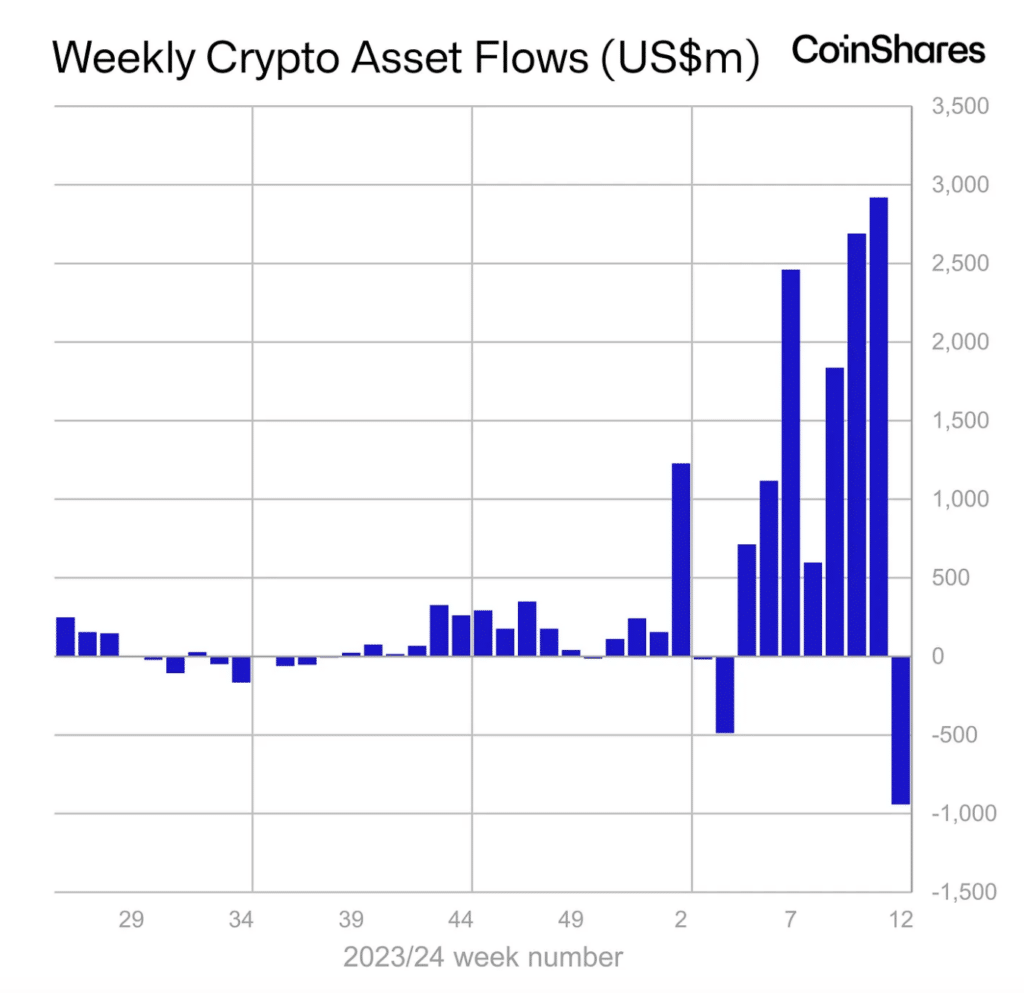

The outflow from crypto funding merchandise from March 16 to 22 reached $942 million after the utmost historic influx of $2.92 billion.

CoinShares specialists be aware that beforehand, optimistic dynamics have been noticed for seven weeks. Throughout this era, inflows into devices amounted to $12.3 billion. Commerce turnover amounted to $28 billion after a file $43 billion the earlier week.

The primary driver of the adverse dynamics was outflows from GBTC from Grayscale for $2 billion. They exceeded web inflows to its rivals ($1.1 billion). Consequently, market contributors withdrew a file $904 million from Bitcoin (BTC) associated devices after the highest-ever receipts of $2.86 billion every week earlier.

Mixed with a rollback in quotes, the amount of digital property beneath administration decreased by $10 billion to $88.2 billion. Per week earlier, the metric instantly exceeded $100 billion. From constructions that enable opening quick positions on BTC, purchasers took $3.7 million after the utmost funding for the reason that starting of the 12 months of $26 million within the earlier seven days.

In Ethereum (ETH) funds, the outflow elevated from $13.9 million to $34.2 million. Traders withdrew $5.6 million and $3.7 million from devices primarily based on Solana (SOL) and Cardano (ADA), respectively. Merchandise primarily based on Polkadot (DOT), Avalanche (AVA), and Litecoin (LTC) recorded inflows of $5 million, $2.9 million, and $2 million, respectively.

Noteworthy, every week earlier, inflows in cryptocurrency funding merchandise amounted to $2.92 billion after $2.69 billion within the earlier reporting interval. Thus, the influx for the reason that starting of the 12 months reached $13.2 billion. For comparability, for the whole 2021 the determine was $10.6 billion.