Crypto choices change Deribit is poised for a record-breaking week with over $15 billion in choices set to run out for Bitcoin and Ethereum.

The assertion highlighted that “over USD 15 billion in choices notional open curiosity (OI) will expire this week,” marking a historic occasion in Deribit’s operational historical past. This Friday is poised to witness one of many platform’s largest expirations of options contracts.

The expiration contains $9.5 billion in BTC choices open curiosity out of $26.3 billion and $5.7 billion in ETH choices open curiosity out of $13.2 billion, accounting for 40% and 43% of the entire OI, respectively.

Additional particulars supplied by Deribit reveal the impression of present market situations on these expirations.

“For BTC choices, at a value degree of [$70,000], USD 3.9 billion will expire within the cash. Equally, for ETH choices, USD 2.6 billion will expire within the cash,” Derebit explained.

The figures are significantly greater than typical, attributed to the latest price rally in each cryptocurrencies. That is anticipated to induce upward strain or volatility on the underlying belongings as a result of greater in-the-money (ITM) expiries and the diminishing affect of the decrease max ache ranges.

Analyzing the market’s volatility side, Deribit notes a contango within the volatility floor for each BTC and ETH. Present implied volatility (IV) ranges for March 29 choices stand at 63% and 67%, respectively, anticipating reaching a more healthy 80% additional alongside the curve. The commentary suggests market contributors don’t foresee important value fluctuations till expiration.

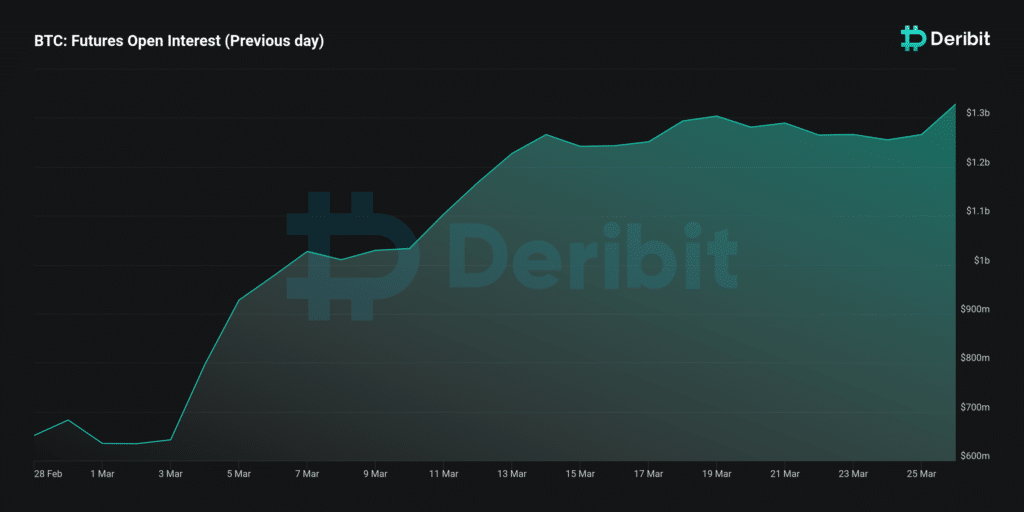

“$465 million in BTC March Future plus $230 million within the March ETH future will expire,” Derebit moreover disclosed, totaling roughly $695 million of the $1.9 billion at present excellent.

The platform additionally highlighted the present open curiosity in its dated futures, stating that the present OI of their dated futures of $1.9 billion is the very best OI variety of any crypto market, pushed by an annualized foundation of about 15% – 20%.

The excessive degree of curiosity is brought on by the numerous returns generated, sparking appreciable anticipation for substantial buying and selling exercise across the expiry interval.