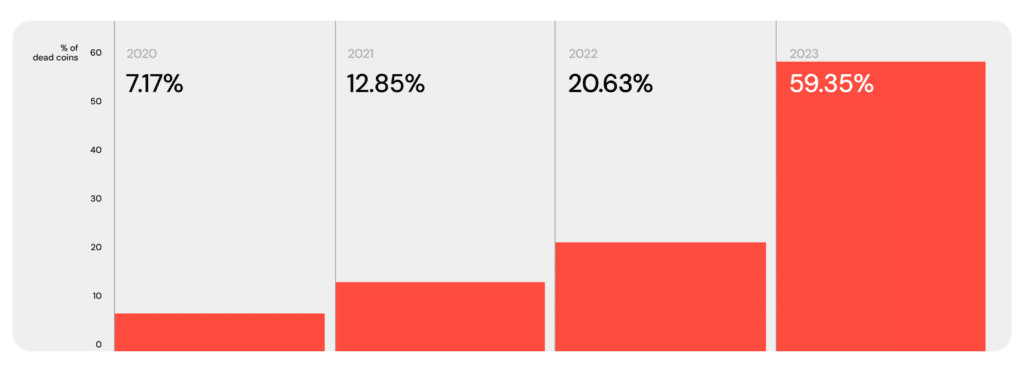

A brand new analysis report carried out by AlphaQuest and Storible reveals that amongst 12,343 crypto initiatives investigated, over 8,850 have grow to be defunct prior to now yr.

The most recent crypto winter worn out greater than half of cryptocurrencies listed on CoinMarketCap, what seems to be a self-purification of the market forward of a brand new rally, in response to data compiled by AlphaQuest. The information reveals that 2023 was the hardest yr within the 2020-2023 cycle, as practically 60% of cash bit the mud throughout that interval.

Amongst lifeless cash, over 90% of the defunct cash met their finish because of points associated to low liquidity and dwindling buying and selling quantity, indicative of waning investor curiosity. Moreover, greater than half of those initiatives ceased updating their web sites, whereas 47.6% have been delisted from CoinMarketCap. Moreover, barely over 35% of the defunct cash exhibited full inactivity throughout all accounts on social media.

“By analyzing social media exercise, traders can keep knowledgeable and cautious on the planet of cryptocurrency.”

AlphaQuest

Furthermore, the analysis underscores a sobering actuality: greater than 70% (4,834) of crypto initiatives that emerged in the course of the 2020-2021 bull run have met their demise, with over 30% changing into inactive shortly after the FTX crypto trade filed for chapter. AlphaQuest famous that almost all of those failed ventures (75%) have been targeted on the video and music sector, with an extra 75% comprising asset-backed stablecoins that faltered amid the bear market’s onslaught.