An Aave fork on Blast community liquidated consumer positions price over $26 million as a result of an misguided threshold change.

Pac Finance, an iteration of decentralized finance (defi) lender Aave on Coinbase’s layer-2 chain Blast, tried to regulate its loan-to-value (LTV) parameters on April 11. As an alternative, the Aave fork unknowingly lowered its liquidation threshold.

The end result was a sweeping wipeout of Ether-collateralized (ETH) positions on the platform. In response to Will Sheehan, Founding father of block explorer Parsec, one consumer misplaced as much as $24 million because of the Aave fork incident on Blast. On-chain analytics additionally confirmed members 1000’s of {dollars} in losses denominated in ezETH.

Aave fork Pac Finance admits error

Hours after the difficulty was highlighted, Pac Finance acknowledged the error and disclosed that affected customers had been contacted. The workforce additionally mentioned a plan to mitigate the error was within the works.

“In our effort to regulate the LTV, we tasked a sensible contract engineer to make the required adjustments. Nonetheless, it was found that the liquidation threshold was altered unexpectedly with out prior notification to our workforce, resulting in the present situation.”

Pac Finance workforce

To keep away from additional mishaps, Aave promised to arrange a group discussion board to debate future upgrades and adjustments to its defi lending protocol. Pac Finance added that it intends to deploy a governance contract to reaffirm transparency and restore consumer belief.

Stani Kulechov, Founding father of blockchain developer Avara and the dad or mum firm behind Aave’s undertaking, tweeted that the matter highlighted a root situation with protocol spin-offs.

A basic drawback with forking code is the dearth of in-depth data of the software program and the parameters.

Stani Kulechov, Avara Founder

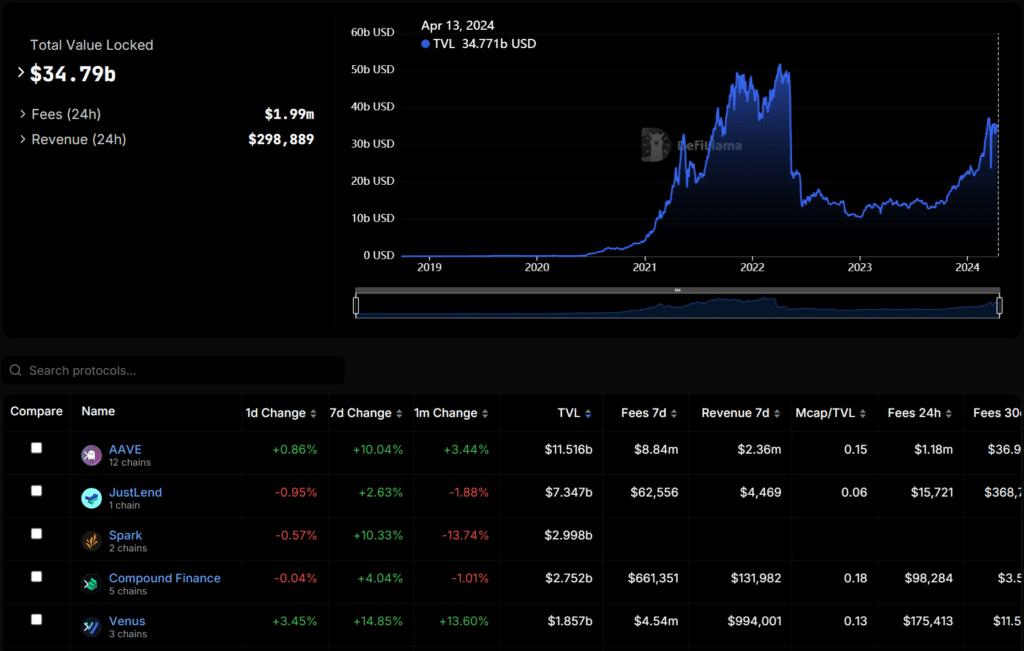

The lending market is one in every of defi’s largest sectors, permitting customers to borrow and supply liquidity to crypto’s burgeoning ecosystem. In response to DefiLlama, lending protocols maintain almost $35 billion in complete worth locked (TVL).

Aave is probably the most vital participant available in the market with $11.5 billion in TVL and availability throughout 12 chains, together with Ethereum, Arbitrum, Polygon, Optimism, Avalanche, Gnosis, Base, Metis, Binance Sensible Chain, Scroll, Fantom, and Concord. It has additionally deployed its stablecoin GHO to compete with Maker’s DAI token on Ethereum’s blockchain.