BlackRock, the world’s largest asset supervisor, noticed its Bitcoin ETF (exchange-traded fund) attain $10 billion in belongings beneath administration (AUM) faster than every other ETF in U.S. historical past.

This milestone has been pushed by an ongoing rally within the value of Bitcoin (BTC), the world’s flagship cryptocurrency.

BlackRock’s BTC ETF hits new milestone

This milestone, pushed by a surge in Bitcoin costs, highlights the growing curiosity and adoption of digital belongings inside conventional funding circles.

Launched in January, IBIT has swiftly gained traction amongst buyers searching for publicity to Bitcoin. IBIT’s launch coincided with a bullish section for Bitcoin, because the cryptocurrency reached new highs, attracting vital consideration from each institutional and retail buyers.

The U.S. Securities and Change Fee’s (SEC) approval of spot Bitcoin ETFs earlier this yr marked a pivotal second for the cryptocurrency market. This regulatory approval paved the best way for a surge in belongings beneath administration for varied Bitcoin ETFs, with BlackRock’s IBIT main the best way.

The fund’s success could be attributed to favorable market circumstances, investor confidence, and the growing mainstream acceptance of cryptocurrencies as reliable funding alternatives.

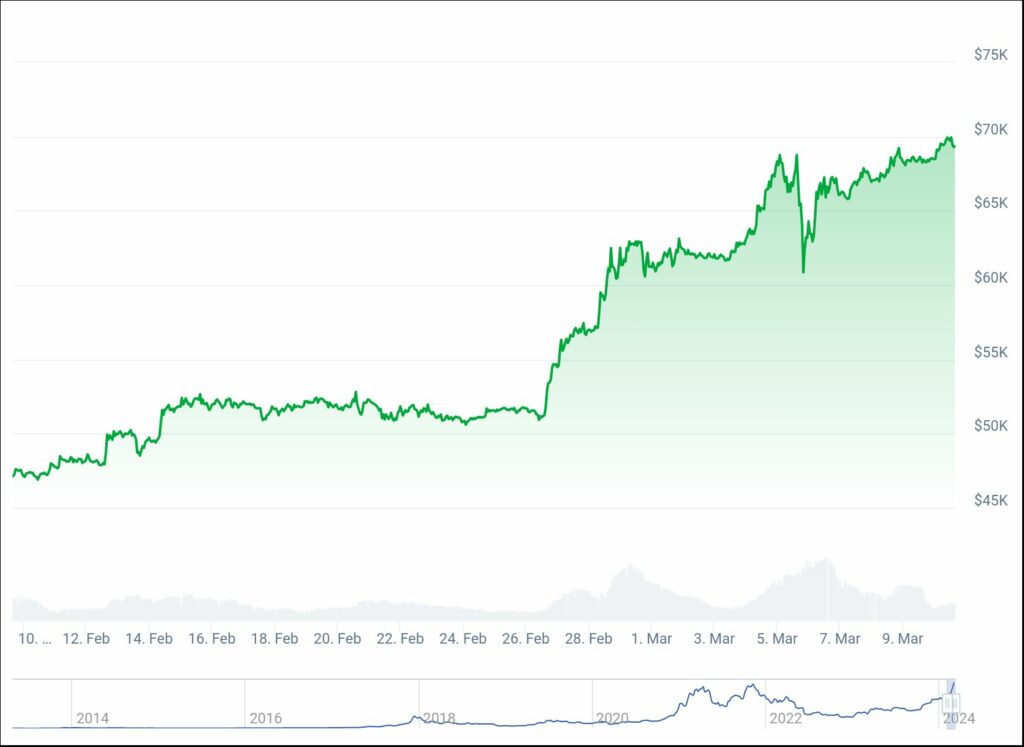

In line with information from CoinGecko, Bitcoin (BTC) has seen a exceptional 11% surge within the final seven days and a formidable 47% improve over the previous month. On March 1, the worth of Bitcoin (BTC) surpassed $60,000, marking its first ascent to this degree since November 2021.

BlackRock’s achievement with IBIT shouldn’t be an remoted incident however somewhat a part of a broader pattern available in the market. Different funds, similar to Constancy’s Sensible Origin Bitcoin Fund, have additionally seen vital progress in belongings beneath administration, reflecting the broader shift in the direction of digital belongings throughout the funding panorama.

The inflow of funds into these ETFs highlights the rising enchantment of cryptocurrencies in its place asset class and underscores the function of ETFs in offering buyers with simpler entry to this rising market. On the time of writing, Bitcoin (BTC) is exchanging palms for $69,223.

Bitcoin ETFs appeal to large capital

Bitcoin exchange-traded funds (ETFs) have emerged as vital funding choices, with iShares, Constancy, and Ark Funding Administration main in attracting new capital since their launch.

On March 5, BlackRock’s iShares Bitcoin ETF (IBIT) experienced an inflow of $788 million in internet inflows, setting a brand new every day report for the funding automobile.

In line with SoSoValue, the IBIT ETF has attracted over $9 billion in cumulative inflows and presently manages practically $12 billion in belongings. The inspiration of this asset pool is over 183,000 Bitcoin (BTC) acquired by the asset supervisor since January eleventh, the official launch date of buying and selling.

BlackRock’s largest every day influx additionally marked its most important acquisition of BTC, acquiring practically 12,600 Bitcoin in a single day. This surpasses its earlier highest buy on Feb. twenty eighth, when the Bitcoin ETF issuer procured over 10,140 BTC for its IBIT fund.

As reported by crypto.information, BlackRock intends to develop its investments in BTC ETFs by means of its Strategic Earnings Alternatives Fund. The Wall Road big revealed its plans in a submitting with the U.S. SEC on March 4th, shortly after announcing its Bitcoin ETF intentions in Brazil.

Moreover, Constancy’s Sensible Origin Bitcoin Fund has additionally seen vital internet inflows since its inception, indicating a rising urge for food for spot Bitcoin ETFs. Cathie Wooden’s Ark 21Shares Bitcoin ETF additionally gained momentum, amassing over $600 million in belongings by the tip of January.

These success tales spotlight the growing demand for cryptocurrency investments and the constructive market reception towards these modern ETF merchandise.

In distinction to the success tales, Knowledge Tree, Valkyrie, and Franklin Templeton have struggled to match the extent of inflows seen by their counterparts resulting from varied elements similar to market positioning, investor notion, or aggressive dynamics throughout the cryptocurrency funding panorama.

The differing fortunes of those Bitcoin ETFs underscore the aggressive nature of the cryptocurrency funding house and the significance of things like model fame, fund construction, and market timing in attracting investor curiosity.