Because the fourth Bitcoin (BTC) halving will get nearer, some consultants consider the occasion may result in centralization threat, threatening the blockchain community.

As soon as each 4 years, the block reward for Bitcoin miners is reduce in half to assist the asset keep its shortage. The occasion known as halving. Traditionally, miners have stayed totally operational and even grown in quantity during the last three compensation cuts because of the rising BTC worth.

Nevertheless, many marvel if the BTC worth is excessive sufficient for miners to stay operational or if it will face centralization and even existential dangers after the fourth halving event.

Talking with crypto.information, Ryo Coin co-founder Lani Dizon says market dynamics can change, and unexpected occasions can have vital impacts.

“Making an attempt to foretell the precise influence of a halving on Bitcoin’s worth is a problem. Many components can affect the market, together with general demand for Bitcoin, investor sentiment, market traits, world financial situations, regulatory adjustments, and technological developments inside the blockchain ecosystem, and extra.”

Lani Dizon, Ryo Coin co-founder

Dizon believes whereas some miners may discover the diminished block reward “difficult,” particularly if the worth doesn’t improve instantly or sufficiently to offset the discount in rewards, the “Bitcoin community is designed to regulate.” She added:

“Nevertheless, from a logical perspective, when mining prices are decrease than Bitcoin’s market worth, extra miners will keep within the community. When mining prices improve past the miner’s income, some miners will go away.”

Compensation considerations

One of many predominant considerations across the centralization of Bitcoin is the compensation of the miners serving to the community keep operational.

Because the block reward reduces by 50% within the upcoming halving — falling from 6.25 BTC to three.125 BTC — Bitcoin’s excessive worth volatility may make it more durable for particular person miners to be properly compensated to function their nodes in difficult situations.

Traditionally, the BTC worth reached new all-time highs a 12 months or 18 months after every halving occasion. Right here’s how the Bitcoin worth reacted after every halving:

- First halving on Nov. 28, 2012: Bitcoin was buying and selling at $12.35 and surged to $964 a 12 months later.

- Second halving on July 9, 2016: Bitcoin’s worth elevated from $663 to $2,500 in round one 12 months.

- Third halving on Could 11, 2020: BTC was buying and selling at round $8,500 and reached nearly $69,000 in simply 17 months.

In line with Lucian Calin, the info middle technician at Argo Blockchain, some over-leveraged miners won’t make it via the halving due to excessive overhead prices or huge debt, however it’ll all even out in the long run. He added:

“It’s like a sport of monopoly, the wealthy hold getting richer, on this case, different miners will purchase out smaller miners and take over their actions. Mining will all the time exist on Bitcoin till the final Bitcoin is mined and even previous that to verify the transactions are confirmed.”

Halving rewards, rising centralization dangers

Halving Bitcoin’s block reward may pressure small-scale and particular person miners due to the excessive prices concerned in mining. Smaller miners may exit the market in the event that they lack enough assets. This case may favor bigger mining corporations, probably resulting in extra centralized community management.

Bitcoin’s centralization may pose a a lot larger risk to the worldwide monetary system than it appears, with BTC exchange-traded funds (ETFs) registering over $11.2 billion in whole internet flows.

Centralization may probably expose the Bitcoin community to the 51% assault and will even result in a single entity having full management over the blockchain.

This doesn’t appear unimaginable, on condition that the Foundry USA Pool controls 27% of the whole Bitcoin hashrate. The biggest BTC mining pool has a mean hash energy of 160.43 EH/s adopted by AntPool’s 141.46 EH/s — accounting for 23.8% of the whole community hash fee.

Nevertheless, Lani Dizon says that Bitcoin’s decentralized nature is designed to stop any single entity from controlling it. Its community depends on a proof-of-work (PoW) consensus mechanism, the place miners compete to validate transactions and safe the community. Dizon added:

“Though there are centralization considerations within the mining ecosystem, the place giant mining swimming pools or entities may probably exert affect, Bitcoin’s decentralized design makes it resistant for any giant entity to have full management.”

Lucian Calin argues that with this present ETF from BlackRock and different huge establishments, “we would see them attempt to take over Bitcoin and make it extra centralized.” Calin added:

“However will probably be very exhausting for them to take action with out making the worth explode up like they did up to now few weeks. All of that’s due to the low provide of obtainable Bitcoin on exchanges which is able to intensify with the Bitcoin halving arising.”

Calin believes that huge establishments can’t monopolize Bitcoin with out making its worth attain “tens of millions of {dollars}” since there’s a restricted variety of cash accessible on exchanges. Per data from Coinglass, roughly 1.78 million BTC tokens can be found on all exchanges, which accounts for lower than 10% of the utmost Bitcoin provide.

“Bitcoin completely can’t be centralized”

On March 18, Bitfinex crypto change released a report claiming that the forthcoming Bitcoin halving may result in the centralization of the BTC mining energy. Centralization may ultimately result in vulnerabilities and censorship which is “opposite to Bitcoin’s ethos.”

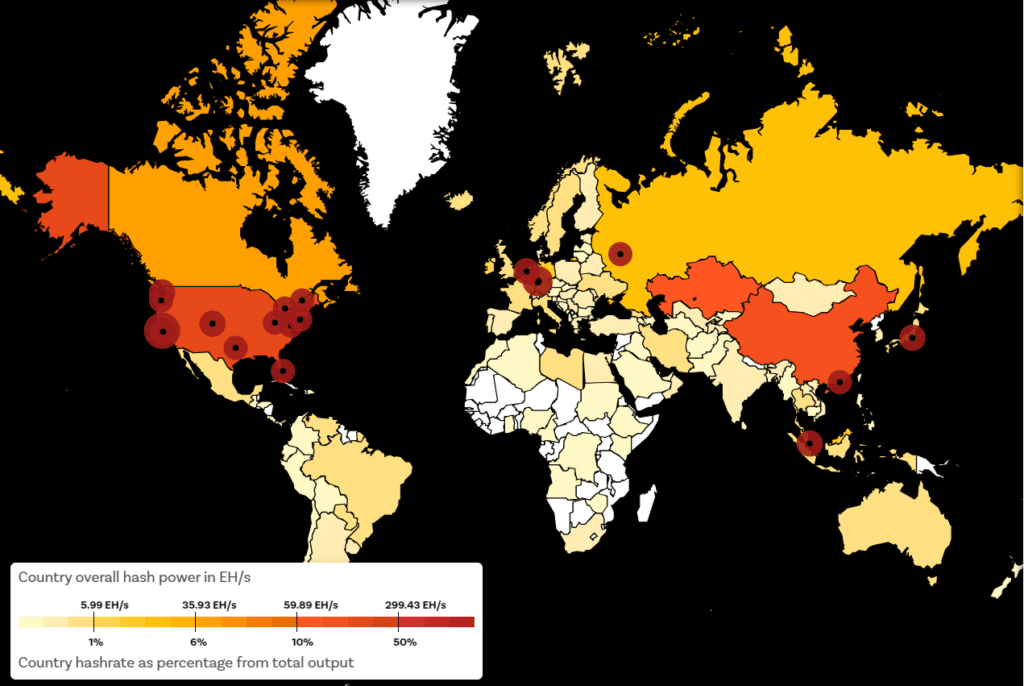

The U.S. alone has a 37.84% share of the whole BTC hash fee with a complete hash energy of 226.61 EH/s, in line with The Chain Bulletin.

Whereas this poses considerations about Bitcoin’s centralization, the diversified world distribution of miners and their various strengths to adapt basically mitigate that threat, making certain the community stays decentralized.

Bitcoin miner and the director of enterprise growth at Canaan, Christopher James Crowell, believes that Bitcoin mining is an excessive amount of of a world “phenomenon to be managed by a central entity.” Crowell advised crypto.information:

“Nations all around the world have their very own distinctive benefits. Whether or not it’s low labor prices, low-cost energy, or nice innovation, there are many distinctive entities in mining Bitcoin to soundly say that it completely can’t be centralized.”

Authorized dilemma

If the unimaginable occurs, consultants have various concepts on how the governments would react to the state of affairs since Bitcoin’s centralization may mood with the worldwide monetary state of affairs.

Dizon says that governments would view any try to regulate Bitcoin by a single entity as a major risk to monetary stability and will take regulatory actions to mitigate the focus of energy. She acknowledged:

“They might doubtless reply with elevated regulatory scrutiny and probably implement measures to decentralize management, safeguard monetary stability, and shield in opposition to manipulation or monopoly energy within the Bitcoin ecosystem.”

Alternatively, Calin says that the federal government can’t do something because of the worldwide nature of Bitcoin. He stated:

“The businesses will merely transfer their headquarters and operations elsewhere on the planet the place it’s extra favorable for them and provide it to many different folks that means.”