Bitcoin declined over 5% on March 22 as spot ETFs recorded unfavorable numbers for the fourth consecutive day, primarily on account of Grayscale GBTC exits.

Based on SoSo Worth, 10 spot Bitcoin (BTC) ETFs marked $93.8 million in cumulative single-day outflow throughout buying and selling on March 21. Grayscale’s GBTC accounted for a lot of the BTC ETF share liquidation, amounting to $358 million.

Bloomberg’s James Seyffart verified that Grayscale’s BTC ETF has misplaced practically half of its shares to promote orders following the approval of spot BTC ETFs on Jan. 11.

Seyffart concurred with fellow analyst Eric Balchunas that a few of GBTC’s liquidation could also be attributed to Gemini and Genesis. Chapter crypto change FTX additionally liquidated $2 billion in Grayscale shares, crypto.information reported in January.

Outflows from GBTC overshadowed inflows into eight different merchandise. BlackRock’s BTC ETF garnered over $223 million in demand, adopted by $12 million injected into the fund from Bitwise. Knowledge confirmed that the WisdomTree did not obtain inflows for a minimum of the second time.

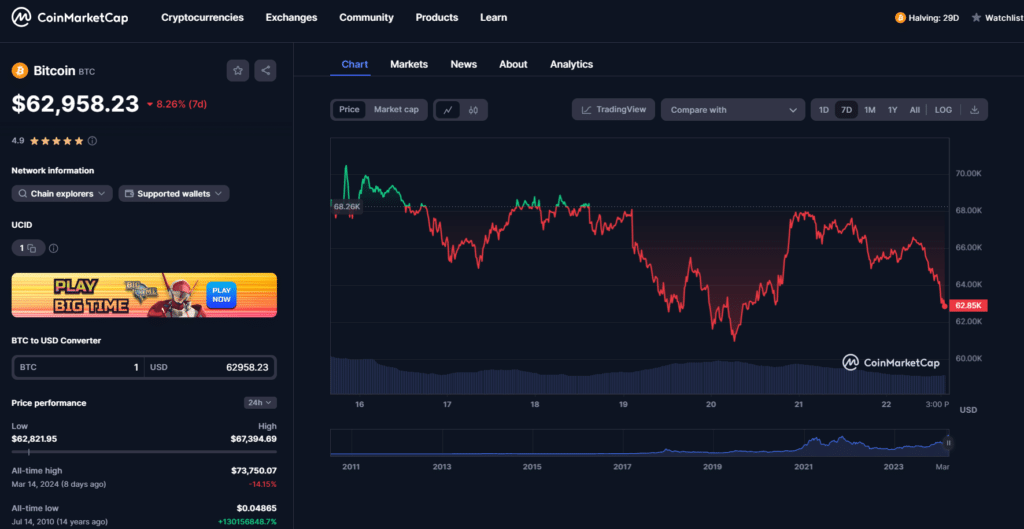

Bitcoin down 8% in every week

Bitcoin retraced over 8% prior to now week after falling under $63,000, per CoinMarketCap. BTC has dropped 14% from its $73,750 all-time excessive set on March 14. The world’s largest cryptocurrency traded round $62,900, roughly a month away from its quadrennial halving event.

Funding advisor at neobank Keytom, Evgeny Filichkin, echoed the final sentiment that the halving mixed with spot BTC ETFs demand will catalysize a provide shock and sure set off a parabolic run.

Following the halving occasion, the provision of recent BTCs will lower, inflicting market dynamics to accentuate. With rising demand and restricted availability, the heightened shortage will amplify Bitcoin’s attraction, driving additional funding curiosity.”

Evgeny Filichkin, Keytom funding advisor