Bitcoin open curiosity signaled greater value expectations from buyers, however one analytics agency opined a doable market correction amid historic spot ETF web inflows.

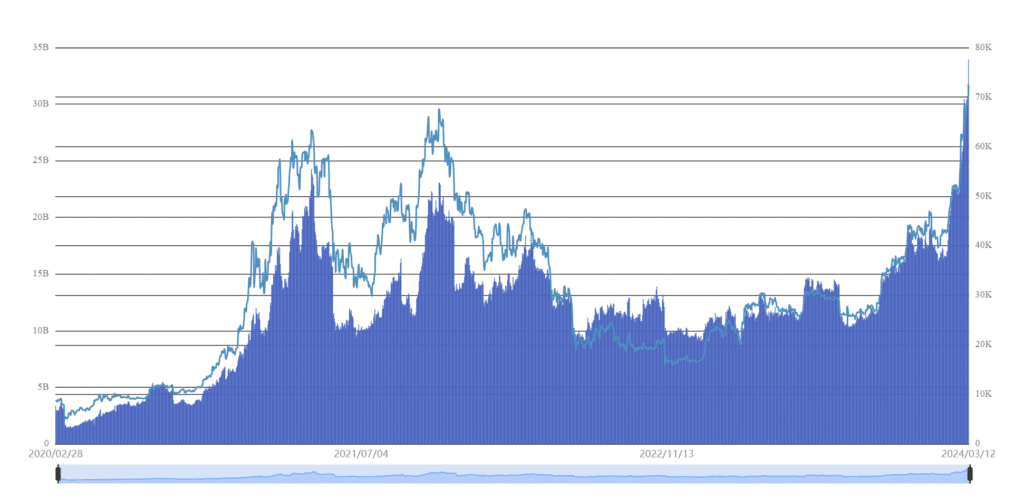

In response to SoSo Worth, Bitcoin (BTC) futures open curiosity reached a brand new all-time excessive (ATH) of $33.9 billion on March 13 because the cryptocurrency set one other ATH. The landmark second for BTC contract holdings got here because the $1.4 trillion asset hit a $73,637 price ticket, per CoinMarketCap.

BTC contract positions leapfrogged the earlier peak of $23 billion recorded in the course of the bull cycle prime in November 2021. SoSo Worth famous that funding charges throughout main exchanges like Binance additionally touched the very best level since early final 12 months. The startup suggested warning as crypto markets hovered round these new highs.

“Excessive funding charges sign potential pullback dangers for buyers. But, the Bitcoin ETFs have additionally seen file single-day web inflows.”

Spot BTC ETF knowledge confirmed over $1 billion in cumulative web inflows garnered by 9 issuers on March 12. BlackRock’s iShares BTC ETF (IBIT) took the lead once more, attracting $848 million for its highest-ever single-day web influx.

Grayscale’s GBTC additionally noticed lower than $80 million in web outflows and has shed greater than $11 billion in three months.

Saylor: Bitcoin is the endgame

MicroStrategy government chairman Michael Saylor has up to date his view on Bitcoin because the superior digital forex and the last word digital property. When requested what MicroStrategy’s finish sport is with the crypto, Saylor reiterated the plan to purchase extra Bitcoin for so long as doable and by no means promote.

Saylor’s thesis predicted that many of the world’s $900 trillion wealth will ultimately movement into BTC as extra corporations and buyers migrate into the digital sphere for optimum capital preservation.

MicroStrategy is likely one of the largest BTC holders, with a 205,000 Bitcoin stack price over $15 billion. In response to Google Finance, the software program designer’s inventory has grown 157% year-to-date, outperforming the S&P 500 index.