The Terraform Labs and UST disaster triggered a market crash, costing traders billions. Now, almost two years on, what’s the present state of this cryptocurrency turmoil?

Do Kwon, the founding father of Terraform Labs and the developer of TerraUSD (UST) and Luna tokens, continues to be a controversial and mysterious determine within the cryptocurrency world. In mid-March 2022, the worth of UST and Luna plummeted to nearly zero, shortly wiping out roughly $60 billion from traders’ holdings.

Since then, there have been main developments. Kwon is awaiting extradition, and makes an attempt are being made to revive the previously profitable undertaking. The continued state of affairs with Terraform Labs and Do Kwon continues to be evolving.

How Terra ecosystem collapsed

In Might 2022, concurrent with the investigation information, the value of UST fell to $0.98, dropping its peg to the greenback. Do Kwon reassured traders, stating the state of affairs was beneath management. But, the next day noticed an additional decline within the token’s worth, dropping to $0.35.

Kwon then turned to Twitter, encouraging his followers to take a position extra in an effort to maintain the greenback peg. This technique, nonetheless, proved unsuccessful.

Traders started actively dumping UST and Luna, inflicting Luna’s worth to drop catastrophically to $0.10 – a decline of 96%. Do Kwon didn’t touch upon this case, and social media customers grew to become satisfied that the Terra ecosystem was a daily pyramid scheme launched to steal traders’ cash.

Terraform’s revival

In mid-Might 2022, Kwon ended his silence and revealed plans for a brand new Terra blockchain, excluding UST. This proposal gained help from 65% of traders.

Terra 2.0 debuted on Might 28, 2022. Nonetheless, shortly after its launch, the worth shortly dropped – Luna misplaced 77% of its worth, adopted by a further 20% lower on June 8. Amid these developments, Kwon restricted his Twitter account, limiting entry to pick out followers.

Investigation of Terraform Labs by U.S. authorities

In June 2022, the U.S. Securities and Trade Fee (SEC) initiated an investigation into Terraform Labs and its algorithmic stablecoin. The SEC’s inquiry targeted on whether or not the advertising of UST breached federal investor safety legal guidelines earlier than the stablecoin crash. Particularly, SEC prosecutors examined Terraform Labs’ actions for potential infringements of securities and funding product legal guidelines.

By February 2023, the SEC charged Terraform Labs and co-founder Do Kwon with conducting a “multi-billion-dollar securities fraud.” In December 2023, a courtroom sided with the regulator, ruling that UST, LUNA, wLUNA, and MIR belongings constituted funding contracts.

South Korea’s investigation into Terra

In late Might 2022, the South Korean prosecutor’s workplace launched an investigation into the creators of the just lately failed Terra cryptocurrency undertaking. The main target was on figuring out if any intentional worth manipulations or different unlawful actions have been concerned within the collapse.

As a part of the inquiry, former workers of Terraform Labs, who have been concerned within the early growth of the Terra ecosystem in 2019, have been summoned for questioning.

In September 2022, a South Korean courtroom issued an arrest warrant for Do Kwon, together with 5 others, on prices of violating the nation’s capital markets legal guidelines. On the time of the warrant, all have been reportedly in Singapore.

On the similar time, representatives of Terraform Labs imagine that the Korean prosecutor’s workplace exceeded its authority in pursuing Terra founder Do Kwon.

Final June, journalists reported that Kwon may face authorized repercussions in a number of jurisdictions, beginning with South Korea. Dan Sung-han, the lead investigator in Kwon’s case, anticipates that Kwon may face a major sentence, doubtlessly over 40 years, within the monetary fraud case.

In response to Sung-han, prosecutors have already seized 246.8 billion received (roughly $190 million) associated to Kwon’s case and intend to freeze a further 31.6 billion received (about $24.25 million).

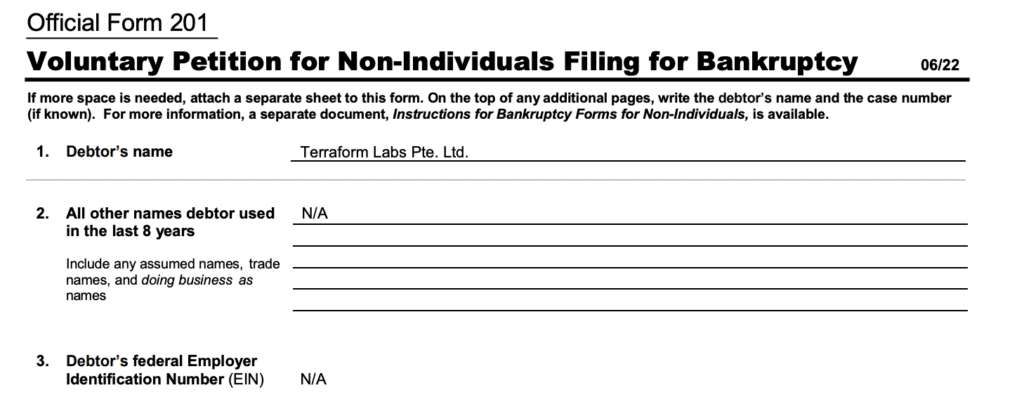

Terraform Labs chapter

On Jan. 21, Terraform Labs filed for chapter. In response to courtroom paperwork, the agency’s belongings and liabilities are estimated to be between $100 million and $500 million, with the variety of collectors various between 100 and 199.

Terraform Labs has acknowledged its dedication to fulfilling all monetary obligations to workers and suppliers all through the Chapter 11 course of with out the necessity for additional funding. Moreover, the corporate goals to maintain creating its web3 choices.

Do Kwon’s escape and extradition

Do Kwon was residing in Singapore till mid-September 2022. At the moment, South Korea issued an arrest warrant for him for alleged violations of capital markets legislation, and Interpol launched a crimson discover, main Kwon to flee.

For a number of months, Do Kwon allegedly hid in Serbia, however his precise whereabouts have been unknown. In March 2023, authorities in Montenegro arrested him for making an attempt to fly to Dubai with a faux passport, resulting in a four-month jail sentence.

For nearly a yr after his arrest, there was ongoing debate about whether or not to extradite Kwon to america or South Korea. Montenegro’s authorities revisited the choice to deport the founding father of Terraform Labs a number of occasions.

On March 5, the plan at hand over the entrepreneur to U.S. authorities was reversed. Montenegro’s Courtroom of Enchantment overturned the decrease courtroom’s choice, citing “critical violations of the provisions of felony proceedings.”

Consequently, Montenegro’s Supreme Courtroom resolved to extradite Do Kwon to South Korea. This ruling permits for a streamlined course of to switch the accused to South Korean officers for additional authorized motion.

Summing up

Almost two years have elapsed because the downfall of a once-prominent cryptocurrency undertaking. Whereas this chapter would possibly appear to be closing, the unfolding occasions counsel in any other case.

The chapter of Terraform Labs and the extradition of its founder, Do Kwon, mark the start of a brand new section in one of many largest cryptocurrency collapses. The destiny of traders who misplaced billions within the undertaking stays unsure, as does the particular nature of the penalties that Kwon might face.

With two years of investigation behind them, South Korean authorities are anticipated to take a agency stance towards Kwon for his alleged deception, evasion, and failure to cooperate.