In its newest report, Sweden’s Riksbank harassed the need for in depth technical and regulatory improvement to make sure safe offline funds with e-kronas.

Sweden’s central financial institution, Riksbank, cautioned in its latest analysis observe on CBDCs in regards to the potential dangers related to unsynchronized knowledge in offline funds. Highlighting the significance of synchronizing offline transactions with on-line balances, the financial institution addressed concerns relating to liquidity dangers stemming from shadow wallets, and middleman nodes that facilitate connections between offline and on-line wallets.

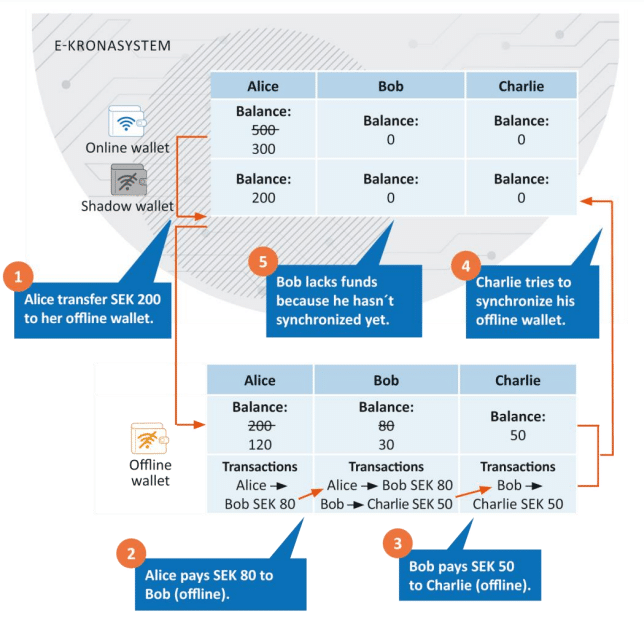

The chance turns into obvious when a number of customers have interaction in consecutive offline transactions with out correct synchronization. As an example, when people add CBDCs to their offline wallets, it’s essential for the system to align this stability with their on-line counterparts. Nevertheless, if customers spend CBDCs offline, discrepancies emerge between the offline and on-line balances, leading to lowered funds for recipients.

If a recipient makes an attempt to synchronize their pockets after receiving CBDCs from an offline transaction however finds that the sender hasn’t synced their pockets, they face usability points, the central financial institution explains, including that this hole in safety underscores the significance of sender synchronization to make funds obtainable for recipients.

To sort out these challenges, Sweden’s central financial institution is exploring potential options, similar to establishing liquidity swimming pools for funds or imposing restrictions on offline CBDC utilization. As an example, CBDCs obtained offline might solely change into obtainable for offline transactions as soon as synchronization happens. Nevertheless, the feasibility of those options stays unsure, pending additional evaluation by the Riksbank.

Whereas the central financial institution just lately concluded its pilot of the e-krona answer, no choices have been made relating to the issuance of a digital foreign money or the selection of expertise.