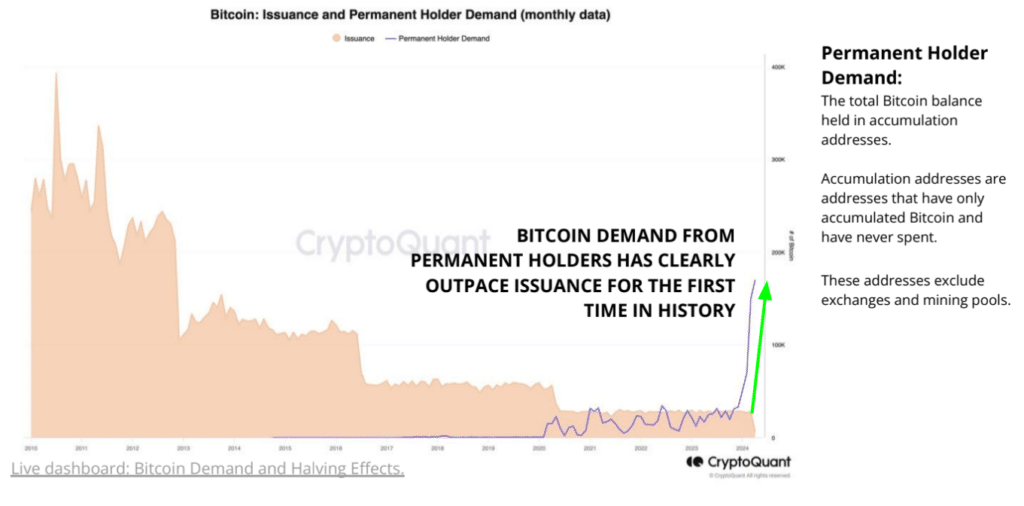

Analysts at CryptoQuant discovered that Bitcoin demand from “everlasting holders” has outpaced BTC issuance for the primary time in historical past, including gas for the potential value rally.

Bitcoin‘s demand from long-term holders has surged previous issuance ranges for the primary time within the cryptocurrency’s historical past, in response to a current research report from CryptoQuant.

The cohort of long-term holders is now including round 200,000 BTCs monthly, analysts say, including that the determine is way exceeding the month-to-month issuance of roughly 28,000 BTC.

Analysts at CryptoQuant famous that with the upcoming halving set to scale back month-to-month issuance to about 14,000 BTC, such a requirement marks a major shift in Bitcoin’s supply-demand dynamics.

Commenting on the upcoming halving, Tezos co-founder Arthur Breitman described the occasion as a “discount in safety finances,” suggesting that whereas the reward change for miners may benefit the Bitcoin ecosystem within the quick time period by probably addressing overpayment for safety, underscoring the necessity for future changes to emission insurance policies to keep up safety.

“Immediately, it is a good factor as a result of Bitcoin possible overpays for safety in the mean time, nevertheless it’s additionally a reminder that, in the long term, the emission coverage must change to keep up safety. Monetary projections primarily based on the halving are unserious.”

Arthur Breitman

Regardless of Breitman’s warning, crypto executives maintain differing views. Arthur Hayes, former head of BitMEX, anticipates BTC value declines earlier than and after the halving, attributing it to restricted greenback liquidity throughout this era. In the meantime, Marathon CEO Fred Thiel suggests that the halving’s affect might already be priced in, citing profitable spot exchange-traded fund (ETF) approvals.

As Bitcoin miners put together for lowered rewards, the upcoming halving in mid-April will minimize mining rewards from 6.25 to three.125 BTC per block. This course of happens mechanically, with the Bitcoin community protocol adjusting itself upon reaching a programmed block top. The milestone of mining all 21 million BTCs is projected round 2140, after which miners will rely solely on transaction charges for rewards.