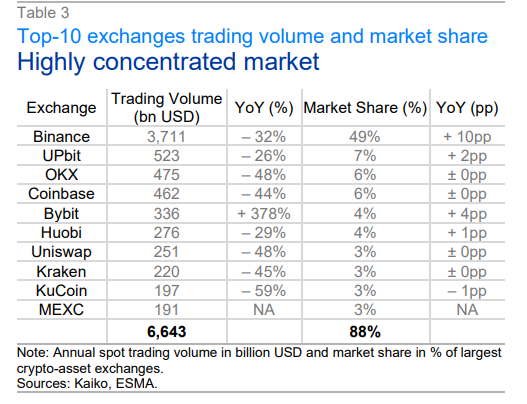

The crypto market seems to be extremely concentrated, as solely 10 exchanges course of round 90% of all trades, in response to a current examine achieved by the European securities regulator.

A current examine performed by the European Securities and Markets Authority (ESMA) has unveiled a big focus inside the crypto buying and selling panorama, elevating considerations about its potential implications for market stability. In response to the study titled “Crypto belongings: Market buildings and EU relevance,” solely 10 crypto exchanges deal with roughly 90% of all trades, with Binance accounting “for nearly half of worldwide buying and selling volumes.”

Collectively, Binance, UPbit, and OKX management over 60% of the market share, with Bybit experiencing a 380% enhance in buying and selling quantity year-over-year, whereas Coinbase noticed a 44% decline for a similar interval, the examine exhibits. ESMA warns that such focus carries potential dangers, expressing vital considerations in regards to the potential fallout of a significant asset or change failure on the broader crypto ecosystem.

“Furthermore, we discover that market liquidity can fluctuate extensively and tends to be larger within the largest exchanges.” ESMA

The European securities regulator additionally identified that opposite to common perception, cryptocurrencies don’t constantly function a protected haven during times of market stress, saying cryptocurrencies “are strongly interconnected” with equities and “no steady relationship with gold” has been discovered.

Regardless of regulatory efforts such because the EU Digital Asset Service Supplier (VASP) license, the examine suggests {that a} substantial portion of transactions executed on EU-licensed exchanges doubtless happen exterior the EU, underscoring the necessity for continued monitoring and regulation of the crypto market.