A pockets reportedly linked to the Ethereum Basis has liquidated $13.3 million in ETH, elevating eyebrows and sparking conversations a couple of attainable value decline.

The Ethereum Foundation‘s choice to liquidate $13 million value of Ethereum (ETH) has left buyers considering the transaction’s potential impression on the worth of the world’s second-largest cryptocurrency by market capitalization.

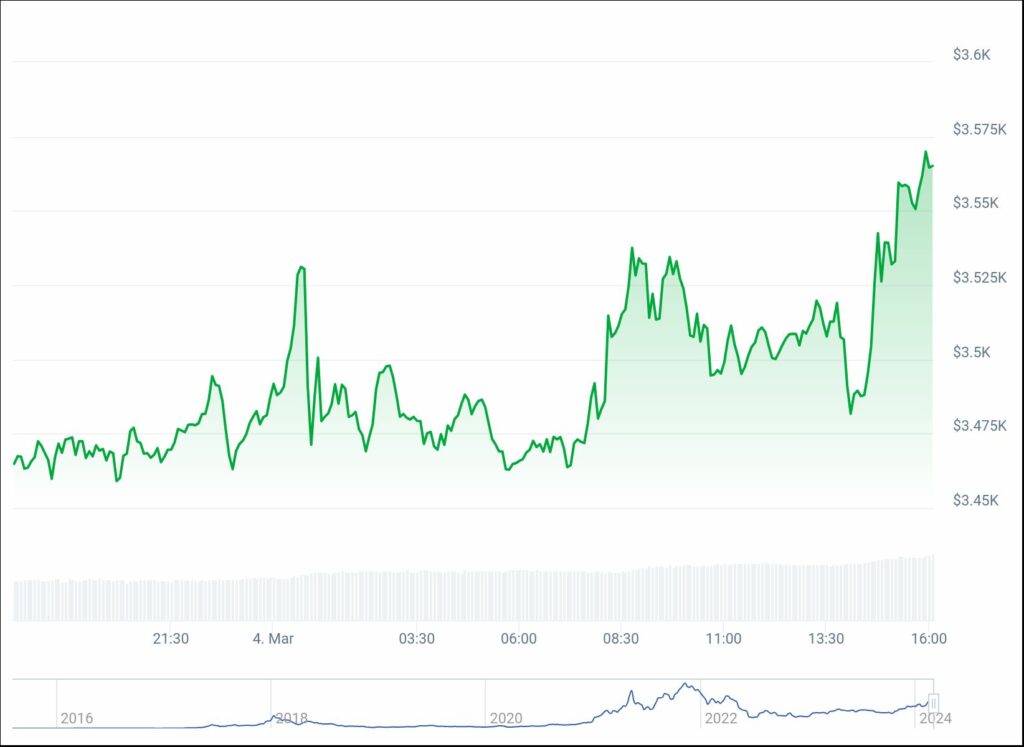

Historically, the inspiration’s actions are thought-about precursors to market shifts, triggering issues a couple of potential decline. Regardless of this, Ethereum shows bullish indicators because the charts look in the present day.

The Ethereum value chart presents an optimistic view with a robust uptrend, marked by persistently larger highs and lows. Presently buying and selling at $3,550, Ethereum has skilled a 14.6% improve within the final seven days, commanding a market cap of $420 billion and a crypto market dominance of 17.8%, in line with CoinGecko.

Although market pullbacks are pure in an uptrend, they induce investor anticipation because the market awaits its subsequent transfer. The weekly Relative Energy Index (RSI) stands at 89.95, approaching the overbought zone, suggesting a attainable correction, which aligns with the Ethereum Basis’s current sell-off.

Within the broader market context, Bitcoin (BTC) has gained over 28% within the final seven days, nearing its all-time excessive of $69,000 in November 2021. On the time of writing, the worth of BTC is hovering across the $67,000 area.

In the meantime, the Ethereum community is getting ready to activate the Dencun replace, combining Cancun and Deneb updates. Scheduled for Mar. 13, this enchancment intends to considerably scale back layer-2 transaction charges whereas enhancing Ethereum’s scalability, effectivity, and safety.

On Feb. 27, the Ethereum Basis announced that it had efficiently activated the improve on take a look at networks.

Final month, Ethereum skilled substantial growth, attracting 1.8 million new customers to its community. Santiment’s metric monitoring funded Ether wallets revealed a surge, with the overall ETH holders reaching 115.5 million addresses.

In distinction, BTC witnessed a decline of 70,000 pockets addresses throughout the identical interval, underlining Ethereum’s market dominance.

The rising demand from new ETH addresses and a $2.3 billion lower in trade provide positions Ethereum favorably for a possible advance in direction of $4,000 in March 2024.

Spot Ethereum ETF prospects

Amidst Ethereum’s constructive trajectory, a number of issuers are seeking approval for spot Ethereum ETFs, mirroring the success of spot BTC merchandise. Nonetheless, SEC delays and commissioner feedback trace at challenges on the street forward.

An upcoming assembly between the U.S. Securities and Change Fee (SEC) and spot Ethereum ETF candidates later this month, will decide the destiny of Ether-based funding autos. Choices on the merchandise are postponed till Might on the earliest, with VanEck’s submitting main the queue. The SEC’s approval or rejection by Might 23 will affect different issuers, together with BlackRock, Franklin Templeton, Grayscale, and Invesco Galaxy.

The approval of spot Bitcoin ETFs in January marked a major improvement after years of rejections. This choice, influenced by a Grayscale lawsuit in opposition to the SEC, was seen as a turning level in legitimizing crypto adoption and funding in america.