Crypto hacks have value the digital asset trade billions of {dollars}, with consultants advising extra consideration and assets towards safety measures.

In accordance with DefiLlama, all-time losses incurred from crypto hacks exceeded $7.7 billion as of April 1, regardless of a 23% decrease in incidents through the first quarter of 2024 in comparison with final 12 months. Information revealed that decentralized finance protocols misplaced essentially the most cash since 2016, with hackers having stolen $5.8 billion from defi in seven years.

Platforms that allow customers to switch property between blockchains, generally referred to as bridges, account for over half of defi hacks. Exploiters looted $2.8 billion from these options by means of a number of assault vectors inherent in sensible contract loopholes.

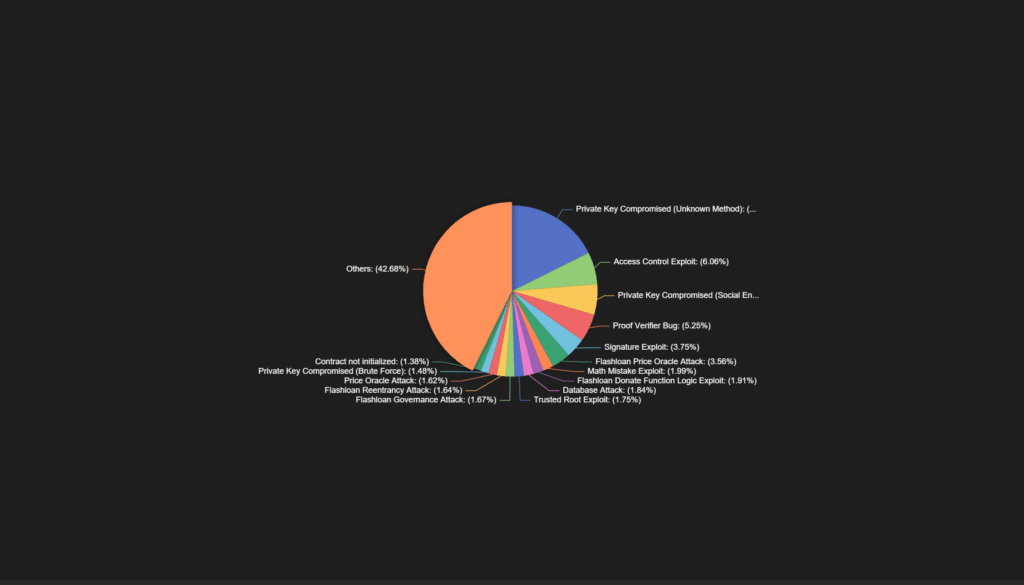

Per DefiLlama, non-public key compromises, entry management exploits, proof verifier bugs, signature exploits, and flash mortgage worth oracle assaults ranked because the 5 hottest strategies for crypto hacks. Nonetheless, 42% of all incidents stay unaccounted for, so consultants are uncertain how attackers orchestrated practically half of all hacks.

The primary recorded crypto hack

The oldest recorded crypto hack was perpetuated on “The DAO”, a decentralized autonomous group targeted on enterprise capital funding. Launched in April 2016, the initiative was hacked two months later in June, and misplaced roughly $60 million.

Hackers utilized a reentrancy bug to execute a withdrawal perform a number of instances inside a single transaction, permitting the funds to be drained.

Ronin’s document $600m crypto hack

Axie Infinity’s Ronin bridge misplaced over $600 million in a crypto hack attributed to North Korea’s notorious cybercriminal group, Lazarus. It stays the crypto’s largest single-protocol exploit up to now.

As crypto.information reported, Lazarus robbed lots of of tens of millions in Ethereum (ETH) and Circle’s stablecoin USD Coin (USDC), after compromising Ronin’s non-public keys. Ronin has staged a comeback this 12 months, following help from exchanges like Binance and coin listings on Coinbase.

Though safety stays a crypto ache level, consultants opine that the trade will in the end obtain extra resistance in opposition to unhealthy actors as stakeholders set up higher relationships.

We imagine that the cryptocurrency trade will progressively attain complete safety over time. This necessitates the trade’s regular progress, coupled with efficient collaboration between governments, regulation enforcement companies, and the crypto sector.

Slava Demchuk, AMLBot co-founder and CEO