The world’s largest asset administration firm, BlackRock, has elevated the quantity of Bitcoin on its stability sheet.

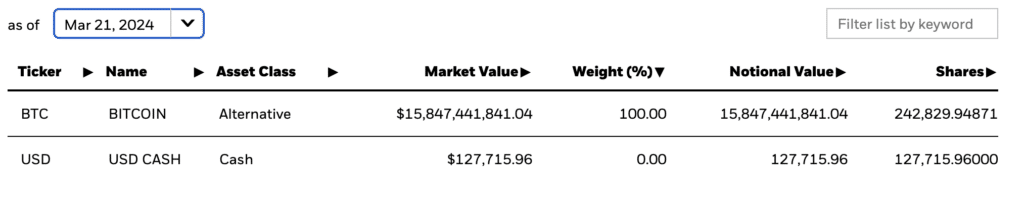

Based on the web site, BlackRock has elevated the quantity of Bitcoin (BTC) in its iShares Bitcoin Belief (IBIT) to 242,829. The amount of belongings underneath administration within the fund’s spot Bitcoin ETF reached $15.5 billion on the present change charge.

Fox journalist Eleanor Terrett additionally reported that BlackRock’s Head of Digital Belongings, Robert Mitchnick, famous that Bitcoin is the highest precedence for the corporate’s purchasers, adopted by Ethereum.

Mitchnick emphasised that the crypto group wish to see much more crypto merchandise from BlackRock, however this differs from the corporate’s present focus.

“The crypto group wish to see a protracted tail of different crypto merchandise from BlackRock, however he says “that’s simply not the place we’re centered.”

Robert Mitchnick, BlackRock Head of Digital Belongings

Based on SoSo Worth, on March 21, IBIT took first place when it comes to capital inflows. It added $233.4 million to its stability sheet, and the amount of funds underneath administration reached $13.3 billion. In second place is an funding product from Bitwise Asset Administration with $12.1 million, and in third place is Valkyrie Bitcoin Fund (BRRR) with $4.72 million.

On the identical time, the entire every day capital outflow within the spot Bitcoin ETF sector amounted to $93.8 million. The damaging development continues for the fourth day in a row as a result of an increase in outflows of $358.7 million from the GBTC fund from Grayscale Investments. Between March 18 and March 21, the determine rose to greater than $1.8 billion, and the entire outflow of funds amounted to greater than $835 million.