On March 21, the market capitalization of stablecoins reached $150 billion for the primary time in 18 months.

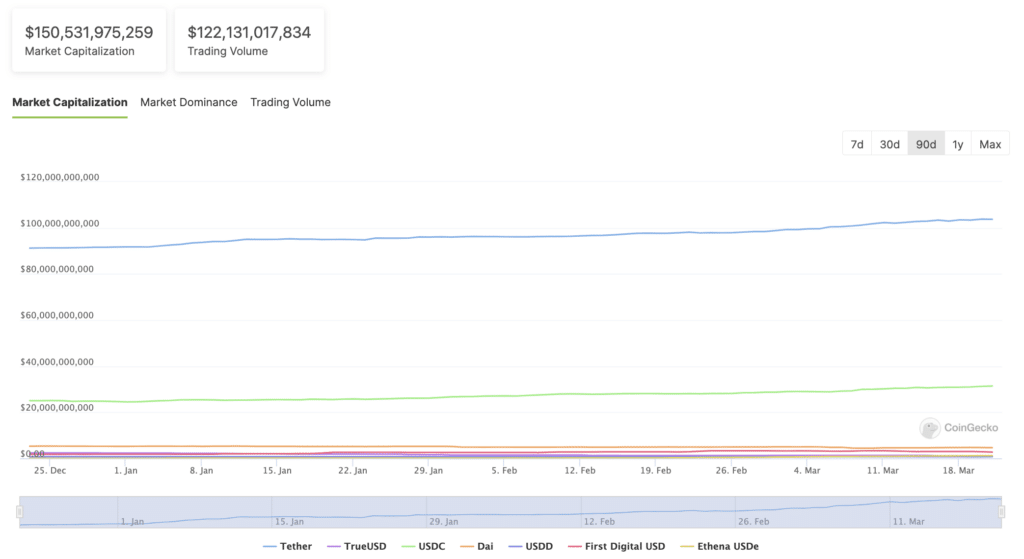

In response to CoinGecko, along with the expansion of market capitalization to $150.5 billion, every day buying and selling quantity for the asset class approached $122 billion.

The undisputed chief on this class is Tether (USDT), which has 70% dominance. The second largest stablecoin, USD Coin (USDC), has a market capitalization of $31.8 billion, giving Circle‘s stablecoin a market share of over 20%. In third place is DAI, which had $4.7 billion and three% of the market share on the time of writing.

The crypto neighborhood believes that the rise in stablecoins‘ market capitalization is an optimistic sign for additional market progress.

Particularly, stablecoins fulfill a market want if they’ve such a big market capitalization.

Earlier in March, ranking company S&P World Rankings released its ninth stability ranking for the stablecoins USDC, USDT, DAI, FDUSD, FRAX, USDM, GUSD, USDP and TUSD.

USDC, USDP, and GUSD have been rated “sturdy,” whereas solely USDM from Mountain Protocol was rated “ample”. Stablecoins USDT, DAI, and FDUSD have been referred to as “constrained.”

The very best threat and lowest valued have been FRAX and TUSD. Not one of the listed belongings acquired the very best rating within the present rating.