Analysts at QCP Capital word that regardless of Bitcoin’s fast drop to $59,000, funding is again to wise ranges and the extra doubtless state of affairs is the outperformance of the ETH/BTC pair.

In a unstable in a single day session, Bitcoin (BTC) quickly set a brand new all-time excessive of $69,400 solely to endure a fast decline, plummeting to $59,200 inside a matter of some hours. This steep downturn resulted within the liquidation of over $1 billion value of leveraged lengthy positions on Binance alone.

Nevertheless, as famous by analysts at QCP Capital, the market shortly rebounded because the dip was aggressively purchased up, with the $60,000 degree demonstrating strong assist. In keeping with analysts, funding charges have returned to “wise ranges,” hovering round 30% yearly on Binance. Subsequently, analysts at QCP Capital anticipate Ethereum (ETH) to outperform Bitcoin, noting that the narrative surrounding a spot Ethereum exchange-traded fund (ETF) features traction.

“[…] the doubtless state of affairs is the outperformance of ETHBTC because the ETH spot ETF narrative comes into play.”

QCP Capital

Regardless of the leverage unwinding, time period futures are nonetheless buying and selling at a major premium to identify costs, analysts emphasised, including there was a surge in shopper exercise aimed toward promoting the spot-forward unfold, significantly for contracts expiring between September and December this 12 months, permitting buyers to safe risk-free yields for the 12 months.

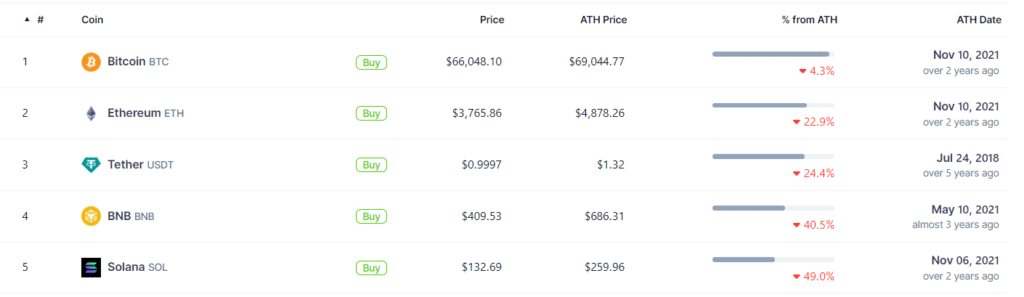

As of press time, Ethereum stays considerably distant from its all-time excessive in comparison with Bitcoin, suggesting a possible for fast worth appreciation. Whereas Bitcoin trails solely 4.3% from its historic peak reached on Mar. 5, Ethereum lags behind its 2021 report by over 20%, in response to CoinGecko information.

Because the crypto panorama evolves, Wall Avenue behemoths are intensifying efforts to introduce extra spot crypto ETFs, following the U.S. Securities and Change Fee’s (SEC) approval of all purposes for spot Bitcoin ETFs earlier in January. Reviews point out ongoing discussions between the SEC and Ethereum ETF candidates, with choices on spot Ethereum ETFs delayed till Might on the earliest. VanEck’s submitting, particularly, awaits a response by Might 23, alongside purposes from BlackRock, Franklin Templeton Grayscale, and Invesco Galaxy.