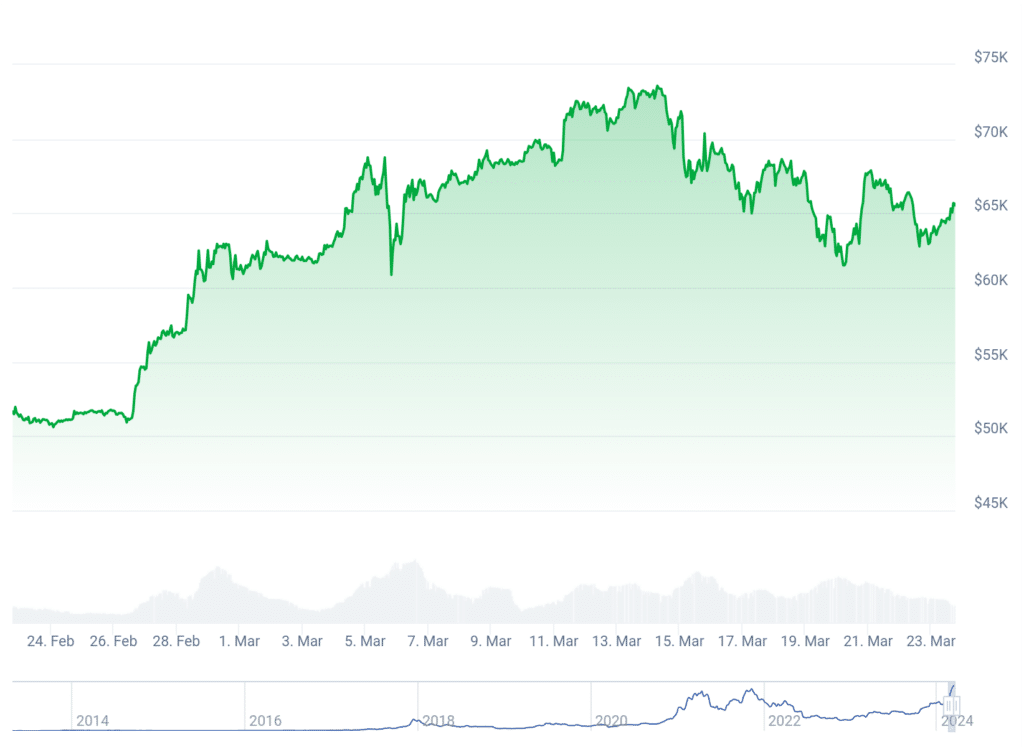

Because the 2024 Bitcoin halving approaches, Bitcoin (BTC) is struggling to carry above $63,000, and the worth is predicted to drop even additional in what’s termed a “correction.”

Crypto analyst Michael van de Poppe took to X to state that the present consolidation is a case of “peaking pre-halving,” and there may be nonetheless time for Bitcoin to hit a brand new all-time excessive.

Bitcoin has skilled practically a 2.6% value drop over the previous week and 4% within the final fortnight. In keeping with Van de Poppe, this could possibly be because of the upcoming halving occasion.

He stated that like each different cycle, we’re but to see Bitcoin peak earlier than the halving, including that we’d not see a lot “spectacle” coming from Bitcoin except it hits $70,300.

Bitcoin halving is an automated course of that reduces miner rewards by half. Halving happens each 4 years, or after 210,000 blocks of Bitcoin are mined. The following halving occasion is predicted to happen in April 2024.

Van de Poppe in contrast Bitcoin’s value motion to the 2016–2017 cycle, suggesting that historical past will repeat itself and Bitcoin will expertise a big upward development.

“My foremost thesis is that we’ve seen the pre-halving hype and that we’re going to have an extended, huge bull market.”

On the time of writing, Bitcoin was buying and selling at $65,537, a 3.2% improve within the final 24 hours, in accordance with CoinGecko. As beforehand said, the present value represents a 2.6% drop over seven days.

Nonetheless, it marks a 26% enchancment over 30 days.

Pseudonymous analyst Rekt Capital means that this 12 months’s Bitcoin pre-halving correction has already begun. Bitcoin pre-halving retraces sometimes happen 14–28 days earlier than the halving occasion.

In keeping with Rekt Capital, this 12 months’s value fall is just like the 20% pre-halving correction in 2020 and the 40% pullback earlier than the 2016 halving.

He added that the correction would final about 77 days, although the discount could possibly be lower than in earlier cycles.

The present downward development presents a greater alternative for traders to purchase Bitcoin earlier than the upcoming halving occasion, which, if historical past repeats itself, will possible be adopted by a bullish development.