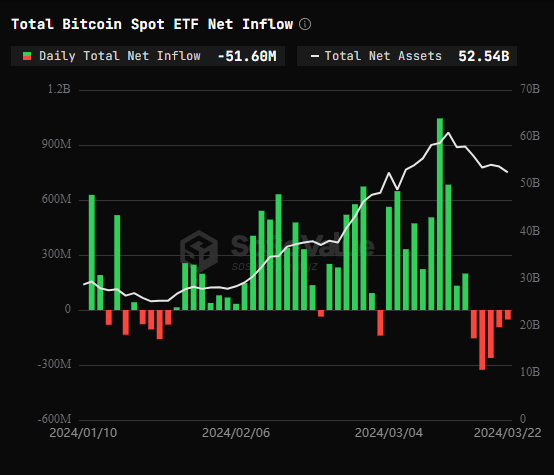

Spot Bitcoin exchange-traded funds (ETFs) reported complete web outflows of $51.6 million on Friday, marking the fifth day of constant withdrawals.

Amongst these, the Grayscale ETF (GBTC) skilled a considerable single-day web outflow of $169 million. In distinction, the BlackRock ETF (IBIT) and Constancy ETF (FBTC) noticed modest single-day web inflows of $18.89 million and $18.13 million, respectively, each reaching two-day report lows.

Regardless of this downward development, there’s a silver lining as the speed of outflows seems to be decelerating. Essentially the most vital drop occurred on Tuesday, with over $323 million exiting throughout all 10 ETFs. Correspondingly, Bitcoin’s worth dipped to $62,000 on the identical day.

Nevertheless, because the outflow slows, Bitcoin has began to bounce again, displaying a close to 3% improve as we speak, pushing its value as much as $64,600.

Analysts have recommended that ETF calls for might resurface as the biggest cryptocurrency reaches sure assist ranges.

The upcoming halving might additionally see renewed curiosity from institutional buyers in these ETFs.

This current exercise underscores a powerful correlation between Bitcoin ETF actions and the BTC’s market worth.

Earlier within the month, when Bitcoin ETFs loved a report inflow of $1 billion, the worth of BTC soared to an all-time peak of $73,700.