Are we witnessing a seismic shift within the crypto market as Ethereum inches nearer to Bitcoin in market cap?

Bitcoin (BTC) and Ethereum (ETH) signify the dual pillars of the crypto market, collectively commanding practically 70% of its whole market cap.

Over time, Bitcoin advanced from a novel idea to a worldwide monetary asset, gaining traction amongst establishments. As of Feb. 26, BTC’s market cap is valued at over $1 trillion.

Corporations like MicroStrategy and Tesla have amassed important Bitcoin holdings, solidifying its recognition. Furthermore, the current approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Alternate Fee (SEC) indicators rising institutional acceptance.

In distinction, Ethereum emerges because the second-largest participant, with a market cap nearing $370 billion. Ethereum’s blockchain expertise underpins a various ecosystem of decentralized functions (dapps).

Furthermore, the platform’s transition to a proof-of-stake consensus mechanism via “The Merge” in 2022 marked an important technological development aimed toward addressing scalability, power consumption, and safety considerations.

The cryptocurrency group has lengthy speculated a few potential occasion often called “the flippening,” the place Ethereum’s market cap may surpass Bitcoin’s. Can Ethereum overtake Bitcoin in the long term?

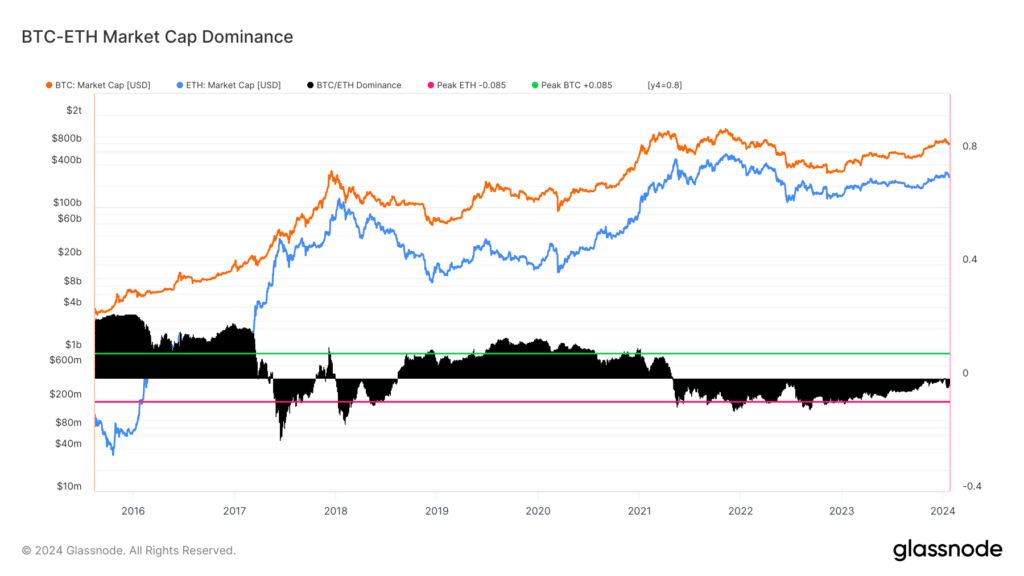

BTC vs ETH: market cap and dominance

Since its inception in 2009, Bitcoin has held its place because the main crypto, dominating the market with a staggering market cap that has outstripped its rivals thus far.

On the outset, Bitcoin’s market cap was a mere $1 million in early 2011, however by early 2013, it had surged to $1 billion, marking an unprecedented 1000x enhance. By the shut of 2013, Bitcoin’s market cap had surpassed $9 billion.

2017 proved essential for Bitcoin, witnessing its market cap soar to over $300 billion for the primary time. This surge was propelled by a retail and institutional funding frenzy and a rising curiosity in cryptocurrencies as a novel asset class.

Nonetheless, this meteoric rise was not with out its setbacks. By Nov. 2021, Bitcoin’s market cap had breached the $1 trillion mark, solely to plummet to round $320 billion by Dec. 2022.

In distinction, Ethereum launched into a extra gradual trajectory. Regardless of its modest beginnings upon its launch in 2015, Ethereum shortly asserted itself among the many prime 5 cryptocurrencies by market cap.

In Dec. 2015, whereas Bitcoin’s market cap stood at over $6 billion, Ethereum’s was a modest $60 million, marking a stark distinction of 100-fold.

In the meantime, the introduction of preliminary coin choices (ICOs) in 2017, adopted by the next defi and NFT booms, catalyzed Ethereum’s exponential progress.

By Dec. 2017, Ethereum’s market cap had surged to $73 billion from $60 million in Dec. 2015, representing an astounding 1210x enhance. This progress considerably narrowed the ratio between Bitcoin and Ethereum’s market caps to three.25:1.

Concurrently, the idea of “Bitcoin dominance” – Bitcoin’s market cap as a proportion of the full cryptocurrency market – emerged as an important metric for assessing the dynamics throughout the crypto area.

Initially exceeding 90%, Bitcoin’s dominance dwindled to beneath 45% by Dec. 2017 as altcoins, spearheaded by Ethereum, gained traction. In consequence, this ratio additional narrowed to roughly 2:1 in Dec. 2021, with Bitcoin’s market cap at round $960 billion and Ethereum’s at $483 billion.

As of Feb. 25, the ratio stood at roughly 2.75:1, with a number of bullish eventualities for Bitcoin, together with the anticipation of the Bitcoin halving in Apr. 2024 and the SEC’s approval of spot BTC ETFs in Jan. 2024, doubtlessly tipping the scales in Bitcoin’s favor within the brief time period.

Actual-world contributions of Bitcoin and Ethereum

The contributions of Bitcoin and Ethereum to the crypto area have change into more and more distinct, every carving out distinctive use instances and driving innovation in numerous instructions.

Bitcoin’s increasing ecosystem

Bitcoin has witnessed robust progress in its ecosystem, notably with the appearance of recent applied sciences and platforms.

The launch of spot Bitcoin ETFs in Jan. 2024 is predicted to have a considerable influence, not solely in enhancing Bitcoin’s accessibility and enchantment but additionally in fostering its place in international finance.

Belief Machines reported an “explosive progress in Bitcoin use instances” within the first quarter of 2023, highlighting the rising developer curiosity in constructing atop Bitcoin.

This progress is attributed to the Stacks (STX) blockchain, which permits smart contracts, defi functions, NFTs, and apps immediately on Bitcoin, thus broadening its utility past only a retailer of worth.

Amid this, Ordinals, launched in Jan. 2023, have added a brand new dimension to Bitcoin’s use instances by permitting data to be hooked up on to particular person satoshis via a course of referred to as “inscribing.”

This innovation has enabled the creation of Bitcoin-native NFTs, marking an important evolution in Bitcoin’s performance past its unique scope as a digital foreign money.

In the meantime, the ECB’s working paper highlights Bitcoin’s important adoption in Rising and Creating Economies (EMDEs), the place it serves not solely as an funding but additionally as a hedge towards foreign money depreciation and a method to facilitate cross-border transactions.

Ethereum’s various utility

Ethereum, then again, has been a frontrunner in facilitating a variety of dapps, defi platforms, NFTs, and so forth, because of its inherent sensible contract capabilities.

Whereas the introduction of Ordinals and the flexibility to mint NFTs immediately on the Bitcoin blockchain has been a big growth, Ethereum continues to carry a aggressive edge within the NFT area.

Ethereum’s established requirements, like ERC-721 and now with Ethscriptions, have made it the go-to platform for NFT creation and buying and selling, providing a extra simple course of in comparison with Bitcoin’s newer entry into the area.

Furthermore, Ethereum is the spine of the defi sector, facilitating lending, borrowing, and buying and selling via permissionless monetary companies. In response to DefiLIama, as of Feb. 26, Ethereum has a complete worth locked (TVL) of round $48 billion, the most important amongst all different chains.

Ethereum has additionally emerged as probably the most used blockchain for the tokenization of real-world property to date. This course of entails changing rights to an asset right into a digital token on the Ethereum blockchain, enhancing the liquidity and accessibility of varied asset courses. Citi has predicted that tokenization may change into a $4 trillion market by 2030.

Can Ethereum overtake Bitcoin in the long term?

Whereas Bitcoin is usually thought to be digital gold, serving as a safe retailer of worth, Ethereum is likened to digital oil, powering an expansive vary of functions past mere monetary transactions.

Goldman Sachs, in a 2021 analysis, highlighted Ethereum’s substantial “actual use potential” as a consequence of its foundational function in operating functions like defi protocols.

This utility, based on Goldman, positions Ethereum to doubtlessly eclipse Bitcoin’s worth sooner or later. Nonetheless, it’s value noting Goldman’s predictions include their justifiable share of misses, including a layer of skepticism to such forecasts.

In the meantime, Jim Cramer of “Mad Cash” has additionally thrown his weight behind Ethereum, citing its prevalent use in buying NFTs and different digital property as a cause for its potential dominance over Bitcoin.

Cathie Wooden of Ark Make investments projects a future the place Ethereum reaches a staggering market cap of $20 trillion by 2030 whereas additionally predicting Bitcoin value to succeed in $1 million.

Such forecasts paint an image the place Ethereum’s broad utility may redefine its place relative to Bitcoin.

The street forward

Whereas speculations about “the flippening” persist, the fact is that each Bitcoin and Ethereum are prone to coexist and thrive, every serving distinctive functions throughout the broader crypto market.

The potential for Ethereum to overhaul Bitcoin in market cap speaks to its expansive utility and the rising demand for its expertise.

Nonetheless, Bitcoin’s entrenched standing as digital gold and its broadening use instances guarantee its continued relevance and resilience.

As we transfer ahead, will probably be important to regulate how these platforms adapt to rising challenges and alternatives within the quest to redefine cash and commerce within the digital age.