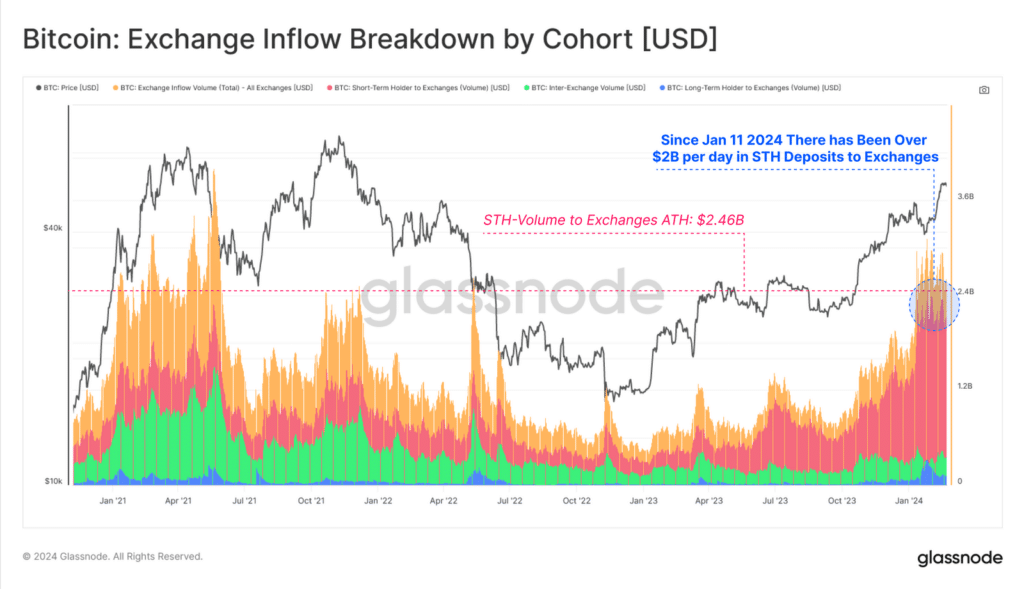

With Bitcoin reaching the $58,000 milestone, short-term holders have set a brand new all-time excessive within the quantity deposited to centralized exchanges, in response to Glassnode.

Crypto exchanges are witnessing an inflow of short-term holders, who’ve constantly deposited over $2 billion price of Bitcoin per day in quantity since mid-January, while additionally setting a brand new most of $2.46 billion in quantity deposited total, a latest research report by Glassnode signifies.

As traders are holding enormous quantities of unrealized earnings since November 2022, the full quantity of deposits and withdrawals has continued to develop, reaching $5.57 billion in every day quantity flowing out and in of exchanges, analysts notice.

“The diploma of hypothesis throughout the present market can be seen by the terribly excessive dominance of exchanges associated in/outflows with respect to all on-chain quantity.”

Glassnode

The info supplied by the Switzerland-headquartered analytical blockchain agency signifies that over 78% of all economical on-chain quantity is being directed to/from exchanges as Bitcoin retains updating its heights.

Nonetheless, the surge in exercise is just not solely attributed to the recent rally, because the introduction of latest spot Bitcoin exchange-traded funds (ETFs) has additionally contributed to elevated demand. These ETFs have attracted roughly 90,000 BTC in web flows, totaling almost $38 billion in property below administration.

“These ETF merchandise have for the primary time allowed institutional traders to realize publicity to the BTC asset by way of conventional rails, opening a brand new diploma of freedom for demand and hypothesis.” Glassnode

Analysts at QCP Capital anticipate Bitcoin’s realized quantity to stay round 40%, suggesting that hitting the $60,000 mark is a pure goal for the March expiry. As of press time, Bitcoin is buying and selling at $58,692, a stage not seen since November 2021, in response to CoinMarketCap knowledge.