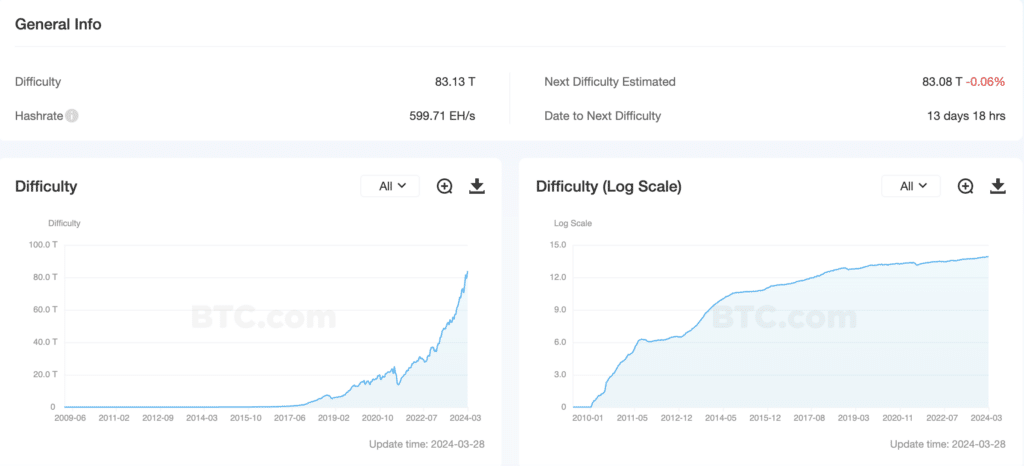

Because of the subsequent recalculation, the problem of Bitcoin mining decreased by 0.97%, with an indicator of 83.13 T.

The typical hashrate for the interval because the earlier worth change was 599.71 EH/s. The vary between blocks is 10 minutes and seven seconds. Mining problem determines the required whole {hardware} capability for mining Bitcoin (BTC). A rise on this indicator brings the halving date of the primary cryptocurrency nearer. Below sure circumstances, it could happen in April 2024.

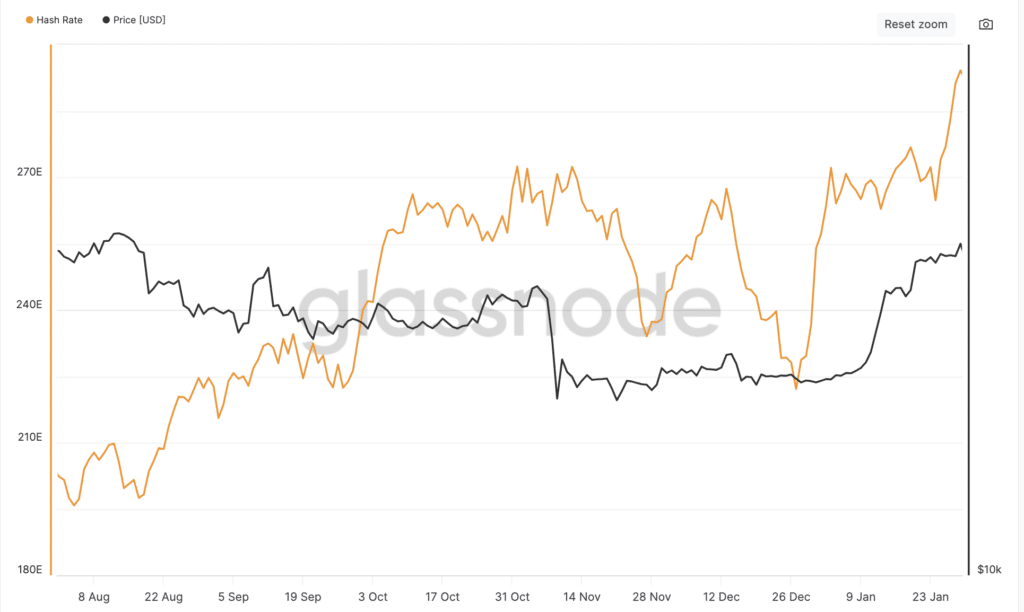

Based on Glassnode, the seven-day transferring common peaked at 614.9 EH/s on March 24. After that, it corrected to 586.1 EH/s.

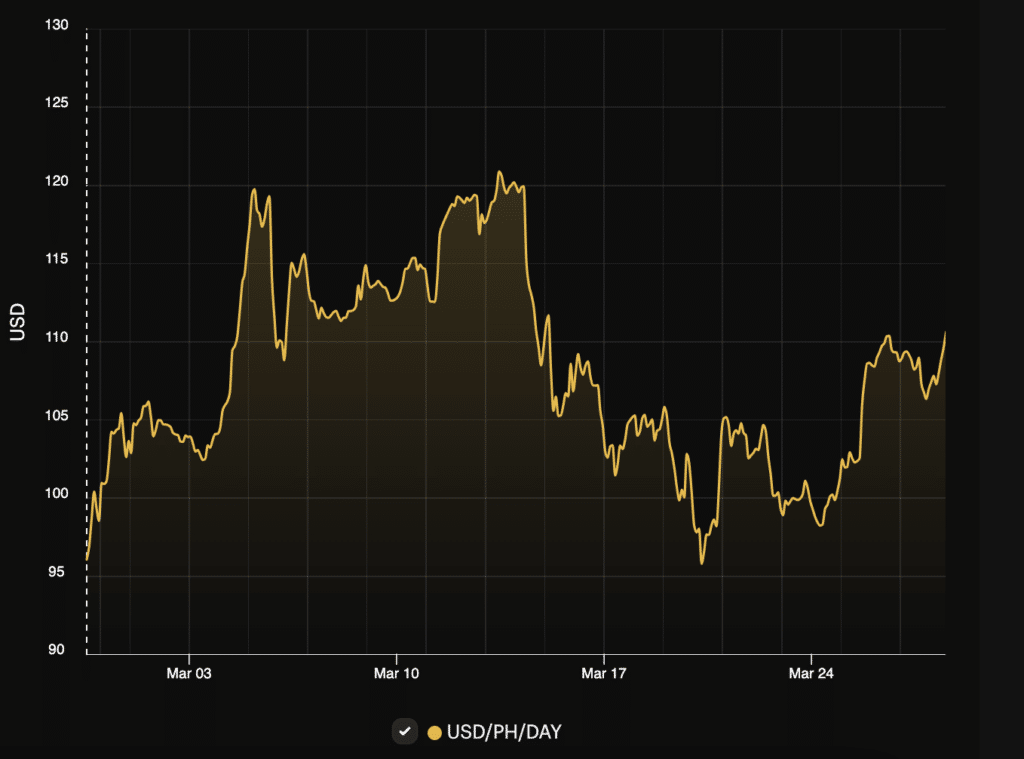

Based on the Hashrate Index, the hash value has elevated over the previous 24 hours from $108 per PH per day to $110.

On March 14, the problem of Bitcoin mining updated its historic most and reached 83.95 T. For the reason that final change date, the indicator has elevated by 5.79%, and the typical hashrate within the Bitcoin community reached 600.72 EH/s.

In the meantime, Bitfinex consultants believe that institutional funding of public firms has deprived particular person and small miners and will have long-term results on community dynamics.

Bitfinex’s consultants famous that the inflow of capital and the “professionalization” of mining operations led to a rise in hashrate, thereby growing the community’s general safety and stability. Thus, Wall Avenue investor funding in company mining has basically modified the community’s incentive construction.