BlackRock spearheads proceedings with 203,754 BTC collected for buyers in below three months because the Bitcoin ETF market expands.

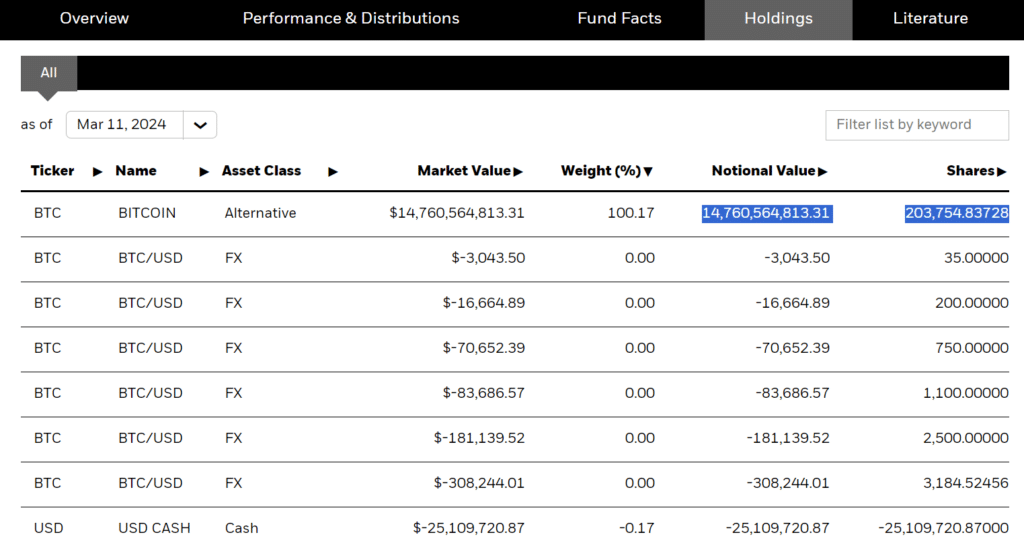

BlackRock’s iShares Bitcoin ETF (IBIT) boasts a notional worth of $14.7 billion as of March 11, based on the asset supervisor’s official information updated on March 12. Excluding Grayscale’s transformed GBTC ETF, this makes IBIT the most important Bitcoin (BTC) ETF among the many 9 new funds accepted on Jan. 10 by the U.S. SEC.

The closest issuer to BlackRock was Constancy’s FBTC, with $9.2 billion in belongings below administration (AUM) per SoSoValue analytics. Each issuers stand head and shoulders above the pack after amassing over $17 billion in cumulative internet inflows from eligible buyers.

BlackRock might maintain the most important BTC stash of any new ETF issuer, however Michael Saylor’s MicroStrategy, which not too long ago acquired a scoop, inched forward of the corporate. The software program maker owns 205,000 BTC.

In the meantime, IBIT’s preliminary success has catalysized curiosity in additional Bitcoin ETFs from the Larry Fink-led Wall Avenue stalwart. As crypto.information reported, the asset administration large sought SEC approval to purchase extra spot BTC ETFs and include such funding autos in its World Allocation Fund.

The corporate additionally expanded its BTC ETF footprint outdoors the U.S. to rising markets in Latin America. BlackRock launched the iShares Bitcoin Belief ETF’s Depositary Receipts along with Brazil’s B3 inventory alternate.

BlackRock’s spot Ethereum ETF unsure

Whereas IBIT’s issuer holds an impeccable report for profitable purposes with the SEC, analysts have surmised that its newest crypto enterprise could also be topic to stiff opposition from the securities regulator.

Fink’s firm and several other different issuers filed for spot Ethereum (ETH) ETF shortly after making progress with the BTC counterpart. Nevertheless, the SEC delayed approving or denying these filings till Could.

Specialists like Bloomberg’s Eric Balchunas and Variant Fund’s Jake Chervinsky predicted slim possibilities that the SEC will approve these merchandise by the Could deadline. A scarcity of dialogue between the SEC and issuers like BlackRock was highlighted as a significant sign for this skepticism, though reports have urged conferences must be held this month.